Supply chain management solutions provider American Software (NASDAQ:AMSWA) stock is finally breaking as metrics improve. The supply chain management software provider has been a relative under-the-radar stock that has stayed under the $20 range for the majority of over a decade. The Company has been transitioning over to the subscription-based model from the legacy licensing model. This approach along with the pandemic-induced global supply chain disruption has enabled the onboarding of notable new and existing customers placing orders. These brands include Ashley Furniture to Hostess Brands (NASDAQ:TWNK), Lacoste Operations, Peet’s Coffee, and Under Armour (NYSE:UAA). Supply chain disruption has been the source of numerous material shortfalls for listed companies during the pandemic ranging from semiconductors to automobile and component shortages. American Software is a key player in the world of supply chain management which is critical in the reopening and return to normal process. Prudent investors seeking to get in on the expanding nature of supply chain management can watch for opportunistic pullbacks.

Q4 Fiscal 2021 Earnings Release

On June 8, 2021, American Software released its fiscal fourth-quarter 2021 ended April 30, 2021, and full-year 2021 results. The Company reported an earnings-per-share (EPS) profits of $0.11 beating analyst estimates for $0.05, by $0.06. Revenues fell (-2%) year-over-year (YoY) to $28.6 million. Recurring revenue streams for Maintenance and Cloud Subscriptions rose to 60% of total revenues compared to 57% same period year ago. Subscription fees rose 28% YoY to $8.1 million and Software license revenues rose 15% YoY to $1.2 million. Cloud Services annual contract value (ACV) rose 45% to $38.3 million for Q4 2021. Maintenance revenues for the quarter fell (-12%) YoY to $9.2 million. Professional services revenues fell (-13%) to $10.1 million. Subscription revenues rose 31% YoY to $28.9 million while Software license revenues fell (-61%) YoY which reflects the transition to a software-as-a-service (SaaS) subscription model. American Software CEO, Allan Dow stated:

“Our performance reflects increasing adoption of cloud-based supply chain transformation solutions and our backlog as measured by our Remaining Performance Obligations (RPO) increased 51% to $116 million in the fourth quarter when compared to last year, which demonstrates the longer-term commitment of our customers to our platform and services. Our pipeline remains robust as we enter our fiscal year 2022 as the current spotlight on supply chain disruption continues to fuel interest in our supply chain transformation initiatives.”

Conference Call Takeaways

American Software CEO Allan Dow set the tone:

“We anticipate that by fall, we’ll have entered into the new post-pandemic work structure. The pandemic and the ensuing global crisis heightened awareness of the overall supply chain responsibilities for brands, retailers, and products. I characterize these responsibilities into three categories: economically sound delivery of goods to consumers and brand producers, including an appropriate level of resiliency to the disruptions; the second, minimizing the environmental impact of the supply chain from raw material to consumer delivery; and the third leg, which, in my opinion is the most important, the ethical treatment of workers around the world.”

He continued:

“We have decades experience in enabling economically optimized resilient supply chains… Through our customers, we’re enabling sustainable supply chains while simultaneously addressing these economic, environmental and social responsibility imperatives in a whole new way.”

The supply chain disruptions have been good for business as they move past pandemic-related churn and return to more traditional stability. CEO Dow expects to see the rise in recurring revenues accelerate. Cloud revenues rose 45% YoY as the Company added seven new customers in nine countries. He concluded:

“We continue to drive more backlog for future work, which is consuming most of our resource capacity we have on hand, including a growing consumption of external capacity from our consulting partner channel.”

AMSWA Opportunistic Pullback Levels

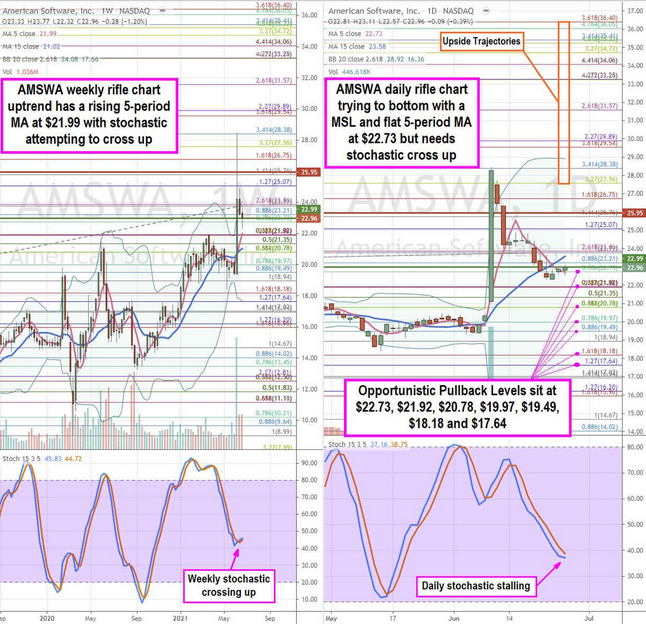

Using the rifle charts on the weekly and daily time frames provides a precision view of the playing field for AMSWA shares. The weekly rifle chart peaked on the earnings spike at the $28.38 Fibonacci (fib) level before snapping back down. The rising weekly 5-period moving average (MA) sits at the $21.92 fib with a rising 15-period MA at $21.02. The weekly upper Bollinger Band (BB) sits at $24.08. The weekly stochastic has crossed back up. The daily rifle chart is attempting to bounce off the daily market structure low (MSL) buy trigger above $22.96. The daily formed a market structure high (MSH) sell trigger on the breakdown under $25.95. The daily stochastic is still falling at the 40-band. Prudent investors can monitor for opportunistic pullback levels at the $22.73 fib, $21.92 fib, $20.78 fib $19.49 fib, $18.18 fib, and the $17.64 fib. The upside trajectories range from the $27.56 fib up towards the $36.40 fib level.