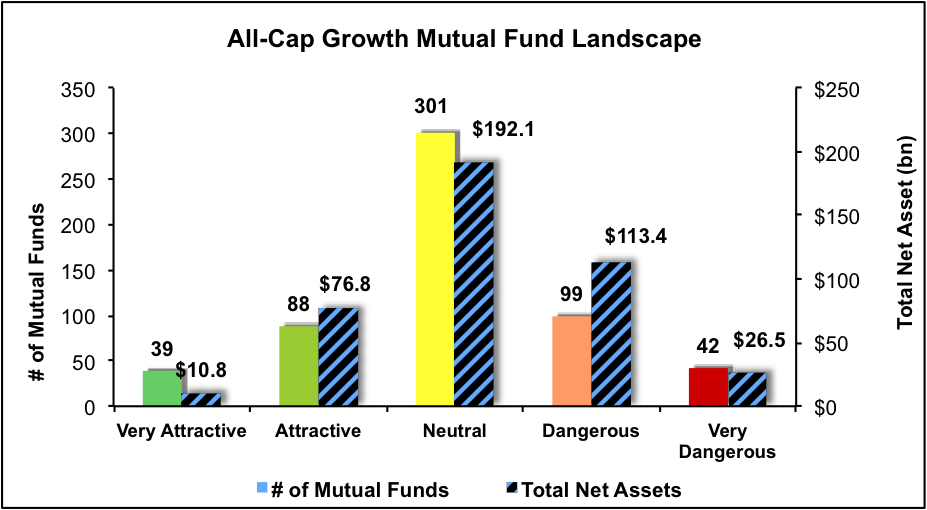

The All Cap Growth style ranks sixth out of the twelve fund styles as detailed in our 3Q16 Style Ratings for ETFs and Mutual Funds report. Last quarter, the All Cap Growth style ranked eighth. It gets our Neutral rating, which is based on an aggregation of ratings of 15 ETFs and 569 mutual funds in the All Cap Growth style as of July 28, 2016. See a recap of our 2Q16 Style Ratings here.

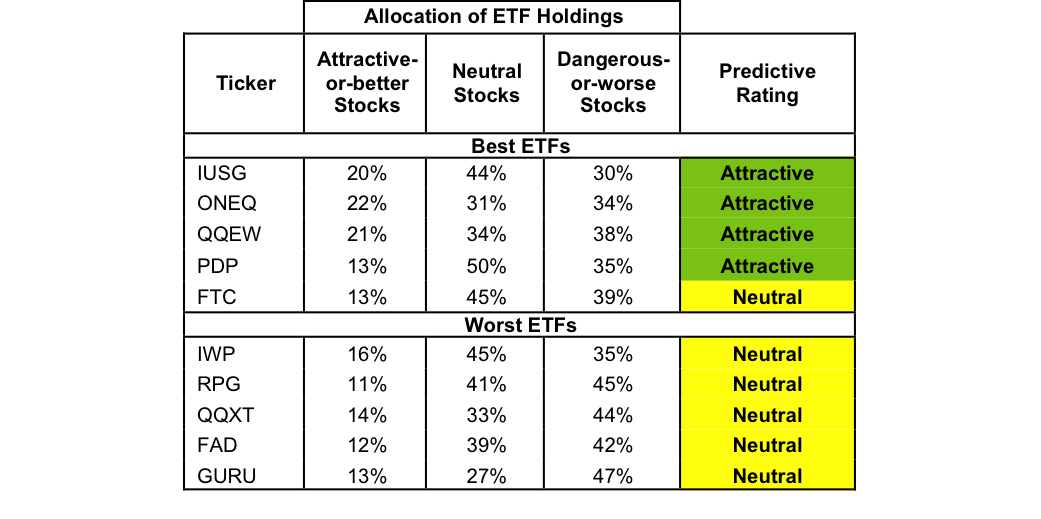

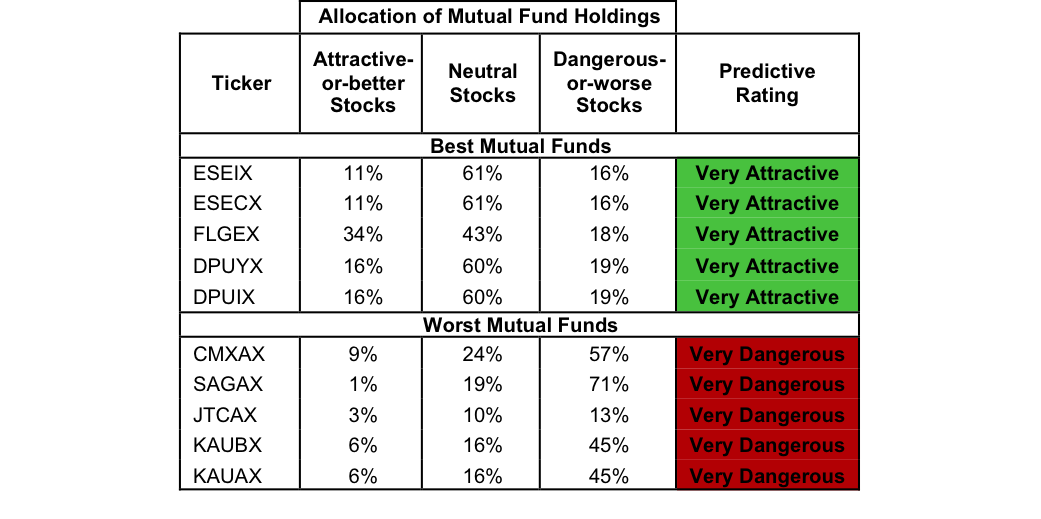

Figures 1 and 2 show the five best and worst rated ETFs and mutual funds in the style. Not all All Cap Growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 13 to 2171). This variation creates drastically different investment implications and, therefore, ratings.

