We’ve been waiting years for our fixed income trade of a decade…

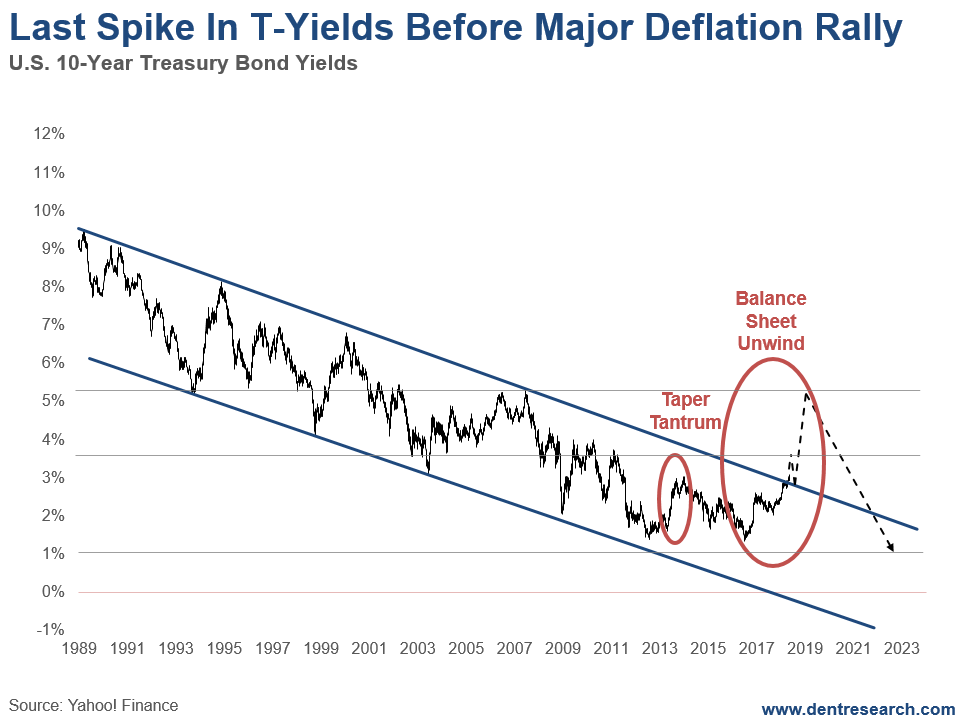

Our target’s at the top of the long-term Treasury Bond Channel near 3% on current 10-year yields. And recently, we advised our Boom & Bust subscribers to buy long-term Treasurys at around 2.99% on the 10-year.

Now we’re thinking it could get better… much better.

Yesterday, we emailed subscribers with instructions to tighten their stop losses on our Trade of the Decade play. If yields break much higher (above 3.15%), then we’ll exit our current position and wait for a much better long-term opportunity.

Treasurys are breaking above the best long-term indicator we’ve ever had: the 10-Year Treasury Bond Yield Since 1989.

That’s almost 40 years…

The last low, at 1.38% yields, didn’t quite test the bottom of the channel. But, this first break above the top of this 40-year trend-line is significant. I’ve been forecasting late-stage inflation, as has David Stockman, editor of Deep State Declassified.

If this break out continues, we face the opportunity of buying secure bonds at 5%-plus yields, instead of 3%, then we’ll ride them down towards 1% or lower yields over the next several years, banking higher dividends than stocks.

With the 20-year AAA corporate bond and 30-year Treasury bond yields rising, they’ll become increasingly better than stock dividend yields. The bonds have greater safety and appreciation in the asset class, which has proven to do well during times of deflation and debt leveraging. High-quality bonds tend to go up in value and accrue more interest, similarly to cash – which has no yield – but does appreciate dramatically, when everything else goes down.

Just look back at the worst of the 2008 crash when stocks dropped 50%. Gold went down 33%, and silver 50%… while the U.S. dollar went up 27% and Treasury bonds surged, likewise.

Your gut may tell you: Money printing can only be bad, and only end up in inflation.

But that only happens in rare cases, and is NOT happening here.

We’re only printing such unprecedented amounts of money to prevent the greatest deflationary crisis since the Great Depression – when debt gets written off and financial bubbles bursts. That destroys money!

That’s deflationary, not inflationary.

Money printing and artificial stimulus will only make the coming crisis worse!

This bond breakout underway is issuing a stark warning: Get out of passive stock investments and real estate on any near-term rallies… If yields spike, as I expect we’ll see, it’ll send both asset classes into free fall.

Baron Rothschild said that the secret to his wealth was: “He always got out a bit early!”

Be like Baron Rothschild, if you’re not following a proven strategy like those we provide here at Dent Research!