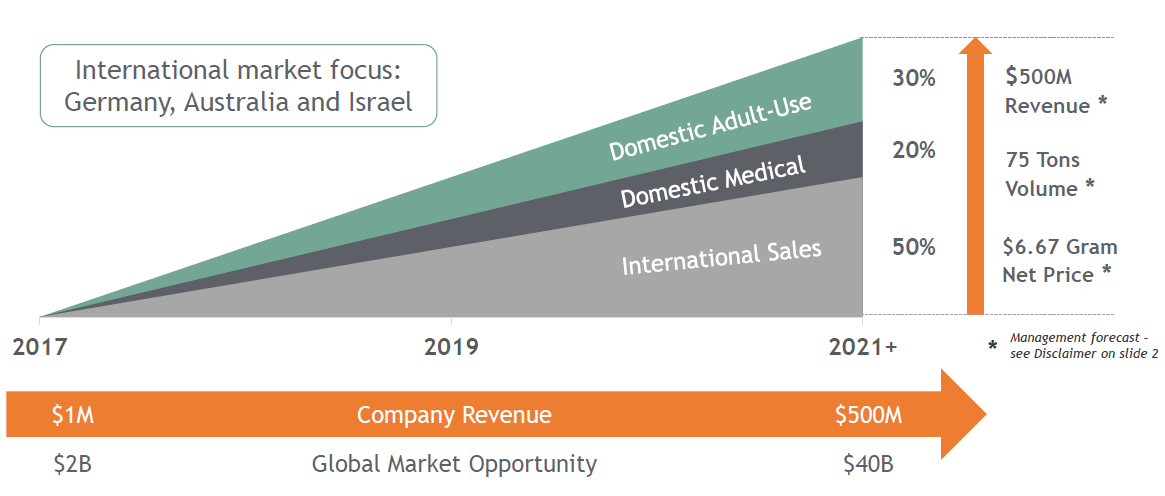

ABcann Global Corp (V:ABCN) estimates its revenues to grow multifold through 2021, reaching $500 million from less than $1.0 million run rate

ABcann Global Corporation is a junior cannabis player holding a niche in cultivation technologies that deliver higher yields and consistent quality. ABcann is planning aggressive expansion of its flagship facility in Napanee, Ontario, with production targets of over 30,000 kgs annually by 2019.

The correction in cannabis stocks over the past two months has had a devastating effect on junior cannabis players such as ABcann Global. From the high of $3.85 on January 25, 2018, the share price of ABcann has fallen 59% to its recent price of $1.59. As the Company continues its expansion activities over the next two years, increasing its production and revenues, its stock price could rebound. ABcann Global estimates its revenues to grow multifold through 2021, reaching $500 million from less than $1.0 million run rate, as of September 30, 2017. An important catalyst for the stock would be the completion of its 30,000 sq. ft Vanluven facility in Napanee by mid-2018, for an output of 1,400 kgs annually, that would target both the medical and adult-use markets.