Investors seeking exposure to the All Cap Growth style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Figure 1: ETFs with the Best and Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Four ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity minimums. See our ETF screener for more details.

Figure 2: Mutual Funds with the Best and Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Catalyst/Lyons Hedged Premium Return Fund (CLPFX) is excluded from Figure 2 because its total net assets (TNA) are below $100 million and do not meet our liquidity minimums.

iShares Core Russell US Growth ETF (NYSE:IUSG) is the top-rated All Cap Growth ETF and Eaton Vance Atlanta Capital Select Equity Fund (ESEIX) is the top-rated All Cap Growth mutual fund. IUSG earns an Attractive rating and ESEIX earns a Very Attractive rating.

Global X Guru Index ETF (NYSE:GURU) is the worst rated All Cap Growth ETF and Federated Kaufmann Fund (KAUAX) is the worst rated All Cap Growth mutual fund. GURU earns a Neutral rating and KAUAX earns a Very Dangerous rating.

Cisco Systems (NASDAQ:CSCO: $31/share) is one of our favorite stocks held by DPUYX and earns a Very Attractive rating. Cisco is on July’s Most Attractive Stocks list. Over the past decade, CSCO has grown after-tax profit (NOPAT) by 7% compounded annually to $9.1 billion in 2015. NOPAT has grown to $10.1 billion over the last twelve months (TTM). The company’s return on invested capital (ROIC) has improved from 14% in 2005 to a top-quintile 17% TTM as well.

Despite the improving fundamentals, CSCO remains undervalued. At its current price of $31/share, CSCO has a price-to-economic book value (PEBV) ratio of 0.9. This ratio means that the market expects Cisco’s NOPAT to permanently decline by 10% from current levels. If Cisco can grow NOPAT by just 4% compounded annually over the next decade, the stock is worth $38/share today – a 23% upside.

Crown Castle International (NYSE:CCI: $97/share) is one of our least favorite stocks held by GURU and earns a Very Dangerous rating. CCI’s economic earnings have declined from $23 million in 2012 to -$465 million over the last twelve months. Worse yet, 2012 was the only year CCI earned positive economic earnings in any year of our model, which dates back to 1998. Over the past five years, CCI has failed to improve its ROIC and currently earns a bottom-quintile 4% over the last twelve months.

Despite the clear deterioration of business fundamentals, CCI remains priced for significant profit growth. To justify its current price of $97/share, CCI must grow NOPAT by 10% compounded annually for the next 15 years. Given the shareholder value destruction through CCI’s history, this expectation seems overly optimistic.

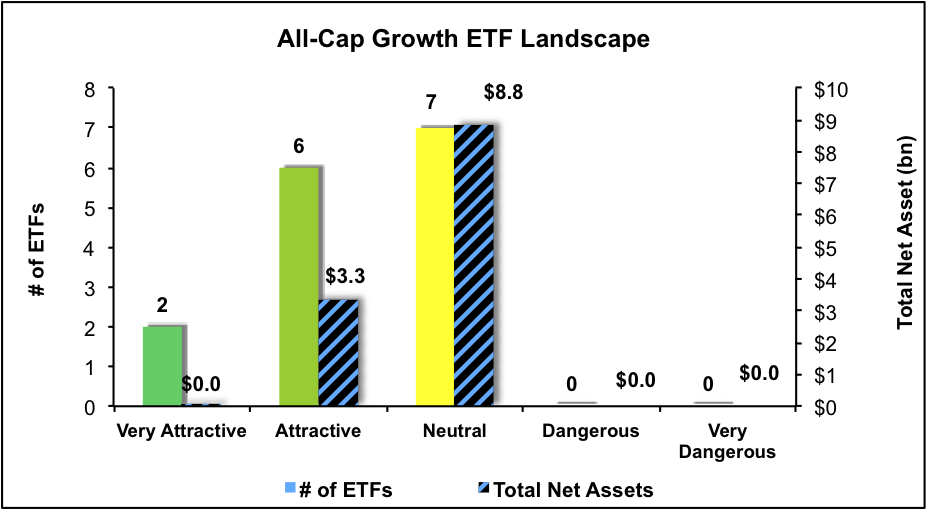

Figures 3 and 4 show the rating landscape of all All Cap Growth ETFs and mutual funds.

Figure 3: Separating the Best ETFs from the Worst Funds

Figure 4: Separating the Best Mutual Funds from the Worst Funds

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.