AMETEK, Inc. (NYSE:AME) recently completed the acquisition of instrumentation provider, MOCON, Inc. for $30 per share in cash or a total value of about $182 million.

Following the closure of the deal, shares of MOCON will no longer be listed for trading. MOCON will now join AMETEK’s Process & Analytical Instruments Division within AMETEK's Electronic Instruments Group.

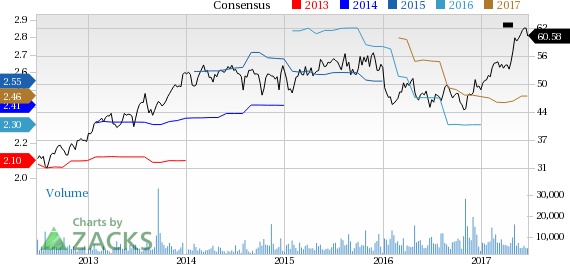

Coming to the share price performance, AMETEK underperformed the Zacks Electronic Testing Equipment industry in the last one year. It has returned only 27.6% compared with the industry’s gain of 48.8%.

Benefits of the Deal

Headquartered in Minneapolis, MOCON provides laboratory and field gas analysis instrumentation to research laboratories, production facilities and quality control departments. Its products and services which detect, measure and monitor, gases and other chemical compounds, are used for food and beverage, pharmaceutical, and industrial applications. The business generated $63 million of MOCON’s total revenue in 2016.

The deal will compliment Ametek’s existing gas analysis instrumentation business. MOCON’s products will provide opportunities to Ametek to further expand into the growing food and pharmaceutical package testing market.

Bottom Line

Located in Berwyn, PA, AMETEK is a leading manufacturer of electronic appliances and electromechanical devices. The company continues to reap benefits from the execution of its four core growth strategies of operational excellence, global market expansion, investments in product development and strategic acquisitions.

AMETEK’s acquisition pipeline remains robust with opportunities to further expand and strengthen its portfolio. The company believes that strong execution of its four core growth strategies of operational excellence, global market expansion, investments in new product development, and strategic acquisitions will remain important growth drivers.

AMETEK is expected to come up with its second-quarter 2017 figures on Aug 3.

Zacks Rank & Stocks to Consider

Currently, Ametek has a Zacks Rank #2 (Buy). Some other favorably placed stocks in the broader technology sector include KLA-Tencor (NASDAQ:KLAC) and Applied Materials (NASDAQ:AMAT) , each sporting a Zacks Rank #1, while Advanced Energy Industries, Inc. (NASDAQ:AEIS) , carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

KLA-Tencor delivered a positive earnings surprise of 11.55%, on average, in the last four quarters.

Applied Materials delivered a positive earnings surprise of 3.35%, on average, in the trailing four quarters.

Advanced Energy Industries, Inc. delivered a positive earnings surprise of 10.46%, on average, in the trailing four quarters.

The Best & Worst of Zacks

Today you are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 ""Strong Buys"" free of charge. From 1988 through 2015 this list has averaged a stellar gain of +25% per year. Plus, you may download 220 Zacks Rank #5 ""Strong Sells."" Even though this list holds many stocks that seem to be solid, it has historically performed 6X worse than the market. See these critical buys and sells free >>

KLA-Tencor Corporation (KLAC): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS): Free Stock Analysis Report

AMTEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research