Aegion Corporation (NASDAQ:AEGN) has announced updates on the company’s previous strategic actions and restructuring plans. Its focus on restructuring actions will drive results, while impact of the recent hurricanes and financial challenges will remain headwinds in the near term.

Details of Strategic Actions

On Aug 1, Aegion announced a series of strategic actions to generate more predictable and sustainable long-term earnings growth. Based on the strategic actions, the company has planned to divest the Corrosion Protection’s pipe coating and insulation business in Louisiana, due to persistence of mix issues and performance challenges on several cathodic protection system construction projects in the U.S. midstream pipeline market.

Also, per the plan, Aegion has approved to exit all non-pipe-related contract applications for the Tyfo Fibrwrap system in North America, restructure Corrosion Protection’s operations in Canada and implement cost-reduction actions as well. These restructuring initiatives are anticipated to generate annualized savings in excess of $15 million in 2018.

What Led to These Actions?

In Australia, the company is unable to procure quality crew needed to execute existing high backlog due to labor shortages. This, along with lack of experience of the crew, has led to significant execution issues and operating losses. The company’s efforts to address the issues have not been successful so far. A more thorough assessment of the market and operation is now underway.

Despite favorable market conditions, Aegion has been plagued with legacy backlog issues for the past year in Denmark. Also, despite investments in the last two years to accelerate sales momentum in North America, the company has failed to sufficiently expand contract applications for the Tyfo Fibrwrap system to strengthen buildings, bridges and other structures.

Updates on Strategic Actions

As part of the repositioning of the Infrastructure Solutions platform’s Tyfo Fibrwrap system operations in North America, Aegion completed an impairment assessment of the long-lived assets and goodwill for the Fyfe reporting unit. The company also performed a detailed evaluation of the Infrastructure Solutions businesses in Australia and Denmark during third-quarter 2017.

Impact on 3Q & 2017 Results

Due to the impairment assessment of the long-lived assets and goodwill for the Fyfe reporting unit, Aegion will incur a non-cash, pre-tax impairment charge of approximately $85 million in third-quarter 2017.

Per the restructuring program in Australia and Denmark, the company expects to report annual savings between $2 and $3 million, with cash restructuring costs in the range of $3-$4 million. Total annual savings from all restructuring activities and other cost-reduction initiatives are estimated to be in excess of $17 million and expected to be fully realized in 2018. Total cash costs associated with the restructuring actions are estimated to be in the range of $12-$15 million.

Further, Aegion will continue to face performance issues subject to restructuring actions, which combined with the impact on operations from Hurricanes Harvey and Irma, are expected to impact third-quarter operating results by approximately $5 million, or 10 cents per share.

Our Take

Despite the negative impact of the hurricanes, Aegion’s strong end markets, investments in sales resources, market expansion and R&D will drive profitability. Its results for full-year 2017 will be backed by strong second-half 2017 orders for projects in the North American market for Insituform CIPP rehabilitation.

Furthermore, the company’s growth will be supported by key project awards in the Middle East, Central America and South America. A favorable market for day-to-day refinery maintenance and turnaround services in the United States will drive revenues and operating margin expansion in its Energy Services segment in the second half of 2017.

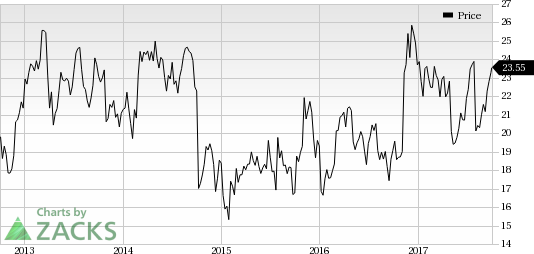

Share Price Performance

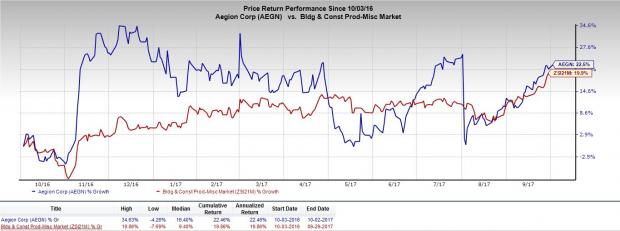

In the past year, Aegion has underperformed the industry it belongs to. The company has gained around 22.5%, while the industry registered growth of 19.9%.

Aegion currently carries a Zacks Rank #4 (Sell).

3 Construction Stocks Stealing the Limelight

Better-ranked stocks, which warrant a look in the broader construction sector, include Babcock International Group (LON:BAB) plc BCKIY, Potlatch Corp. (NASDAQ:PCH) and Owens Corning (NYSE:OC) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Babcock International has an expected long-term earnings growth rate of 8%.

Potlatch has an expected long-term earnings growth rate of 5%.

Owens Corning has an expected long-term earnings growth rate of 14.8%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Owens Corning Inc (OC): Free Stock Analysis Report

Aegion Corp (AEGN): Free Stock Analysis Report

Potlatch Corporation (PCH): Free Stock Analysis Report

Babcock International Group PLC (BCKIY): Free Stock Analysis Report

Original post

Zacks Investment Research