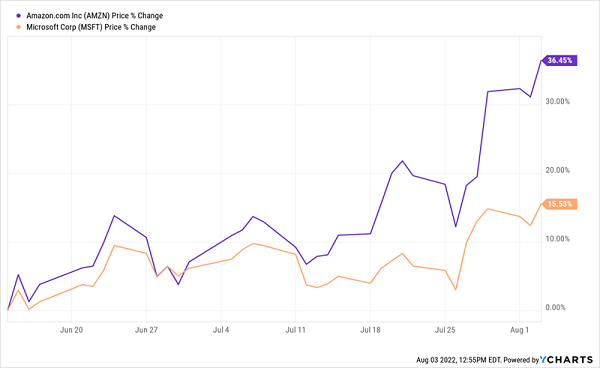

Just a couple weeks ago, many folks thought they had lots of time to grab beaten-down stocks like Amazon.com (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT).Since then, these blue-chips have really popped:

Techs Bounce—But We Can Still Buy Cheap (With 7%+ Dividends, Too)

Fortunately there is a way we can still buy AMZN and MSFT at “pre-launch” prices. And collect 7%+ yields, too!

We’re not buying the shares directly. We’re smarter than that. We’re picking these stocks up with the types of 7%+ dividends we favor at steep discounts to their market prices.

This “dividend discount” method lets us “turn back the clock” and buy the dip after the dip has already happened!

We can also pick these stocks up with outsized dividend yields of 7%+. And our payouts will often come your way monthly, too. That’s a far cry from buying Microsoft on its own, with its practically nonexistent 0.88% dividend. And Amazon, of course, yields exactly 0% today—and likely always will.

How We’ll Buy Our Favorite Dividends Cheap

I bring this up now because it’s a similar situation to one we faced a little less than two years ago, in October 2020. Back then, you’ll recall, the world was mostly in lockdown, but stocks had bottomed months before—and were ripping higher almost daily.

We wanted to pick up some consumer names to profit from the rebound, not to mention the trillions of dollars Jay Powell & Co. (with an assist from the U.S. government) was pumping into consumers’ pockets.

But we sure didn’t want to pay the inflated prices these stocks were going for at the time! And because we’re a high-yield service, we demanded big dividends—ideally big enough to let us retire on our payouts alone, without having to sell a single stock in retirement.

So here’s what we did.

Using Closed-End Funds to “Turn Back the Clock” on Share Prices

Instead of buying these stocks directly, or through a low-yielding S&P 500 index fund, we went with an absurdly overlooked vehicle called a closed-end fund, or CEF.

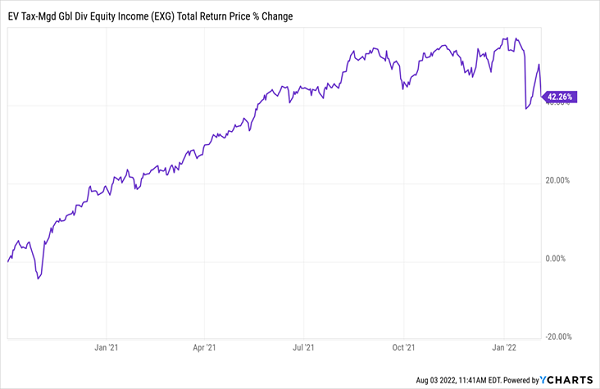

Specifically, we picked up the Eaton Vance Tax-Managed Global Diversified Equity Fund (EXG), which yielded an unheard-of 10% at the time and sent out that dividend as a steady monthly payout, too!

Second, EXG, which held both Amazon and Microsoft back then, traded at a ridiculous 12% discount to net asset value (NAV).

Stick with me here, because these discounts are the key to “turning back the clock” and buying our CEFs’ shares at prices well below those we’d pay on the market. Because that 12% discount meant that we were, in effect, getting Amazon, Microsoft and the rest of EXG’s stocks for 88 cents on the dollar!

CEFs are the only corner of the market with this sweet inefficiency. Unlike their mutual-fund and ETF cousins, CEFs have fixed pools of shares. Which means they can trade at premiums and discounts to the values of their underlying assets.

EXG had one more tool in its kit, too: it writes covered call options on its holdings. If you’ve ever written covered calls yourself, you probably know it’s a great way to generate extra income. It’s also a pain to manage because it requires constant call writing (not to mention an options-blessing in your account!). EXG is a one-click way to outsource this strategy.

I’m sure you can see where I’m going here: buy a CEF at a particularly deep discount and you’ve got a great shot at “bonus” upside as these deals vanish, catapulting the CEF’s share price higher as they do!

That’s exactly what happened with EXG: we rode its closing discount window higher, clocking out in February 2022, by which time the fund’s discount had almost completely vanished, narrowing to 3.7%.

And the price, puppy dog-like, followed the closing discount the whole way, rising 28%. Throw in our 10% dividend and we netted out at a sweet 42% return in under three years!

EXG’s Discount Disappears, We Grab a Fast 42% Total Return

This pattern is easy to spot in CEFs: simply look for a discount that’s wider than usual, then buy—and ride along as your closing discount window drives up the share price. And, of course, you’ll collect your high—and often monthly—dividend the entire time!

One thing to note, though, is that I’m not recommending EXG, which trades at a 1.5% premium to NAV, today. But there are still plenty of other big discounts on the board, including those I recommend in Contrarian Income Report.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."