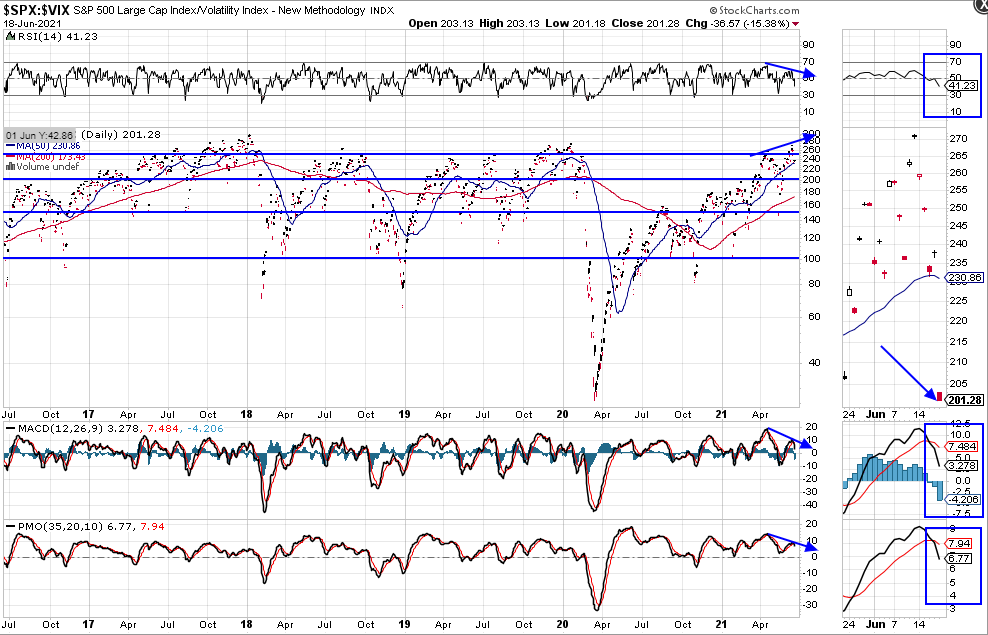

Further to my post of June 11, the SPX:VIX ratio has dropped to just above the 200 level...a major resistance/support level, as shown on the daily ratio chart below.

This follows a recent new swing high in price to just above 250. Ratio price has failed, repeatedly, to remain above 250 over the years.

All three technical indicators, RSI, MACD and PMO, formed divergences on this latest price swing high, hinting at ensuing price weakness. After making a new all-time high of 4257.16 on June 15, the SPX dropped sharply and closed at 4166.45 on Friday.

Furthermore, the RSI has dropped below 50, and the MACD and PMO have formed bearish crossovers, all signaling further weakness ahead.

A drop and hold below 200 could send the SPX down to around 4100, or lower to 4000...particularly if the ratio drops and holds below its next support level of 150 (the 200 MA sits at 173.43, so failure of price to hold that level will see major selling follow in the SPX).

Major historical support on the ratio sits at 100, which, up until the year 2000, represented major resistance during the 1990s. A drop and hold below that level would likely result in panic selling in the SPX, as we saw during the 2008/09 financial crisis [refer to the longer-timeframe monthly chart of the SPX (with SPX:VIX ratio displayed in histogram format) shown in my above-mentioned post for context].