(Wednesday Market Open) The new month kicks off today with a Fed decision in the works. However, drama might be hard to find because futures prices point to basically no chance of a rate move.

With Fed Chair Jerome Powell and company in session today, things might be relatively quiet on Wall Street in the hours leading up to the 2 p.m. ET announcement. The tone did seem positive as things got underway following better-than-expected Apple (NASDAQ:AAPL) earnings and a sunny forecast from chip maker Advanced Micro Devices (NASDAQ:AMD).

The other possible bullish factor at play this morning could be remarks from U.S. Treasury secretary Steven Mnuchin, who said he had “productive” meetings with Chinese Vice Premier Liu He in Beijing, Reuters reported. Tariff talks could remain front and center in coming weeks.

Apple Takes Off As Earnings Beat

The after-hours highlight Tuesday was AAPL earnings, which were down from a year ago but above the Street’s expectations. The stock got an initial 5% lift in post-market trading, partly because revenue and earnings per share didn’t fall as much as third-party consensus estimates had predicted. It probably didn’t hurt, either, that the company announced more share repurchases and raised its quarterly dividend.

Guidance for fiscal Q3 also was higher than Wall Street analysts had expected, and CEO Tim Cook told CNBC that the company’s China performance improved from the previous quarter and strengthened toward the end of the reporting period. While some of that might have reflected price cuts, it could possibly come as a bit of a relief to people wondering how China’s slowing economy affected business for a company where international sales make up 61% of revenue.

That said, iPhone revenue continued its downward drift in AAPL’s fiscal Q2, falling 17% year-over-year. It was the second quarter in a row of declining growth for a product that makes up more than half of the company’s revenue. Services revenue did rise 16% from a year ago, and AAPL has been touting its services business in recent quarters as a growth element. In its call, AAPL talked about strong results for the App Store, Apple Pay, and Apple Music.

One interesting note is that this is the second-straight quarter when AAPL reported a drop in revenue only to see its stock jump after earnings. If it seems like investors have lowered their expectations a little, that’s probably not off base. There’s just not a lot of excitement around the iPhone now, and some analysts say there won’t be until a 5G device is launched—possibly in 2020.

Another thing AAPL talked about on its call is the headwind from a strong dollar, something that’s likely getting harder to ignore for many U.S. companies. The Dollar Index finished Tuesday at about 97.5, a little below last week’s multi-month highs. However, it’s stayed mostly above 96 this year, up from around 90 early last year, and that’s been a drag on results for some multinational firms. At this point, it would probably take more signs of overseas economic strength to put pressure on the greenback, and while some data out of Europe early this week did look promising (see more below), that’s not necessarily a trend.

The other tech news late Tuesday came from Advanced Micro Devices (AMD), which surpassed third-party consensus with its results and gave a forecast for possible market share gains. Shares rose 4% in pre-market hours, and that seemed to lend some support to a few other chip firms as well.

More strong earnings news in the mix this morning include results from CVS (NYSE:CVS), Humana (NYSE:HUM) and Yum! Brands (NYSE:YUM). Same-store sales at YUM rose much more than analysts had expected, a good sign from the consumer demand side. Basically, we’ve seen mainly positive results from a wide group of industries since yesterday’s closing bell and that might give the market an additional tailwind.

Fed Day Lacking In Drama

Trading might be a little slow this morning ahead of the Fed’s decision, but there’s not really much drama associated with the gathering today.

Going into the meeting’s conclusion, expectations for any sort of rate move by the Fed remain near zero, according to CME futures. Odds are 98% of the Fed standing pat, with 2% chances of a 25-basis point rate cut. Looking ahead to June, chances of a rate cut rise to around 21%, with chances for lower rates rising to more than 65% by the end of the year. The Fed hasn’t cut rates since the 2008-09 recession.

As we often see when the meeting holds little sense of urgency, attention might turn more to what Powell says in his press conference afterward. The recent higher-than-expected Q1 gross domestic product (GDP) could be one thing he gets asked about, as the Fed has been forecasting slower growth. Does Powell consider the Q1 number an outlier, with possible slowness potentially pushed into later this year? Or could the Q1 data mean the Fed might have been too pessimistic? We’ll have to wait and see if he addresses this.

