Equities

“April showers bring May flowers”, noted Thomas Tusser nearly five hundred years ago and for equity bulls who have had to suffer one of the worst start of the year performances in recent history that sentiment may be the only ounce of solace out there. The NASDAQ is off to its worst start since the index was created in 1971 while the S&P has not seen such weak performance since 1939.

Equities have been hit by a litany of problems with inflation being the most significant as nominal price levels have soared to forty year highs and show few signs of stabilizing. That in turn has prompted the Fed to assume a far more hawkish posture with the market now expecting a 50bp hike in early May and rate hikes for the rest of the year. Ironically enough the move from rhetoric to policy may actually provide equity markets with some support as it would eliminate much of the uncertainty regarding monetary policy and allow traders to focus on the fundamentals of individual stocks.

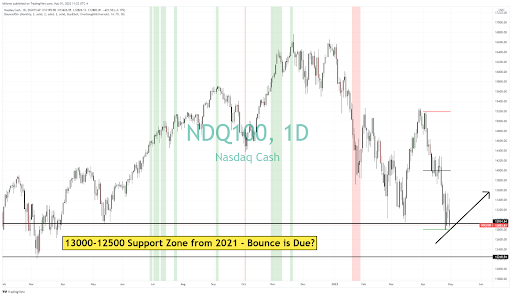

There are plenty of analogues of equities rallying after the start of the Fed hiking cycle in classic sell the rumor buy the news fashion. With sentiment turning highs negative and NASDAQ now approaching the 13000-12500 support zone from 2021 the prospect of a bounce - even if it's a dead cat one - looks quite good.

Commodities

After years of being relegated to the backstage of finance, commodities have emerged as not just the main story, but perhaps the only story that matters to the global economy. Decades of globalization and technological progress have lulled us into complacency about our ability to make, mine, grow stuff at will. No more.

The supply side constraints triggered by Covid lockdowns in China and the increasingly brutal war in Ukraine have created unrelenting pressures on the whole commodity complex. Soybeans for example have had a rising 150 day moving average for more than 100 days. So the pause in the price action of both oil and gold this month - may actually provide a flicker of relief to the otherwise continuous drumbeat of doom and recession coming from the Twitter (NYSE:TWTR) feeds of bears.

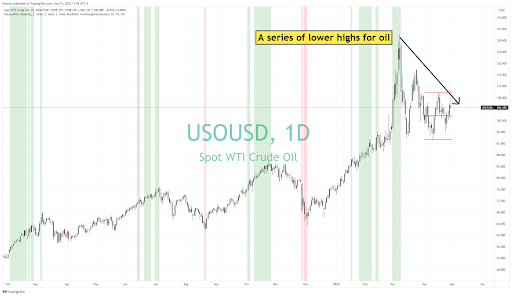

Oil, after staging a spike high at the $130/bbl has done nothing but print a series of lower highs suggesting that despite the removal of Russian oil off the market, supply/demand imbalance may be finding equilibrium around the $100-$110 level. If that indeed is the case that would be very good news for the global economy as stable oil prices albeit at higher price levels would temper all other inflationary pressures in the global economy. For now oil remains the key price in financial markets and as long as it doesn't move and hold above the $110/bbl level the risks of recession will diminish rather than increase.

Gold, too, is also showing signs of inflation fatigue. In fact, nothing casts more doubt on the prospect of sustained inflation more than the recent price action in gold which has shown nothing but repeated failures at lower highs and what appears to be yet another failed bounce at the key $1860/oz. Level. A break below $1850/oz would be a complete repudiation of the rally from the start of the year and open the way for a test of $1800/oz. Support.

Forex

Are there any euro bulls left? Let us know if you find one, because they are certainly an endangered species. The EUR/USD has been in freefall for the past several months hitting a low of 1.0470 before finally staging a mild bounce. The woes for the pair are well known. The war in Ukraine, the energy woes for Germany, the block's biggest economic powerhouse and its major manufacturing hub, the interest rate divergence between the ECB and the Fed.

There really is no clear reason why the pair won’t tumble towards parity - but perhaps not yet. Sentiment in the pair has become so negative and positioning is so skewed that it seems too obvious a move at this point. All of the negatives are well known while the positive may not be accounted for. The sharp decline in the euro should prove to be a boon for tourism this summer - a major part of the region’s economy - but should also provide much better margins for the EU’s various export sectors leading to record Trade Surpluses this year. The counter trend buy is not without risks - especially if the war in Ukraine turns nuclear, but technically the risks are well established at the 1.0300 level as the pair has now approached the final level of its long term support. If Europe can negotiate fresh gas supply deals with Qatar, if Ukraine can absorb the Russian attacks in the East while Turkey keeps the Russian Black Sea fleet trapped in the waters and Russia is forced to retreat, the long EUR/USD trade may turn out to be the biggest FX surprise of the summer.