It’s getting riskier to be a natural gas bear amid the approaching summer.

Gas futures on New York’s Henry Hub flew above the $9 mark for the first time since 2008, stopping about 60 cents short of the minimum $10 level that bulls had been expecting this summer.

“Despite promises of more plentiful supply to come, early heat and the risk of a punishing summer have exhausted the market’s patience and led it on a rapid search to curb near-term demand,” analysts at Houston-based gas markets consultancy Gelber & Associates said in an email to the firm’s clients.

Wednesday’s 14-year high of $9.40 on the Henry Hub came ahead of the Energy Information Administration’s weekly update on natural gas storage due at 10:30 AM Eastern Time (14:30 GMT) today, adding to speculation on what the numbers could be.

Source: Gelber & Associates

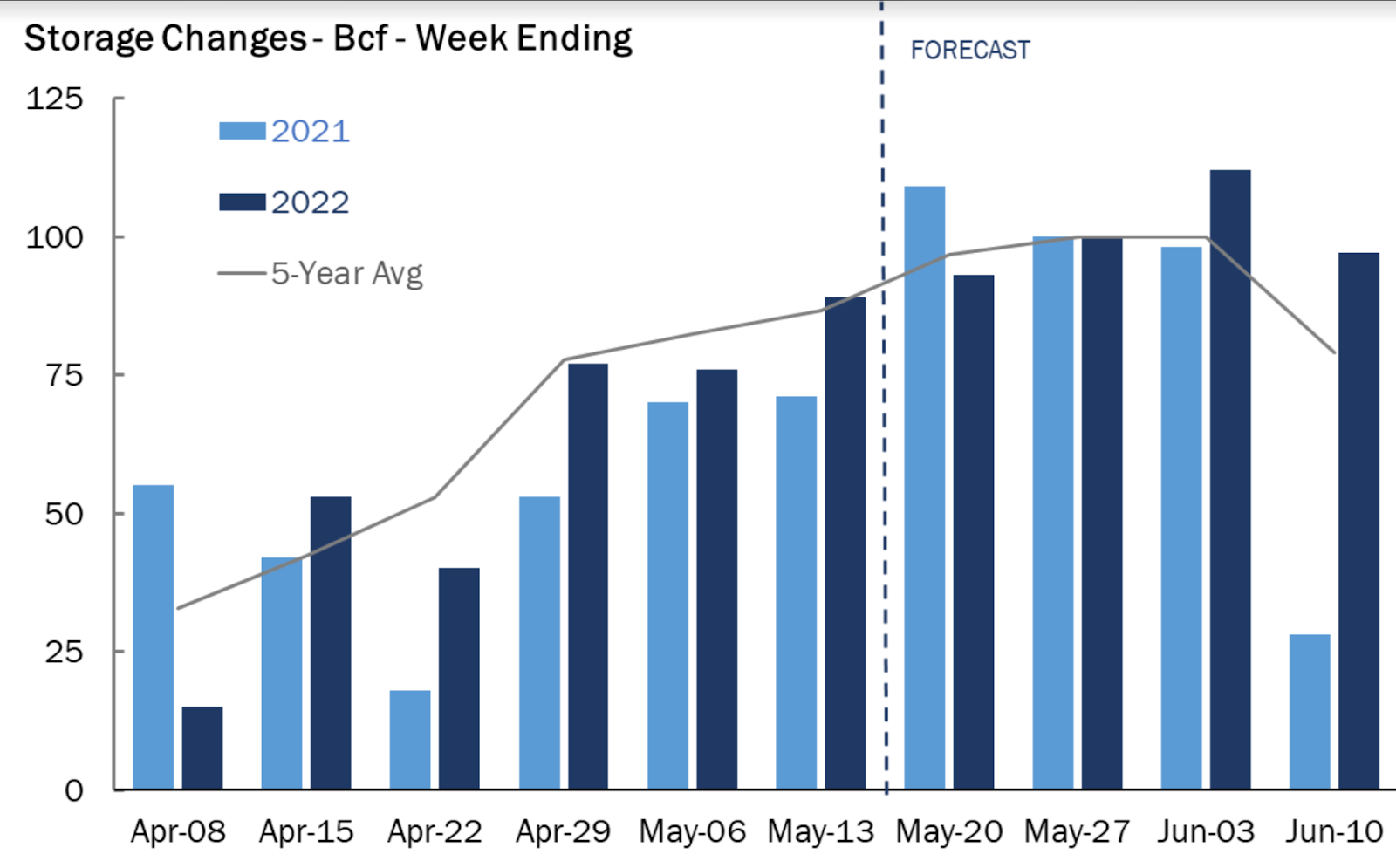

According to a consensus of analysts tracked by Investing.com, utilities likely injected 89 billion cubic feet (bcf) into storage during the week ended May 20 after burning what was needed for power generation and cooling needs.

That would be the same injection rate as in the previous week to May 13, but lower than the 109 bcf build seen during the same week a year ago and the five-year (2017-2021) average injection of 97 bcf.

If accurate, the injection forecast by analysts would lift gas in storage to 1.821 trillion cubic feet (tcf), about 14.9% below the five-year average and 17.2% below the same week a year ago.

Reuters-associated data provider Refinitiv said there were 54 cooling degree days (CDDs) last week compared with a 30-year normal of 34 CDDs for the period.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit.