Inflation also remains below the Fed’s target, and even the word “deflation” has started being mentioned by some pundits. Powell could conceivably get asked what the Fed might consider doing to get inflation up to its targeted 2% level, along with what factors he thinks are keeping inflation so low despite a faster-growing economy.

Also, there’s been a lot of scuttlebutt lately about chances of the Fed lowering rates. The latest came Tuesday when President Trump urged rate cuts. Don’t be too surprised if someone at the press conference directly asks Powell if he and the Fed plan to cut rates and when, but also don’t be surprised if Powell doesn’t offer a direct answer. The Fed has been sticking to its guns for a while now saying it will focus on data, and it seems unlikely that’s going to change anytime soon.

We’ll be back after the Fed decision with an update on the Fed’s statement and Powell’s press conference.

High Achievers

After posting new all-time intraday highs on Monday, stocks had themselves a dull Tuesday as many investors seemed to take a cautious stance ahead of the Fed meeting. The S&P 500 index (SPX) did post a new record close, but didn’t take out Monday’s intraday high. Nasdaq (COMP) came under pressure after achieving record highs of its own earlier in the week, hurt by earnings news (see more below).

Stock sectors traditionally seen as defensive, including Utilities, Staples, and Real Estate, were among the leaders Tuesday. Those sectors also tend to offer relatively high dividends, arguably making them a bit more attractive at times like this when the bond market keeps rallying and rates are under pressure.

That was the case again Tuesday as 10-year yields fell back toward 2.5%. They didn’t seem to get much help from last week’s strong Q1 GDP data, and might have seen weakness Tuesday in part due to a batch of weak data from China.

The softness in China got countered somewhat from a surprisingly strong European growth number. The 19 eurozone countries grew 0.4% in Q1 compared with Q4, the European Union statistics agency estimated. That was the best growth since Q2 last year, and might be a reasons to argue against some suggestions that Europe could slip into recession.

The Communication Services sector got hammered Tuesday, mainly in the wake of disappointing earnings from Alphabet (NASDAQ:GOOG, GOOGL). It’s unclear, analysts said, exactly what led to the company’s slowing advertising growth in Q1, but it might simply be a matter of more competition. Some analysts also worry about the company’s spending trends. Whatever the case, GOOG had its worst trading day in six years.

Alphabet aside, earnings news has generally been pretty solid for Q1 compared with low initial expectations. About 77% of companies reporting so far have beaten consensus earnings estimates, according to FactSet, and the year-over-year decline in earnings per share for S&P 500 companies now stands at 2.3%. That’s the worst in nearly three years, but better than the nearly 4% loss companies had been registering a week ago before the latest big batch of reports.

