Once we expanded barter through commodities with paper “I owe you‘s” (started by the Medici), we entered a system of trust. While a direct exchange prior without a middleman was easy from the view of trust, a system of paper with underlying commodities held by the state got more and more complex. In 1971 Nixon abolished the gold standard and with it, trust got challenged to the next level. Now the dollar is entirely dependent on the trust in the government. Trust is easily given when all is fine but when troubles arise people start asking questions. Trust, Debt, Bitcoin.

Overall, from 1913 into today’s value one US-Dollar got devaluated down to four cents only thanks to governments constantly inflating the money supply. A loss of ninety-six percent! This is only tolerated by its users since this loss is stretched through time and less noticeable as a result. With personal, corporate, and government debts at current times nonrepayable, inflation being far from the less noticeable two percent per year, a day of reckoning is imminent.

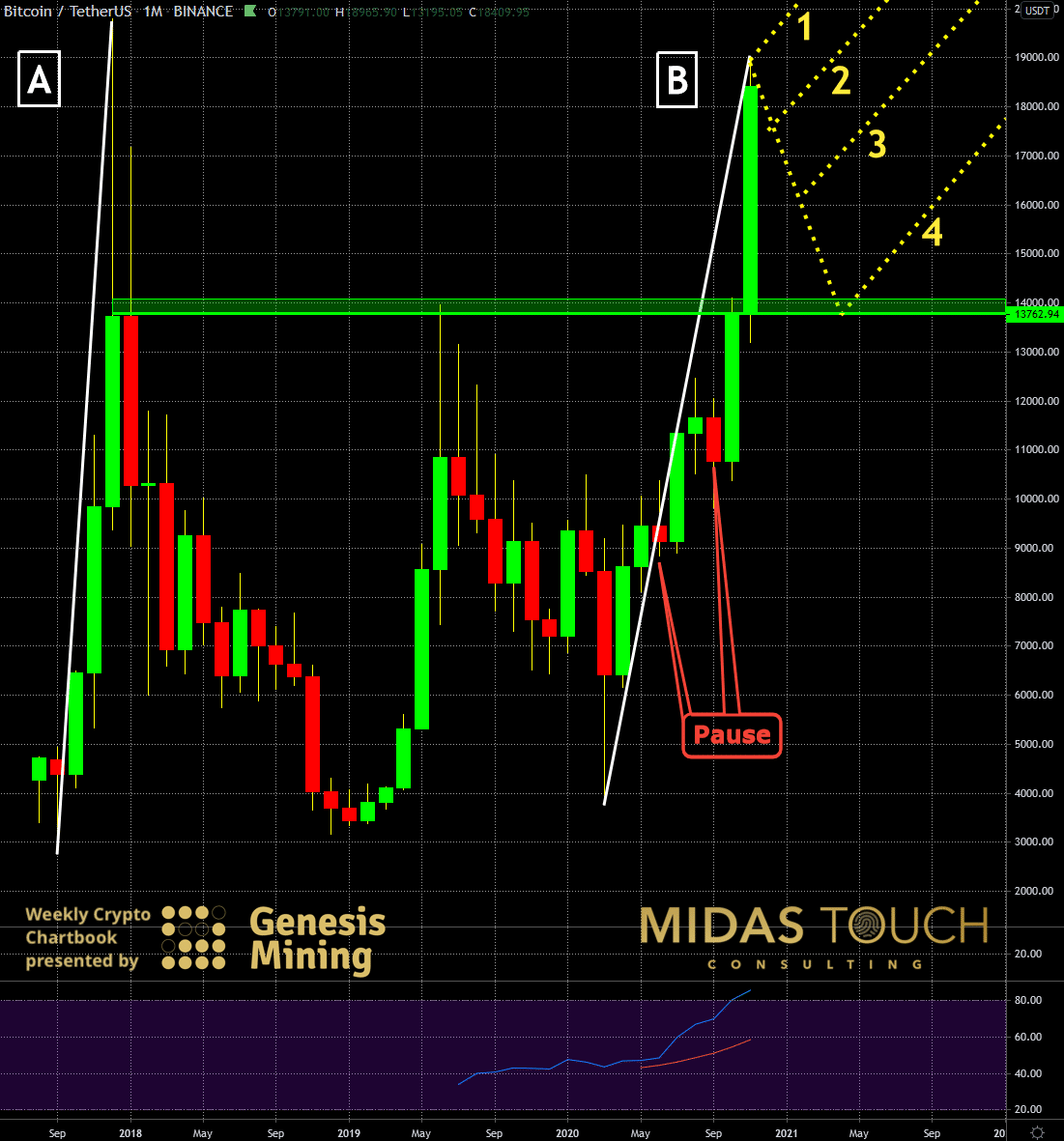

BTC-USDT, Monthly Chart, Price analysis, what’s different this time?

We already had Bitcoin attempt price levels like we are trading right now at in 2017 and it bounced from there nearly one hundred percent back to its original levels. Should we fear this to happen again? No.