Forecasts call for above-average domestic heat this summer, further fueling elevated demand expectations, naturalgasintel.com said in a report.

“At the same time, amid maintenance work, US production is relatively anemic,” the report noted, adding that output has held around or below 95 bcf/d this spring—at times as low as 92 bcf—far from the 97 bcf peak of the past winter.

Bespoke Weather Services, in its own study of the situation, said the lower gas output has pressured US supplies and undergirded a market that could finish the current injection season light on gas in storage for next winter.

Production “remains off highs, while LNG volumes climbed back over 13 bcf,” Bespoke said, referring to liquefied natural gas.

“Power burns remain solid…The main theme has been, and remains, that we simply must see significant, and sustainable, gains in production to ensure we reach a comfortable storage level this fall.”

Despite the step-up in gas burns, cooling demand has eased in recent days after the unseasonably hot weather and strong gas consumption seen earlier in May.

For this week, National Weather Service data showed below-average highs and chilly rains tracking through the central United States.

Highs on Wednesday ranged from 50 to 70 Fahrenheit in the upper Plains, Midwest and Great Lakes regions. Mild conditions also pushed into the key gas-fired region of the Northeast.

So, where does all this lead, in terms of prices?

“Consistent trading above $9 will accumulate the momentum for further upside targets of $9.80 and $10.30,” said Sunil Kumar Dixit, chief technical strategist at skcharting.com. Adding:

“Weekly and monthly stochastics are strongly supportive for further continuation towards higher levels of $11.00 and more.”

