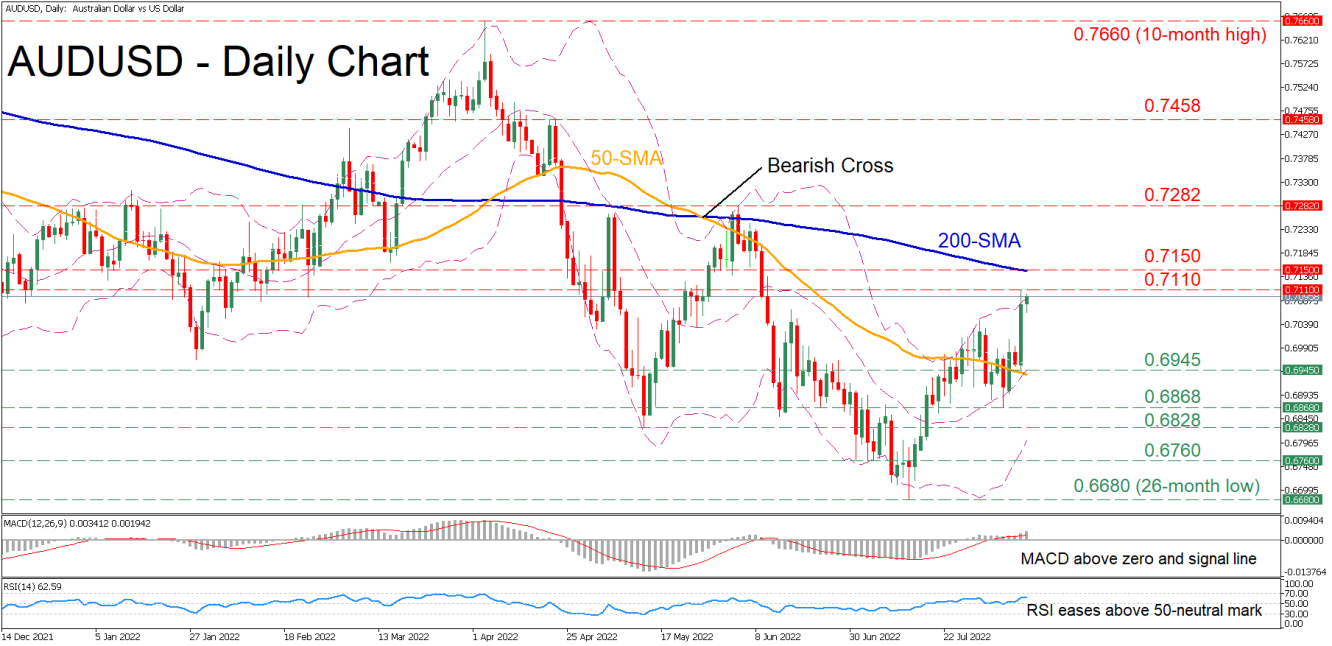

AUDUSD had been battling with its 50-day simple moving average (SMA) after it rebounded from the 26-month low of 0.6680. However, in the previous session the pair experienced a huge jump, closing decisively above its 50-day SMA and coming to a halt at the upper Bollinger band.

The short-term oscillators are reflecting the intensifying positive momentum. Specifically, the MACD histogram has jumped above zero and its red signal line, while the RSI is flatlining above its 50-neutral threshold.

Should buying pressures persist, the recent peak of 0.7110 could be the initial resistance barrier. Piercing through this region, the bulls could target the 200-day SMA, currently at 0.7150. Violating this zone, the spotlight might turn to the June high of 0.7282 before 0.7458 appears on the radar.

On the flipside, if the pair reverses downwards, the 0.6946 hurdle may act as the first line of defence. Should that floor collapse, the recent low of 0.6868 might come under examination. Failing to halt there, the price could descend towards the May low of 0.6828 or lower to challenge the 0.6760 region.

Overall, AUDUSD is showing an appetite for some recovery. Therefore, a break above 0.7282 is needed to alter its medium-term outlook to bullish.