I find lots of similarities between the price pattern of Apple (AAPL) and Gold. Take a look at the weekly price of the GLD ETF.

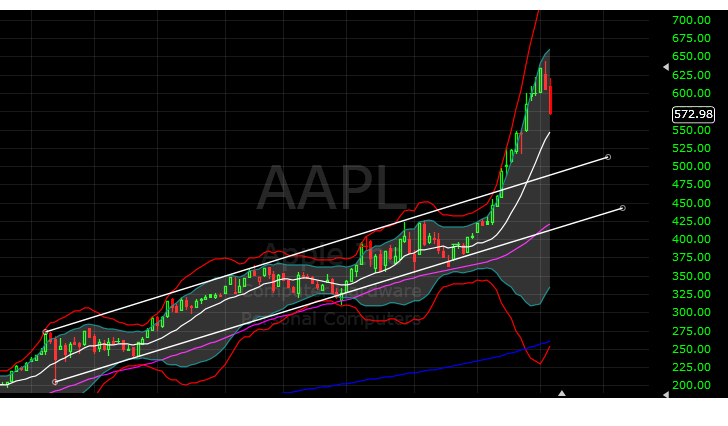

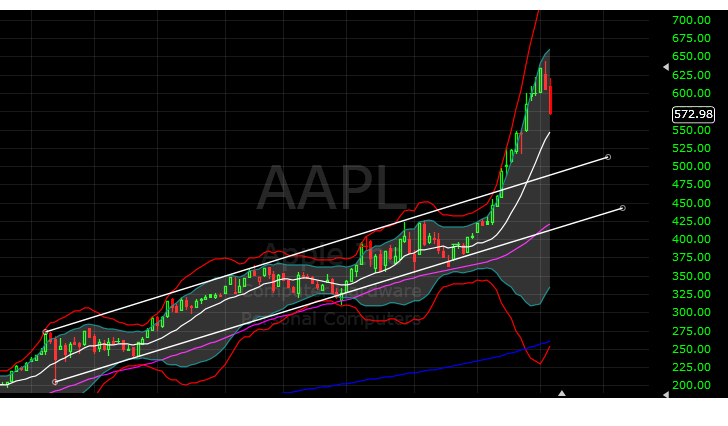

And now at the weekly price of Apple.

Same parabolic move. Similar euphoria. The law of mean reversion applies to everything which shows parabolic moves. In both cases, prices moved within a well defined trend line for a long time. When prices touched the upper trend line, there were corrections which were healthy and subsequently the uptrend resumed. But then greed and irrational exuberance took over.

Gold has reverted to the bottom of the trend line. I remember last year ZH and various other gold bugs were talking of gold $5000. And this year there were talks of Apple $1000. If the mean reversion of Apple takes place, we are likely to see $500 or below before we see $ 1000 for Apple.

Apple quarterly reporting is at the front and centre of things this coming week. Anything less than block buster is going to blow up. And the cycle of Apple is down till June. It does not mean Apple is doomed. It is an excellent company and price may indeed reach higher. But such bursts to the high will come around the release of the iPhone 5 which is due sometime in October. So a good correction will be a buying opportunity.

SPX is holding the support level at 1375. 20 DMA has not yet crossed down the 50DMA but that cross over is close. The market may try again to test the high of 1422 but there are signs of exhaustion. A spectacular earnings report for Apple might give that last boost. But on the other hand the Fed meeting and announcement is due this week and like last month, I do not think they will announce any QE3 this time either. So we are setting up the stage for some volatility.

I think from a TA point of view Apple and the market in general are due for a bounce but such a rally should be sold.

Right now patience is the key.

And now at the weekly price of Apple.

Same parabolic move. Similar euphoria. The law of mean reversion applies to everything which shows parabolic moves. In both cases, prices moved within a well defined trend line for a long time. When prices touched the upper trend line, there were corrections which were healthy and subsequently the uptrend resumed. But then greed and irrational exuberance took over.

Gold has reverted to the bottom of the trend line. I remember last year ZH and various other gold bugs were talking of gold $5000. And this year there were talks of Apple $1000. If the mean reversion of Apple takes place, we are likely to see $500 or below before we see $ 1000 for Apple.

Apple quarterly reporting is at the front and centre of things this coming week. Anything less than block buster is going to blow up. And the cycle of Apple is down till June. It does not mean Apple is doomed. It is an excellent company and price may indeed reach higher. But such bursts to the high will come around the release of the iPhone 5 which is due sometime in October. So a good correction will be a buying opportunity.

SPX is holding the support level at 1375. 20 DMA has not yet crossed down the 50DMA but that cross over is close. The market may try again to test the high of 1422 but there are signs of exhaustion. A spectacular earnings report for Apple might give that last boost. But on the other hand the Fed meeting and announcement is due this week and like last month, I do not think they will announce any QE3 this time either. So we are setting up the stage for some volatility.

I think from a TA point of view Apple and the market in general are due for a bounce but such a rally should be sold.

Right now patience is the key.