Altria Group Inc. (NYSE:MO) is encouraged by the fact that the U.S. Food and Drug Administration (FDA) has filed Philip Morris International, Inc.’s (NYSE:PM) application for iQOS heated tobacco product. The FDA has started reviewing the Modified Risk Tobacco Product application, which was submitted on Dec 5, 2016.

On Mar 31, 2017, Philip Morris had applied for pre-market approval of iQOS heated tobacco product with the FDA. Yesterday, the FDA published the executive summary and research summaries. In addition, the agency will publish additional modules of Philip Morris’ MRTP application on a rolling basis. The timeframe for the review of Philip Morris’ application is solely at the discretion of the FDA.

Upon regulatory authorization of the iQOS heated tobacco products, Philip Morris USA, a subsidiary of Altria, will have an exclusive license to sell these products in the United States. The tobacco industry is under pressure to replace cigarettes with other alternatives due to the dip in smoking rates in developed countries. Health hazards due to smoking have pushed consumers toward low-risk or reduced-risk products. To cater to the new consumer preferences, Altria has collaborated with Okono A/S and developed innovative, non-combustible nicotine-containing products for adult smokers. Its flagship MarkTen e-cigarette brand (launched in 2014) and Green Smoke e-vapor products are some of the examples. MarkTen XL – a variant on MarkTen launched by the company in 2016 have been encouraging in lead markets.

At the end of 2016, MarkTen represented about 55% of the e-vapor category volume in retail channels, including c-stores. In Apr 2017, Nu Mark announced the expansion of MarkTen to approximately 10,000 more stores. Further, it announced the availability of three more flavors for its adult papers – winter mint, summer fusion and smooth cream.

The agreement between Philip Morris Altria Group is also boosting the business of both the companies. Per the agreement, Philip Morris markets Altria’s MarkTen e-cigarettes internationally and Altria distributes two of Philip Morris’ heated tobacco products in the U.S. The companies have also extended their technology sharing agreement signed in Jul 2015 to work on a joint research, development and technology-sharing framework for developing unconventional cigarettes. Such collaboration is encouraging as it will help the participating companies maintain market share amid declining volume and growing awareness against tobacco products.

Altria recently reported weaker-than-expected results in the first quarter of 2017 as both earnings and revenues lagged the Zacks Consensus Estimate. The company kept earnings guidance intact for 2017. The company’s strong brand portfolio, shift to low-risk, smokeless tobacco products and strong pricing remains encouraging. The company’s flagship brand, Marlboro, has been performing well and has boosted its market share.

PM USA, Altria’s smokeable subsidiary invests continuously in improving the brand architecture of Marlboro and has upgraded its shopping website – marlboro.com – which provides engaging content directly to adult smokers through mobile devices. It is also trying to enhance the brand equity of the Marlboro brand and has offered Marlboro Slate, a bold menthol product in the Marlboro Black family. Further, it has acquired Nat Sherman, in order to augment the smokeable segment. Nat Sherman’s premium, excellent and differentiated brand portfolio, complements the brands in Altria's smokeable products segment.

Further, the recent takeover of SABMiller (LON:SAB) by Anheuser-Busch InBev's (NYSE:BUD) helped Altria to maximize the value of its SABMiller investment. It helped to reward shareholders with an expanded share repurchase program, and improved the company’s position in the global market.

However, we believe strict anti-smoking regulations in the form of restrictions on packaging and high excise duties, along with declining cigarette volumes, remain major headwinds.

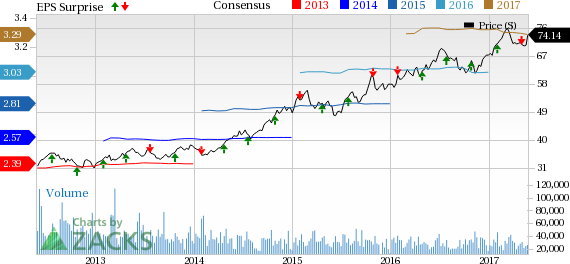

A glimpse of Altria’s stock performance reveals that its shares have been outperforming the broader Zacks categorized Consumer Staples sector since the past one year. The stock rallied 15.9% in comparison with the above mentioned sector’s growth of 6.3%.

Stocks to Consider

Altria currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the consumer staple sector is SunOpta, Inc. (NASDAQ:STKL) , which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. SunOpta has a long-term earnings growth rate of 15.0%.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

Anheuser-Busch Inbev SA (BUD): Free Stock Analysis Report

SunOpta, Inc. (STKL): Free Stock Analysis Report

Altria Group (MO): Free Stock Analysis Report

Philip Morris International Inc (PM): Free Stock Analysis Report

Original post