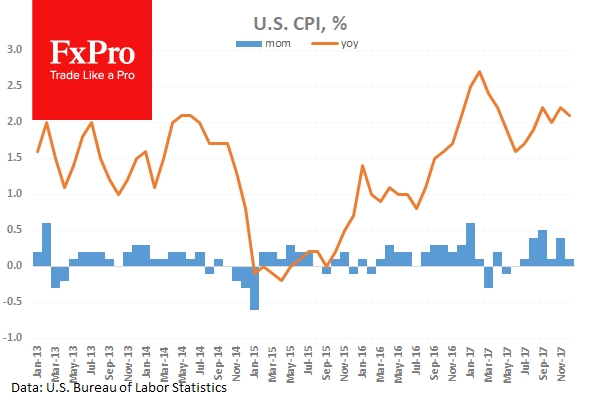

The USD has weakened further overnight as the market awaits important US Data at 13:30 GMT. USD/JPY broke down under 107.000, while GBP/USD made another attempt to stay above 1.39000. EUR/USD advanced to 1.23900, while Gold followed suit to reach a high at 1336.80. The US CPI data later is expected to point to an Inflation figure that maintains the path of rate increases being traveled by the US Fed. Any surprise in the number can spark an increase in volatility comparable to the last week and a half of trading. If the number is a dud, the market can become indecisive and may attempt to test support and resistance before a direction is found. Any trend currently being traded may be altered by the market reaction to the data release.

Bank of Japan Governor Kuroda spoke in parliament saying: Cryptocurrencies are mostly used for speculative investing and should be called crypto-assets. Cryptocurrencies like Bitcoin are not seen as currencies. Japanese economic fundamentals, company profits are strong. The risk-off sentiment in the US led to stock falls and the BOJ will continue to closely monitor developments in markets because financial market moves can have an impact on the real economy. Japan’s economy needs the BOJ to continue its current policy. The Bank of Japan is still a long way from its price target. Japan’s economy needs persistent monetary easing.

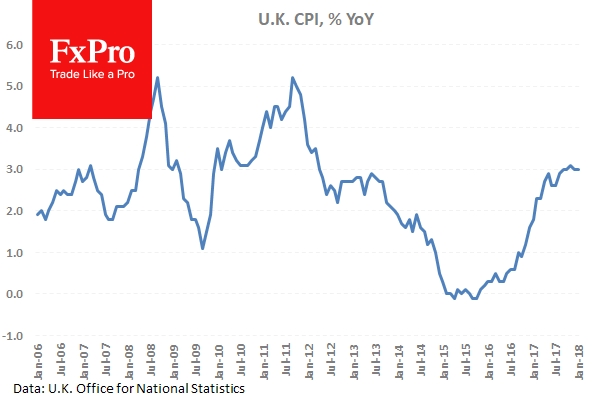

UK Consumer Price Index (YoY) (Jan) was out at 3.0% v an expected 2.9%, from 3.0% previously. Core Consumer Price Index (YoY) (Jan) was 2.7% v an expected 2.6%, from 2.5% prior. Consumer Price Index (MoM) (Jan) was -0.5% v an expected -0.6%, from 0.4% prior. Producer Price Index – Output (MoM) n.s.a. (Jan) was 0.1% v an expected 0.2%, from 0.4% previously. Producer Price Index – Output (YoY) n.s.a. (Jan) was 2.8% v an expected 3.0%, from 3.3% previously. Producer Price Index – Input (MoM) n.s.a. (Jan) was as expected at 0.7%, from 0.6% previously, which was revised up from 0.1%. Producer Price Index – Input (YoY) n.s.a. (Jan) was 4.7% v an expected 4.2%, from 4.9% previously, which was revised up to 5.4%. PPI Core Output (MoM) n.s.a. (Jan) was as expected at 0.3%, from 0.3% previously, which was revised down to 0.2%. PPI Core Output (YoY) n.s.a. (Jan) was 2.2% v an expected 2.3%, from 2.5% previously, which was revised down to 2.4%. Retail Price Index (MoM) (Jan) was -0.8% v an expected -0.7%, from 0.8% previously. Retail Price Index (YoY) (Jan) was 4.0% v an expected 4.1%, from 4.1% prior. GBP crosses experienced movement upon the release of this data.

At 13:00 GMT, US FOMC Member Mester spoke about the economic outlook and monetary policy at the Dayton Area Chamber of Commerce Government Affairs Breakfast. Audience questions followed and some of the comments made were: Inflation to gradually rise to 2% over next 1-2 years and further rate hikes needed this year and next. US economic fundamentals are very strong and Mester sees economy working through latest turmoil. Latest market moves haven’t curbed risk-taking or spending, and trading has been relatively orderly. Tax cuts adding to growth and could be upside risk. GBP/USD sold off from 1.38969 to 1.38519 after the comments.

Australian Westpac Consumer Confidence (Feb) was released coming in at -2.3%, the prior number was 1.8%. AUD/USD moved up to 0.78686 but sold off to 0.78532 after the release, eventually erasing the move and reaching 0.78890.