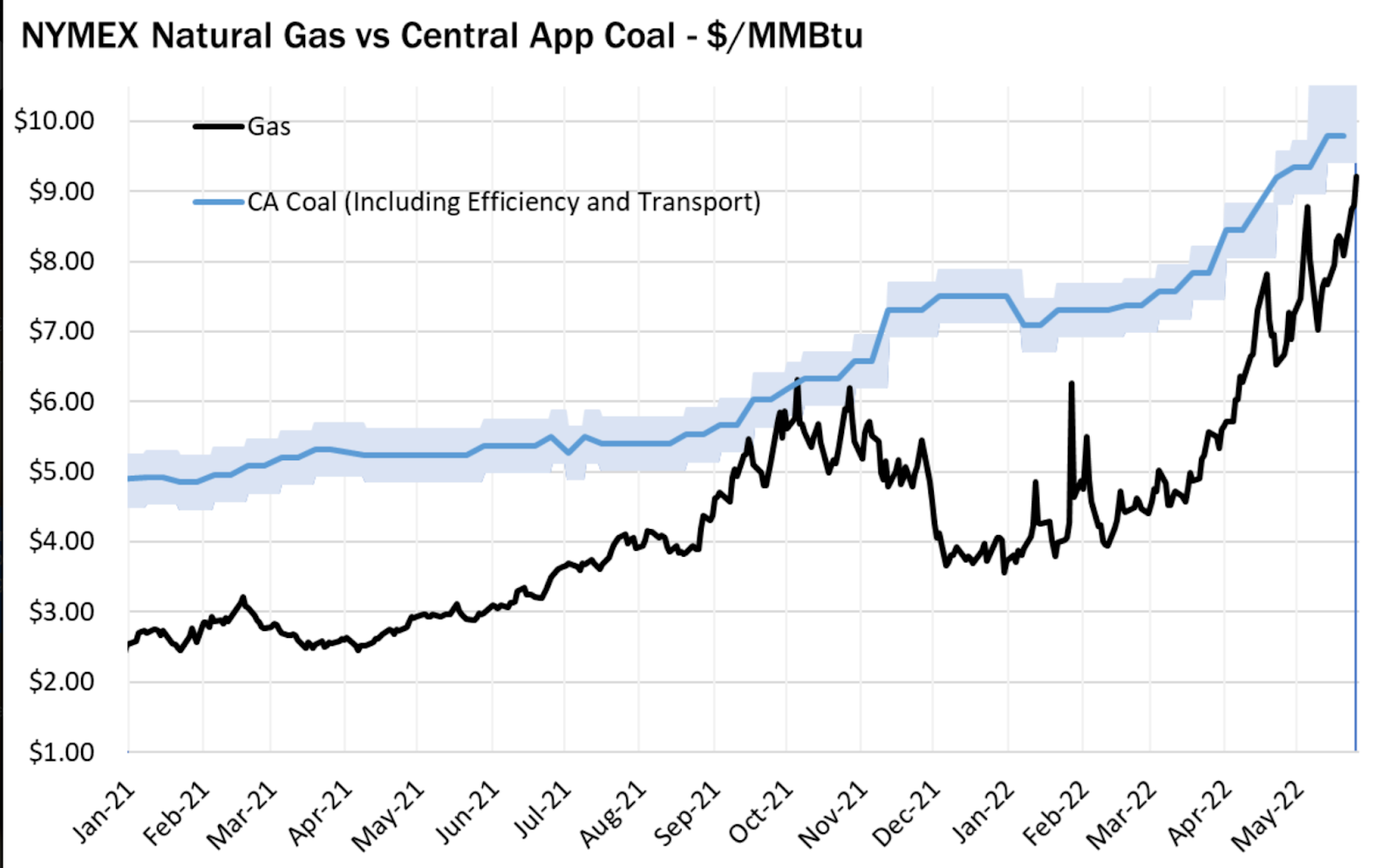

Source: Gelber & Associates

But the Henry Hub’s almost unrelenting run-up for this year—up 147% as of Wednesday—might just break the bank for consumers and utilities if it continues rising at the current rate. That could lead to greater pressure for fuel substitution, say the analysts at Gelber & Associates. Adding:

“As prices approach parity with Central Appalachian coal between about $9.40-$10.20/mmBtu (when taking into account varying efficiency and transport costs), incremental purchasers may finally find that natural gas is no longer the economical option.”

“Time and again, this substitution price has served as a ceiling for past price rallies, and, although fuel switching capacity has been greatly reduced in recent years, there still exists about 1 bcf daily of substitution to stall current momentum.”

Any substitution could lead to a respite in the Henry Hub’s upward charge, before it picks up again on gas bulls’ ardor to smash double-digit resistance.

Many are betting on the market reaching the 2008 peak of above $13 as temperatures spike later this summer, forcing Americans to turn their air-conditioners on to max. Any untoward demand for liquefied natural gas from Europe at that time could exacerbate the rally.

Yet, near-term volatility is always a worry on the Henry Hub. While gas futures are up 25% for May, extending back-to-back gains of 28% in April and March, they could still reverse if there’s a near-term improvement in storage.

Dixit, the chartist, said there was a chance of the market moving lower in the interim if it doesn’t clear the $9.50 ceiling convincingly.

“Wednesday’s price action indicated that traders were hesitant at the $9.40 top.”

“While the weekly and monthly stochastics are strong, the daily stochastic reading hints at potential sideways consolidation of between $9.40 - $8.80.”

“Breaking below $8.80 will cause some downside move to between $8.10 and $7.60,” he added.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.