Looking at the monthly chart above, one can see that at the time (A) the move started from US$2,817 ending at US$19,798 while this time around (B), the movie went from US$3,782 up to US$18,965 so far. This makes move A a 602% advance while move B is only 401%. Also move A developed over four months, while move B took nine months with two breathers in between (pause).

Now, as we are approaching these all-time highs in Bitcoin for the second time, this resistance is weakening, and Bitcoin has also built a solid support zone below at the US$14,000 level. Concluding that the feared, or for many who want to enter or reenter Bitcoin hoped for, retracement might never come (1). Bitcoin can certainly pullback for a healthy retracement (2, 3, 4), but most likely not a very deep one if at all.

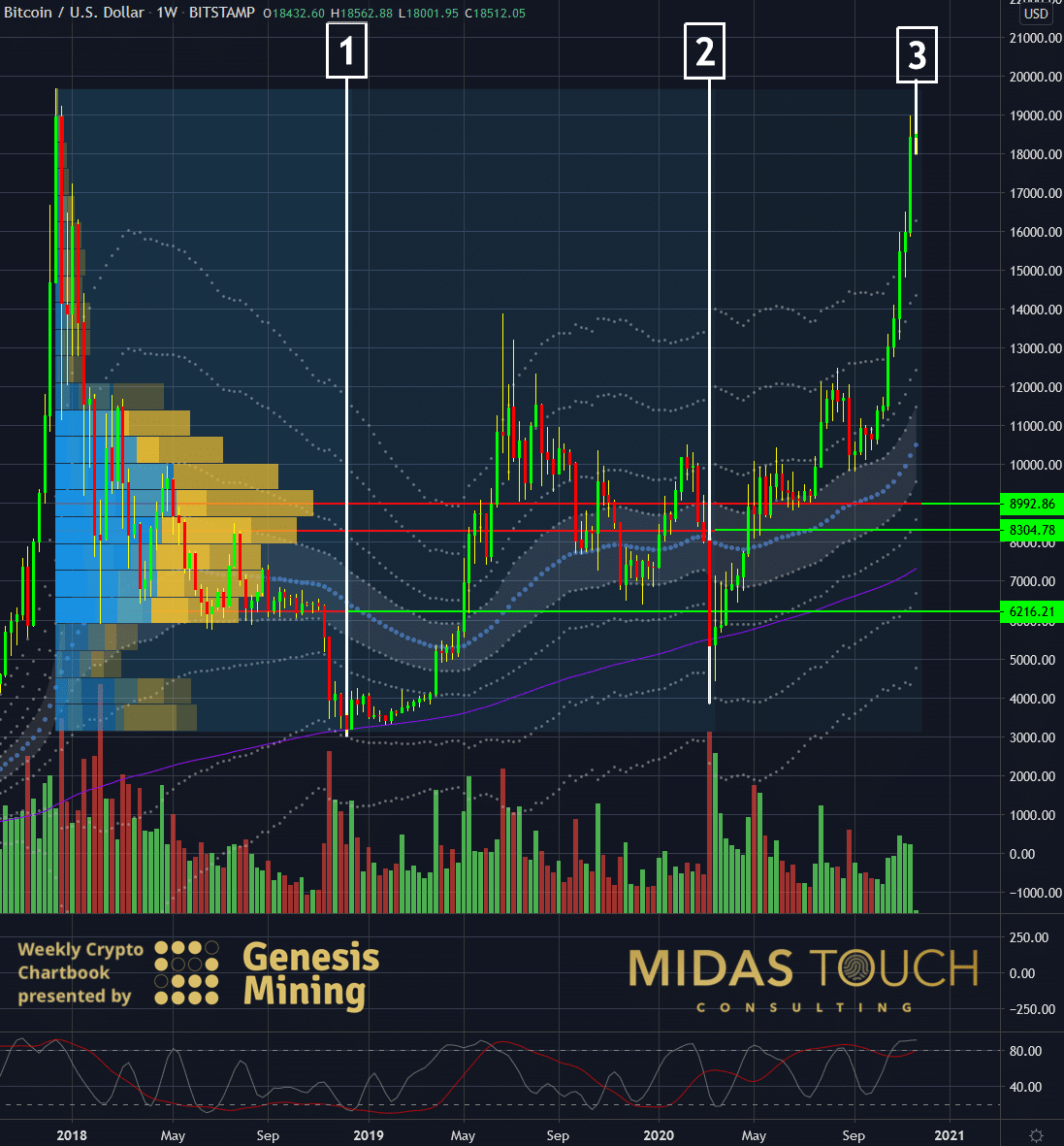

BTC-USDT, Weekly Chart, Volume analysis, healthy support:

It is a mistake to look at volume numbers isolated just in the numbers themselves. The weekly chart above illustrates our view rather from a time range perspective in regard to a volume at the highest transaction zones.

At point 1 we measured volume from the highs in 2017 to the lows in 2018 with the result that most transactions on average happened at the US$6,216 level making this support. The second measurement (2) was taken from the 2017 highs inclusive of the 2020 lows resulting in a support zone at the price level of US$8,304. The final sample analysis encompasses all data between the 2017 highs and the most recent data. We find now a solid supply zone at the US$8,992 zone.

