Actuant Corporation (NYSE:ATU) pulled off a positive earnings surprise in the third quarter of fiscal 2018 (ended May 31, 2018), with adjusted earnings per share of 39 cents surpassing the Zacks Consensus Estimate of 36 cents by roughly 8.3%.

Also, this industrial tool maker’s adjusted bottom line increased 21.9% from 32 cents per share in the year-ago quarter. This came on the back of healthy segmental business and improving margins.

Segmental Performance Drives Revenues

In the reported quarter, Actuant generated sales of $317.1 million, increasing 7.3% from the year-ago quarter. The improvement was driven by 4% growth in organic sales and 4% gain from favorable foreign currency movements, partially offset by 1% negative impact of acquisition and divestitures.

However, the top line surpassed the Zacks Consensus Estimate of $305.9 million by roughly 3.7%.

The company reports its net sales under three segments — Industrial, Energy and Engineered Solutions. The segmental information is briefly discussed below:

Revenues from Industrial segment were $108.3 million, increasing 7.8% year over year. It accounted for 34.2% of the reported quarter’s sales.

The segment’s core sales grew 4% and foreign currency translation had a positive 4% impact. Demand for standard industrial tools was healthy in many end markets while sales for heavy lifting technology declined.

Revenues from Energy segment totaled $83.9 million, inching up 0.5% from the year-ago tally. It accounted for 26.4% of the reported quarter’s sales.

Gains of 3% from favorable currency movements were offset by 1% fall in core sales, and 2% negative impact of acquisitions and divestitures. Improvement in maintenance services, provided by Hydratight, improved in the North Sea and the Middle East, offset by weakness in other regions. Also, rise in demand for medical products and activities in oil & gas market boosted Cortland sales.

Revenues from Engineered Solutions segment grew 12.1% year over year to $124.9 million. It accounted for 39.4% of the reported quarter’s sales.

The segment’s core sales grew 7% and foreign currency translation had a positive 5% impact. Business flourished in off-highway and agriculture end markets while truck sales grew modestly in the quarter under review.

Margins Improve Y/Y

In the reported quarter, Actuant’s cost of sales jumped 4.1% year over year to $200.6 million. It represented 63.3% of sales compared with 65.2% in the year-ago quarter. Gross margin improved 190 basis points (bps) year over year to 36.7%. Selling, administrative and engineering expenses increased 10.7% year over year to $77.6 million. As a percentage of sales, it represented 24.5% versus 23.7% in the year-ago quarter.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) were $44.4 million, up 19.7% year over year. Adjusted EBITDA margin in the reported quarter was 14% versus 12.5% in the year-ago quarter. Adjusted operating income increased 21.8% year over year to $33.8 million while adjusted operating margin grew 130 bps to 10.7%.

Balance Sheet and Cash Flow

Exiting third-quarter fiscal 2018, Actuant had cash and cash equivalents of $189.5 million, up 23.4% from $153.6 million at the end of the previous quarter. Long-term debt balance decreased 1.4%, sequentially, to $510 million.

In the quarter under review, the company generated net cash of $57.7 million from its operating activities, increasing 54.3% year over year. Capital spending totaled $6.2 million, down 25% year over year.

Outlook

Actuant believes that solid results so-far in the fiscal — as well as increase in maintenance activities in the energy end market, introduction of products and initiatives to curb the impacts of the inflationary situation — will help it deliver sound results in fiscal 2018.

For the fiscal, the company anticipates adjusted earnings per share of $1.03-$1.08, narrower than the previous forecast of $1.00-$1.10. This revision roughly increases the midpoint of the earnings guidance from $1.05 to $1.06. Sales are now projected to be $1.17-$1.18 billion, above $1.14-$1.16 billion expected earlier.

Cash flow from operating activities is predicted to be $85-$95 million while capital spending is likely to be $25 million. Free cash flow is anticipated to be $70-$75 million; with free cash flow conversion of more than 100%.

For the fiscal fourth quarter, adjusted earnings are anticipated to be 32-37 cents per share and sales to be $290-$300 million. Core sales are predicted to be 3-5%. The effective tax rate will be in a mid-single digit.

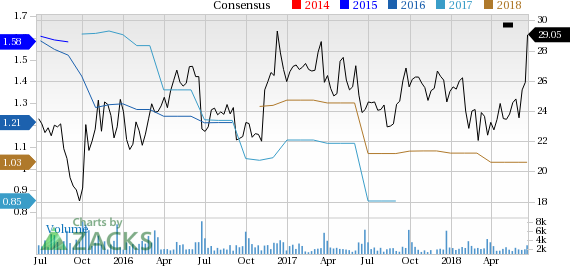

Actuant Corporation Price and Consensus

Actuant Corporation (ATU): Free Stock Analysis Report

Graco Inc. (GGG): Free Stock Analysis Report

Kadant Inc (KAI): Free Stock Analysis Report

Twin Disc, Incorporated (TWIN): Free Stock Analysis Report

Original post

Zacks Investment Research