AUD/USD continues to show strong volatility and is sharply higher today. In the European session, the Australian dollar is trading at 0.6338, up 0.81%. This follows losses of almost 1% on Thursday.

RBA sees lower growth, higher inflation

The RBA monetary policy statement was gloomy, warning that tough times lie ahead for the Lucky Country. The central bank is projecting a GDP of 3% over 2022, slowing to 1.5% in 2023. Inflation is expected at 4.75% over 2023, higher than the 4.25% pace in its previous policy statement. The forecasts are based on the cash rate peaking at 3.5% in mid-2023.

The RBA raised the cash rate to 2.85% earlier this week, with a 0.25% hike, and Governor Lowe said that the central bank was on a “narrow path” that required “striking the right balance between doing too much and too little.” The RBA finds itself in a pickle, as its steep tightening cycle is slowing growth and hurting businesses and households. At the same time, inflation remains red-hot at 7.3%, fuelled by high food prices. Inflation remains the RBA’s number one priority, but it has eased up on the size of the hikes, hoping that inflation will peak shortly and a recession can be avoided.

The week wraps up with the US nonfarm payrolls report, which has been overshadowed by Fed meetings and inflation releases. Still, the release is carefully watched by Fed policymakers and today’s data will be a factor in December rate decision. The October consensus stands at 200,000, lower than the September reading of 263,000. With the markets split 50/50 on whether the Fed will raise rates by 0.50% or 0.75%, the NDP could provide some volatility in the currency markets in the North American session.

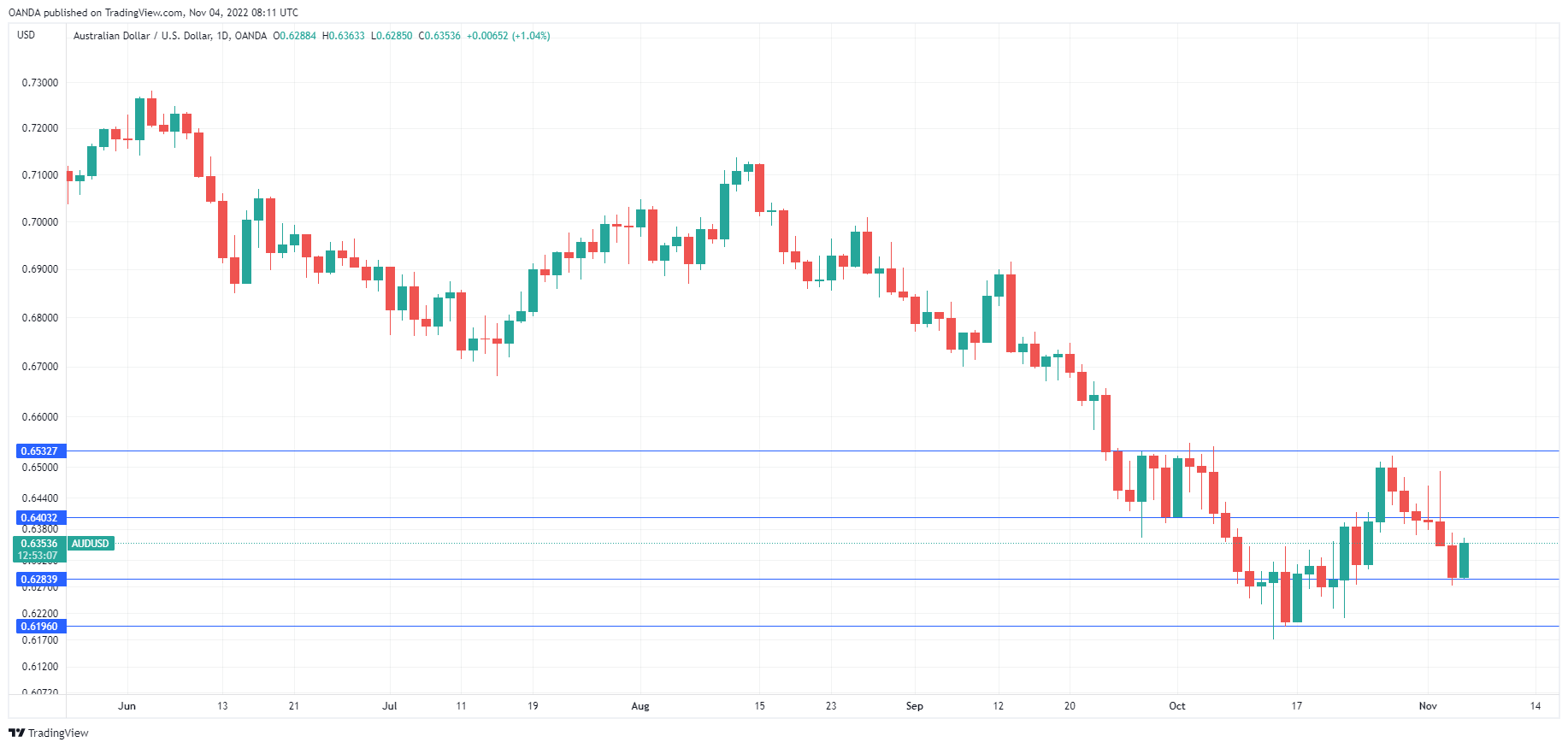

AUD/USD Technical

- There is resistance at 0.6403 and 0.6532

- There is support at 0.6283 and 0.6196