Investment thesis

- Proprietary growing techniques deliver industry-leading yields

- Aggressive expansion and product development plans

- Strong liquidity to support expansion activities

Proprietary cultivation techniques

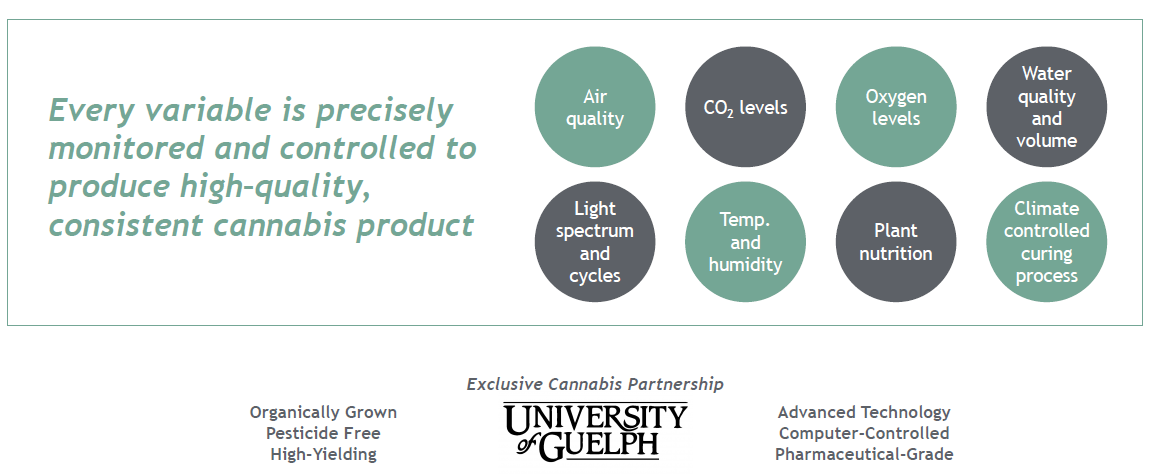

One of the key differentiators of ABcann Global, amongst several emerging cannabis producers, is its proprietary growing techniques that optimize costs, while delivering quality products. The technology centred on its specially designed, environmentally-controlled growing chambers, are estimated to produce quality pharmaceutical-grade cannabis products, with industry-leading yields of 250 grams/sq. ft/year that are expected to reach 400 grams/sq. ft/year, compared to the perceived industry average of ~200 grams/sq. ft/year.

Proprietary Cultivation Technology

Source: Company presentation

Aggressive expansion and product development plans

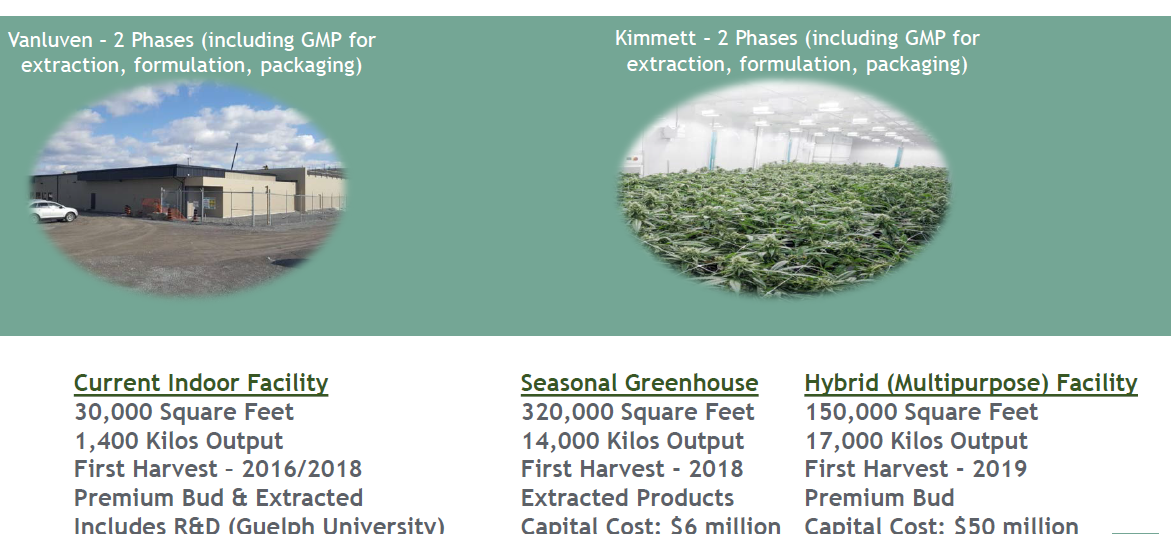

ABcann Global is planning to complete its Phase I 30,000 sq. ft Vanluven facility in Napanee by mid-2018 that is expected to produce about 1,400 kgs per year. The Phase II expansion will involve construction of a 150,000 sq ft Kimmett Facility in Napanee for an output of 17,000 kgs annually. A seasonal greenhouse at Napanee with 320,000 sq ft is anticipated to add another 14,000 kgs per year, taking the total production capacity in Napanee to over 30,000 kgs annually.