What supports the health of the recent directional up move is the fact that price support levels over time have been rising.

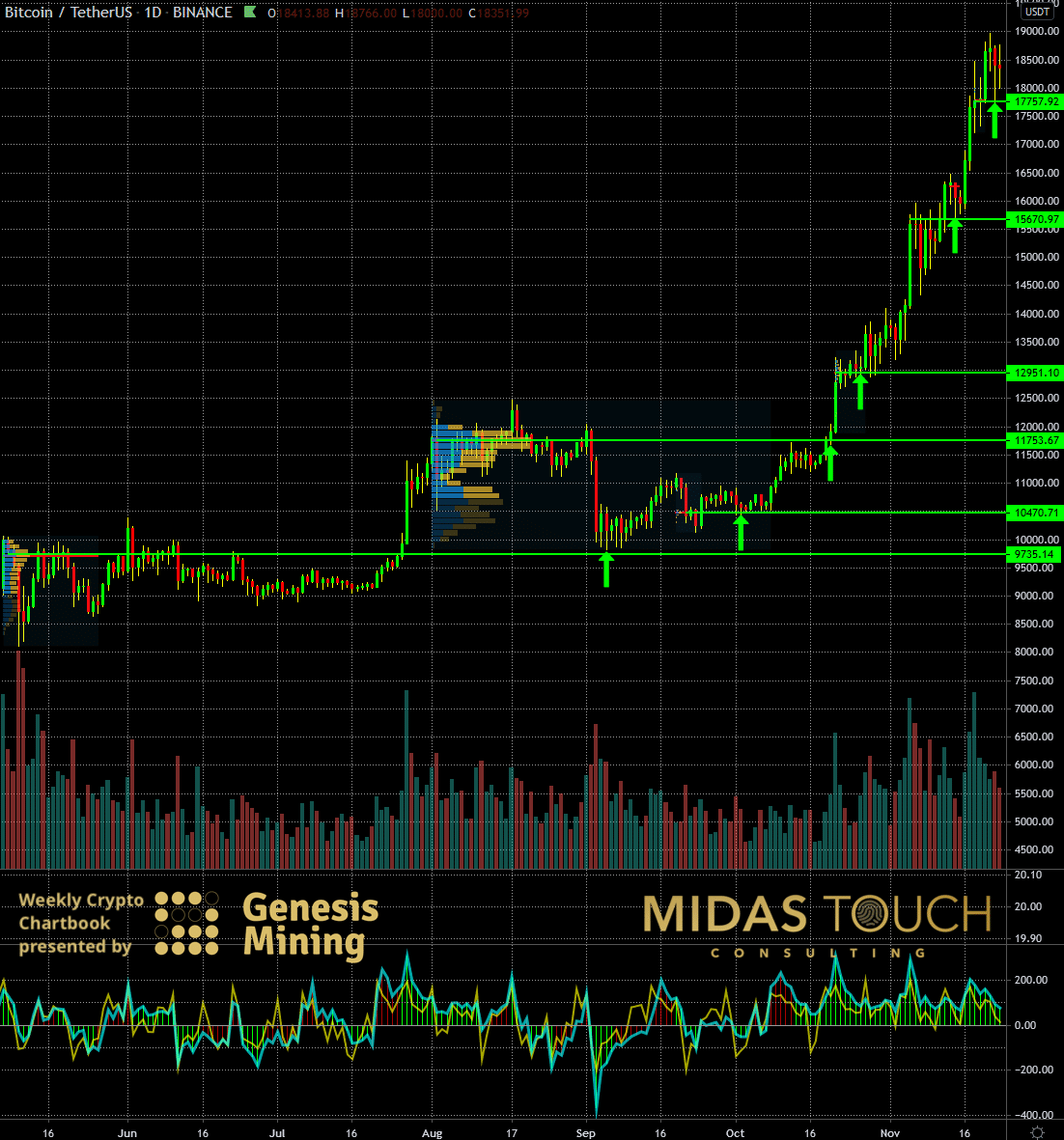

BTC-USDT, Daily Chart, But where to get in?

No matter if you want to add to your position or whether you need to initiate a position, it is never appropriate to think one single point will do the trick. This would preassume one knows precisely where the market turns. But nobody does!

Using a fixed range volume analysis tool is helpful to find low-risk entries. It provides both for sideways and directional markets excellent support resistance zones. In conjunction with our quad exit strategy, you can take aside runner rest positions. In a trending environment, this builds over time low-risk long term core position.

Trust, debt, Bitcoin:

Bitcoin in a way is a step back to the original roots of money. It is limited in supply; you are the bank since there is no middleman. With the internet came a shift in trust. You didn’t need to trust anybody anymore for information. Myths easily got dispelled. While we see a lack of inspiring leadership instilling trust, and trust in governments and banks erode, the trust in the internet seems still to be finding solid grounds. Bitcoins’ existence is built on principles. Principles being ultimate truths. Bombarded with lies from many sides makes this means of exchange attractive in itself.

Your money needs to give you a feeling of security. It is questionable how long fiat currencies will still be able to do that job.