ABB Ltd (NYSE:ABB) recently secured a contract worth more than $90 million from Dubai Electricity and Water Authority — a major power utility in United Arab Emirates. Per the deal, ABB will be responsible for construction of the Shams 400 kV substation, which will integrate solar power from upcoming phases of the Mohammed bin Rashid Al Maktoum Solar Park into the Dubai’s electrical grid.

Under the contract, ABB has been assigned the task to design, supply, install and commission the Shams 400/ 132 kV substation, which will have a capacity of over 2,000 megavolt amperes. On completion of the Phase-3 of the project in 2020, the Solar Photovoltaic is expected to generate more than 1,000 MW of total solar power.

As part of the project, the company will supply 400 and 132 kV gas-insulated switchgear, power transformers, protection, automation and control systems along with surveillance and communication systems. Notably, the substation will be IEC 61850 enabled, which is likely to support open as well as seamless communication with all intelligent devices. This marks the company’s second substation for the park that will ensure reliable delivery of power to utility and industry customers alongside serving building and infrastructure sector.

Existing Business Scenario

ABB has garnered a solid reputation for winning strategic awards and forging important partnerships. Moving ahead, broader market conditions represent selective opportunities that can supplement the company’s growth momentum. The company has also been successful in clinching major orders across all of its three segments, namely — utilities, energy and transport & infrastructure — which are expected to drive growth. Also, greater visibility in the timing of backlog growth adds to the company’s prospects.

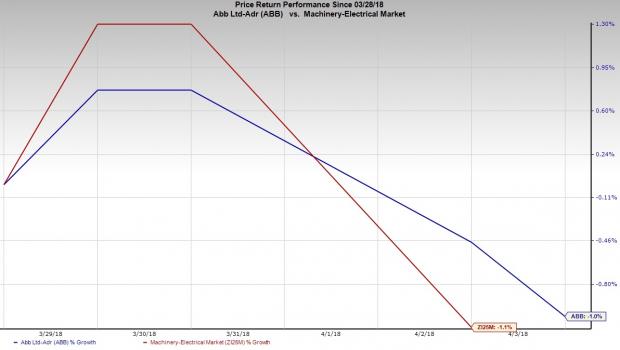

Notably, the Zacks Rank #3 (Hold) company’s shares have lost 1% in the past week, marginally lower than the industry’s decline of 1.1%.

Going forward, strength in matured end-markets, including Europe and the emerging countries like China and India, are expected to fuel ABB’s growth. The company expects utility customers to invest further in transmission and distribution projects and renewable sources like solar and wind. This apart, it anticipates gaining from investments in ultra high voltage DC power transmission projects in mature and emerging markets, and continued investments in maintenance of aging electric infrastructures.

Despite these tailwinds, ABB has been facing strong structural headwinds in its largest business, Power Grids, in the past few quarters. Additionally, lower capital spending for the company’s key upstream energy end-markets is likely to hurt its financials.

Key Picks

Some better-ranked stocks from the same space are A. O. Smith Corporation (NYSE:AOS) , Capstone Turbine Corporation (NASDAQ:CPST) and Regal Beloit Corporation (NYSE:RBC) . Each of the stocks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A. O. Smith has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 3.9%.

Capstone Turbine has surpassed estimates twice in the trailing four quarters, with an average positive earnings surprise of 20.8%.

Regal Beloit has outpaced estimates twice in the preceding four quarters, with an average earnings surprise of 2.9%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

ABB Ltd (ABB): Free Stock Analysis Report

Capstone Turbine Corporation (CPST): Free Stock Analysis Report

A. O. Smith Corporation (AOS): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Original post