Expanding Capacity to 32 Tons in Napanee

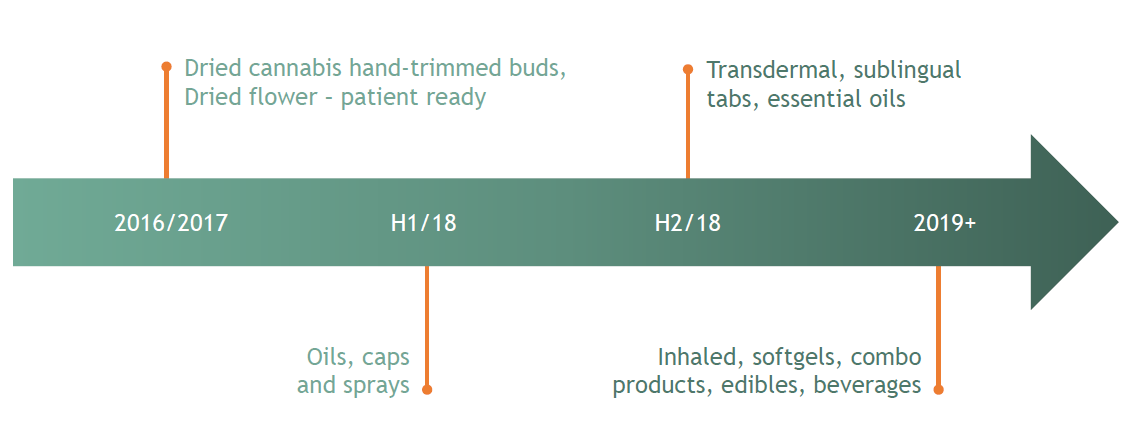

Concurrently, ABcann Global plans to focus on branding and product innovation in the medical and adult-use sectors. Starting with dried cannabis, which are already available for patients, the Company plans to produce cannabis oils, caps and sprays in H1 2018, followed by transdermal and sublingual tabs in H2 2018. In 2019, additional products are planned, which includes soft gels, edibles and beverages.