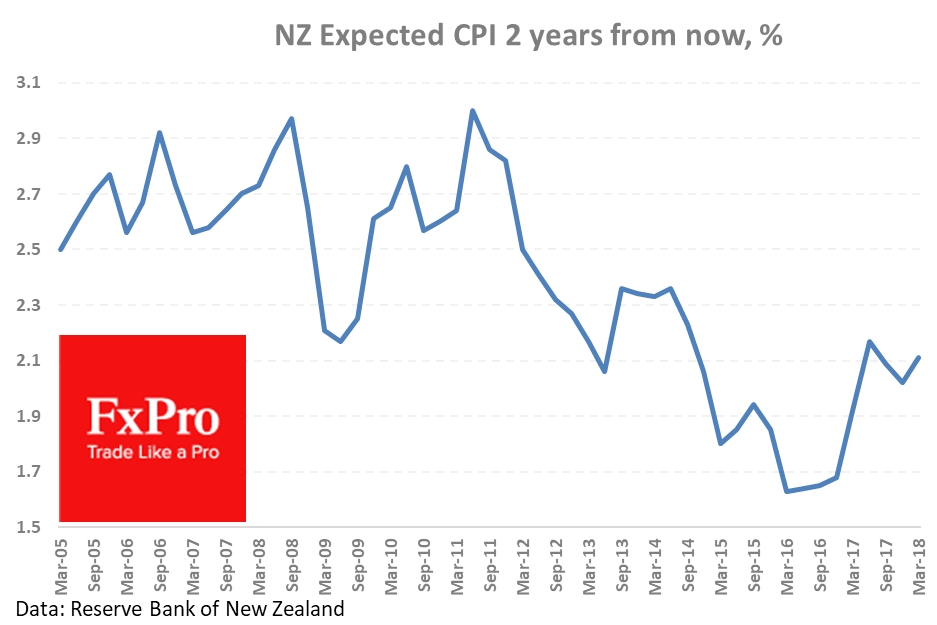

RBNZ Inflation Expectations (QoQ) (Q4) were released, coming in at 2.1% from a prior reading of 2.0%.

EUR/USD is up 0.20% overnight, trading around 1.23750.

USD/JPY is down -0.60% in early session trading at around 107.161.

GBP/USD is up 0.08% to trade around 1.39021.

AUD/USD is up 0.20% overnight, trading around 0.78746.

Gold is up 0.37% in early morning trading at around $1,334.40.

Crude Oil WTI is up 0.29% this morning, trading around $59.05.

Major data releases for today:

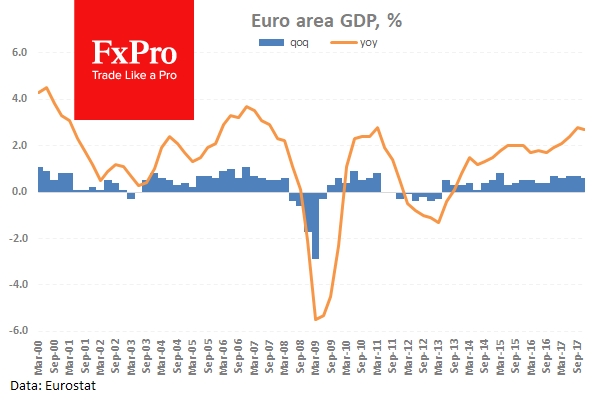

At 07:00 GMT, German Harmonised Index of Consumer Prices (YoY) (Jan) will be released. The consensus is for an unchanged value of 1.4%. Gross Domestic Product (QoQ) (Q4) is expected to be 0.6% from 0.8% previously. Gross Domestic Product (YoY) (Q4) is expected to be 2.2% from 2.3% previously. EUR pairs could have positions opened or closed due to this data.

At 08:00 GMT, German Bundesbank President Weidmann is due to deliver opening remarks at the Bundesbank Cash Symposium, in Frankfurt. EUR pairs may be moved by his comments.

At 08:50 GMT, SNB Governing Board Member Zurbrugg will deliver a speech titled “Cash – a means of payment yesterday, today, and tomorrow” at the Bundesbank Cash Symposium in Frankfurt. His comments could move CHF crosses.

At 09:00 GMT, Italian Gross Domestic Product (QoQ) (Q4) is expected to be 1.6% from 1.7% previously. Gross Domestic Product (YoY) (Q4) is expected to be unchanged at 0.4%. EUR pairs could be moved by this data.

At 10:00 GMT, Eurozone Gross Domestic Product (QoQ) (Q4) is expected to be unchanged at 0.6%. Gross Domestic Product (YoY) (Q4) is expected to be 2.7% from 2.6% previously. Industrial Production w.d.a. (YoY) (Dec) will be released with a consensus number coming in at 4.2% and a prior of 3.2%. Industrial Production s.a. (MoM) (Dec) is expected at 0.2% from 1.0% previously. The EUR could be moved by this data.

At 11:20 GMT, SNB Governing Board Member Zurbrugg will take part in a panel discussion at the Bundesbank Cash Symposium in Frankfurt. His comments can move CHF crosses.

At 12:45 GMT, ECB’s Mersch will speak and this may impact EUR crosses.

At 13:30 GMT, US Retail Sales (MoM) (Jan) will be released with an expected 0.2% from 0.4% previously. Retail Sales ex Autos (MoM) (Jan) is expected to be unchanged at 0.4%. Retail Sales Control Group (Jan) is expected at 0.4% from 0.3% prior. Consumer Price Index (MoM) (Jan) is expected at 0.3% from 0.1% previously, which was revised up to 0.2%. Consumer Price Index (YoY) (Jan) is expected at 1.9% from 2.1% previously. Consumer Price Index Ex Food & Energy (YoY) (Jan) is expected to be 1.7% from 1.8% prior. Consumer Price Index Ex Food & Energy (MoM) (Jan) is expected to be 0.2% from 0.3% previously, which was revised down to 0.2%. USD crosses could see increased volatility around this data release.

At 23:50 GMT, Japanese Machinery Orders (YoY) (Dec) will be released with a consensus of 2.2% expected from 4.1% prior. Machinery Orders (MoM) (Dec) will be released with a consensus of -2.3% expected, from 5.7% previously. JPY pairs could see an increase in price movement after this data.