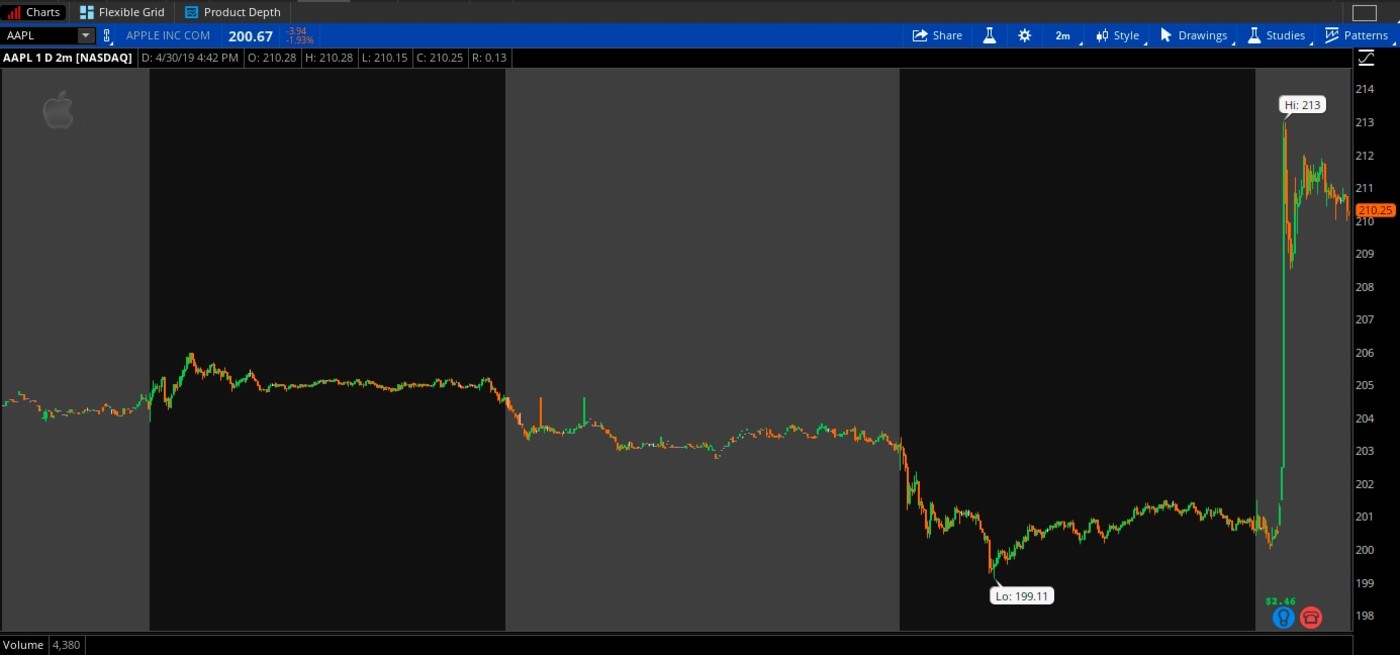

Figure 1: AAPL JOLT: Shares of Apple (AAPL) got a big lift right after the close when the company reported earnings late Tuesday, as this one-day chart demonstrates. At its highs in post-market trading, the stock reached levels not seen since early November. Data Source: Nasdaq. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Four in a Row: April marked the fourth-consecutive month of gains for the S&P 500 Index (SPX) following December’s 9% decline. In fact, only two of the last 12 months (October and December) actually saw losses in the SPX, despite that nagging feeling you might have that the entire Q4 was a disaster. Stocks actually rose slightly in November between their October and December collapses. Now the market is roughly back to where it was at the end of last September, so those Q4 losses might feel long ago. People tend to emphasize the strong performance of cyclical stocks since the start of 2019, but looking back to the end of last summer’s rally, Utilities has actually been the top-performing sector, adding on 9% to the level it was at in late September when the SPX last reached these highs. The two follow-up sectors since then are Communication Services and Real Estate.

What Inversion? Speaking of long ago, it seems like a lot of time has passed since late March, when many analysts were warning about how the Treasury yield inversion might point toward economic weakness ahead. Since then, longer-term yields have gained some traction vs. short-term ones, often a sign of economic growth. Early this week, 10-year yields widened their lead over two-year yields to more than 20 basis points. That’s relatively low historically, but compared to a single-digit gap earlier this year, it seems like a lot.

The three-month yield, which had run up a slight lead over the 10-year at one point, now trails the 10-year by 7 basis points. That said, 10-year yields remain historically low at 2.5%, which is kind of a dichotomy when you consider that stocks are at all-time highs. High stock prices can often be accompanied by losses in the bond market, sending yields higher. This time around, the Fed’s dovish stance might be holding yields back, helped in part by weak economic growth overseas. The latest inflation data didn’t appear to give any new ammunition to anyone looking for a pullback in bonds, and might also look supportive for dividend-paying sectors that often compete with the bond market to draw in yield-seeking investors.

Foreign Affairs: We haven’t seen a lot of evidence of global growth concerns crop up in corporate earnings, and CEOs have set a positive overall tone about the global economy. In some cases, their international businesses seem to be thriving despite recent slower growth in Europe and China, These firms include Starbucks (NASDAQ:SBUX), United Technologies (NYSE:UTX) and United Parcel Service (NYSE:UPS). Some other companies with major foreign footprints, including Microsoft (NASDAQ:MSFT) and Facebook (NASDAQ:FB), showed no signs of foreign weakness hurting their growth, MarketWatch noted.

That said a couple of major U.S. firms, namely Caterpillar (NYSE:CAT) and 3M (NYSE:MMM), have reported softness in their international results this earnings season. Both of those companies cited weakness in Asia-Pacific, with MMM specifically mentioning China. Also, AAPL talked about strong dollar headwinds, as mentioned above.

Disclaimer: Charts For illustrative purposes only. Past performance does not guarantee future results.TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.