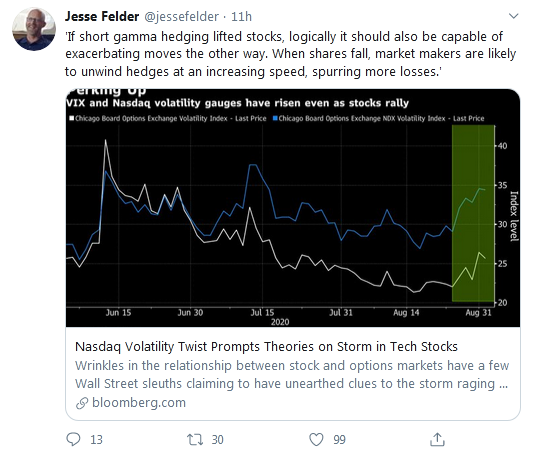

Last week, I noted that a relatively rare condition had arisen in which stocks and expected volatility had risen at the same time. Yesterday morning, I noted on Twitter that the NASDAQ Composite and its volatility index (VXN) had never been more positively correlated than they have over the past 10 days. This week, I’d like to briefly put forth my best guess as to why this is happening.

As noted by Jason Goepfert, speculative call buying has recently surged to levels never seen before.

This has dramatically pushed up the prices of those call options relative to put options, especially in the popular speculative names in the market.

At the same time, market makers selling all those call options to the traders buying them are forced to hedge by buying the underlying stocks.

Rapidly rising call premiums pushes volatility measures higher while surging dealer demand for stocks pushes prices higher. However, this is not a sustainable situation.

And the inevitable unwinding of it could be even more volatile than anything we’ve seen so far.