Product Development Roadmap

Source: Company presentation

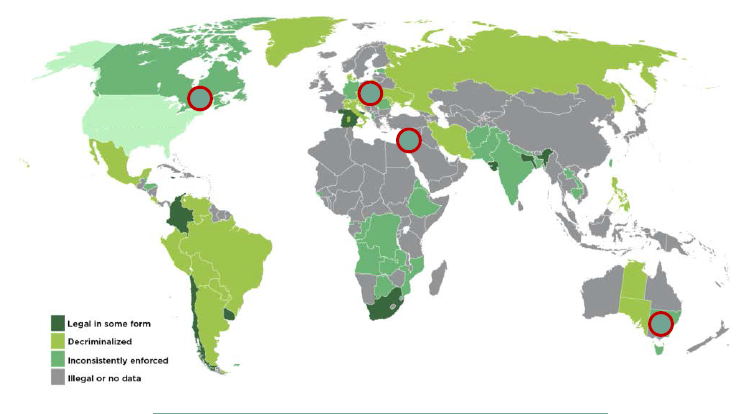

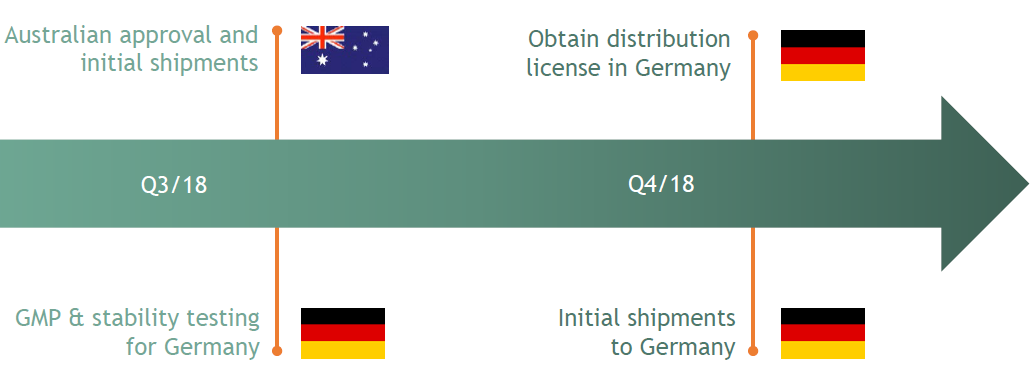

ABcann Global is also planning international expansion across select jurisdictions. In January 2018, the Company’s Australian subsidiary ABcann Australia Pty Ltd. received an Australian import license, with initial shipments expected in Q3 2018. The other key international market for ABcann is Germany and it expects its distribution license in Q4 2018.

Foothold established in Canada, Germany, Australia and Israel

Source: Company presentation

Key forthcoming events in International expansion

Source: Company presentation

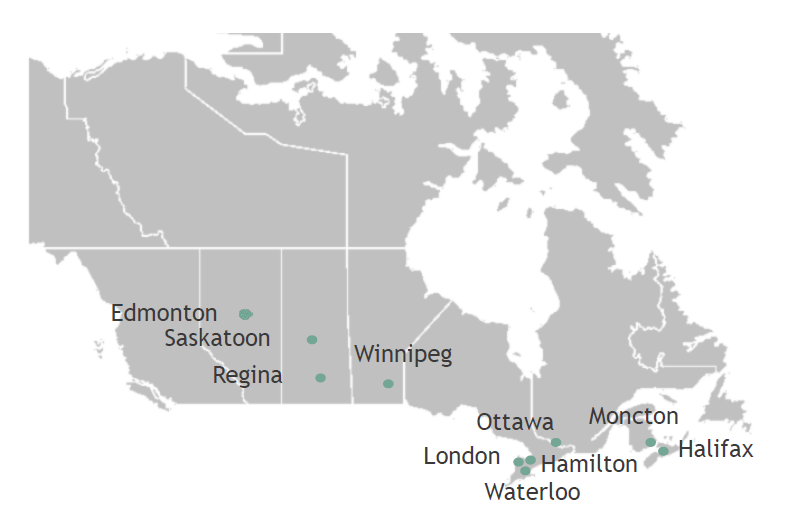

Scaling up clinic business post acquisition of Harvest Medicine

ABcann Global acquired the cannabis clinic business ‘Harvest Medicine Inc.,’ a cannabis discovery center and clinic, in February 2018. Harvest Medicine currently has over ~10,000 active patients with a monthly new patient acquisition rate of 1,300 from a single location. ABcann plans to add four new locations nationwide and expand the highly-rated initial location to add over 15,000 active patients per year.

Scaling-Up Harvest Medicine – Four New Locations Planned

Source: Company presentation

Strong liquidity to support expansion activities

With the closing of an oversubscribed financing of $75 million in February 2018, ABcann has cash of over $100 million, possibly sufficient to fund its expansion and production development plans through 2019, including the 150,000 sq. ft Kimmett Facility, which is expected to require $50 million in capex.

Outlook and valuation

The correction in cannabis stocks over the past two months has had a devastating effect on junior cannabis players such as ABcann Global. From the high of $3.85 on January 25, 2018, the share price of ABcann has fallen 59% to its recent price of $1.59. As the Company continues its expansion activities over the next two years, increasing its production and revenues, its stock price could rebound.

ABcann Revenue Forecasts through 2021

Source: Company presentation

Disclosure: Neither the author nor his family own shares in the company mentioned above.