If we learned anything from 2020, it was the value of a few extra rolls of toilet paper. A close second? The reminder about the value of a reliable dividend.

This lesson has been taught over and over. The dot-com bubble. The Great Recession. The “COVID crash.” And sure enough, first-level investors don’t learn a thing—they chase one fat yield after another into the ground.

We next-level income investors know better. It’s important to consider the business engine under the hood. When we find cash flow machines like the eight dividend payers we’re about to discuss, we’re talking about decades of payments.

And it’s not only about the payouts that are heading into our pockets. Over the long haul, stock prices appreciate along with their dividends. Many 2X, 3X and even 5X and 10X profits are enjoyed over many years as these payouts continually rise, and stocks “chase their dividends higher.”

We focus on reliability, and leave dicey dividends to the brave (read: foolish).

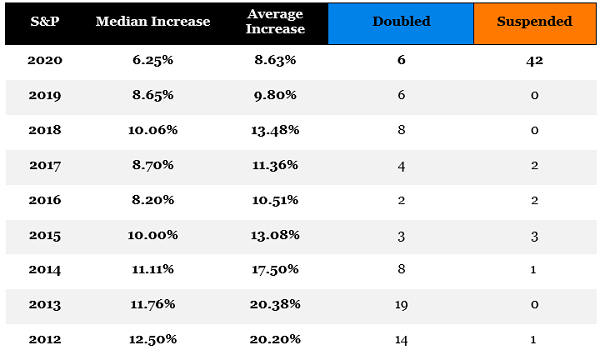

Consider this: In the eight-year span between 2012 and 2019, nine S&P 500 companies suspended their dividends. That’s virtually one a year. A blip. That’s nothing.

S&P Indicated Dividend Rate Changes

Source: Howard Silverblatt, S&P Dow Jones Indices

Then in 2020, we saw forty-four dividends go down. And that was merely within the S&P 500’s collection of blue chips!

Of course, no crystal ball will tell any of us when we’ll get our next market crash or our next recession. But the right data can give us a pretty concrete idea of which dividends will survive those events.

If you’re not yet familiar with the DIVCON system, let me catch you up. This “dividend health” system examines a broad world of stocks, digging into important payout metrics such as free cash flow generation, earnings growth and even money allocated to buybacks, then it rates stocks on an easy-to-understand 1-to-5 scale.

- DIVCON levels 1 and 2 represent weak dividends with a higher likelihood of being cut in the future.

- DIVCON levels 4 and 5 meanwhile reflect stronger dividends that not only should persist, but should grow higher in time.

Since we put a premium on reliability, we naturally gravitate towards the “fundamentally strong” dividends reflected by DIVCON 4 and 5 ratings. Let’s discuss a few, starting with the insurance industry.

These stocks should benefit from a continued rise in long-term interest rates. Here four that have strong cash flows with respect to their payouts already.

The Insurers: Rising Interest Rate Catalyst

DIVCON likes insurers, such as:

- Prudential Insurance (PRU): 5.6% yield, DIVCON 4

- CNA Financial Corporation (CNA): 3.5% yield, DIVCON 4

- Fidelity National Insurance (FNF): 3.7% yield, DIVCON 4

- Aflac (AFL): 2.9% yield, DIVCON 5

Each one of these firms has plenty of extra cash. The “worst” of the quartet is CNA, which has a still-cushy 173% free cash flow-to-dividend ratio. The rest boast FCF-to-dividends ranging from 670% to 1,030%, which means they can cover their dividends six to ten times over this year.

With plenty of cash coverage, it’s no surprise that each of these are reliable dividend growers, too. Aflac, a “Dividend Aristocrat” with four decades of consecutive annual hikes under its belt, is the most well-known. But don’t sleep on CNA. The headline yield isn’t much at 3.5%, but that doesn’t factor in the typically mammoth special dividend. CNA Financial has been doling out $2 “special” payouts for years, which bring its total yield up closer to 8.2%!

CNA is “only” providing an extra 75 cents for this year’s special payout to reflect COVID difficulties—a good sign those $2 payouts will return when normalcy does.

These and other insurers finally have finally been getting up off the mat since summer as economic hopes have improved, and more importantly for insurers, interest rates have begun to bounce back.

Firms that write policies smartly—like these four insurers—generate extra “float” which they can invest each year. With long-term rates in the tank, these companies haven’t been able to earn much on their idle cash. But as interest rates rise, it will provide them with a nice catalyst for higher profits:

Getting paid a reliable dividend while we wait for a catalyst to kick in is not a bad way to invest. Do pharma payouts look similarly intriguing?

Pharmaceuticals: Booster Shots for Our Portfolio?

Big Pharma and Big Biotech stand out in DIVCON’s ratings, too. You’ve got “Dow Dog” Merck (MRK, 3.5%), which gets a top DIVCON 5 rating. You also have Pfizer (PFE, 4.5%) and AbbVie (ABBV, 4.9%), which are plenty-safe DIVCON 4s and offer more yield.

Few industries offer up safer dividends than pharma stocks. That’s good, because once these companies enter mega-cap territory, it’s difficult for them to produce much growth.

Typically, these companies must go out and “buy” a promising drug, much as Pfizer did with its virus vaccine. Ironically, Pfizer’s stock didn’t move at all last year despite the positive headlines for the company. Drug development is a tough business, and dividend growth can often reflect this.

Let’s bounce back to the financial world to close out our tour of DIVCON 4+. Here we have a boutique investment banking stock that is bizarrely in the bargain bin.

Investment Banker: A Rare Bargain?

One i-banking firm stands out to me, and that’s Jefferies (JEF). Jefferies provides clients with asset management, brokerage services, financial advisory, it has a research arm, it underwrites IPOs.

The market is in go-go mode. That alone helps Jefferies. But a frenzied market also helps the business in another way—by spurring more M&A, which plays into another Jefferies advisory business.

DIVCON gives Jefferies a perfect 5, and it’s not hard to see why. The company has a FCF-to-dividend ratio of 1,350%, which is conservative to the point of being downright chintzy.

But at least it’s working on it—JEF announced a 33% hike to 20 cents per share quarterly for its 2021 dividends.

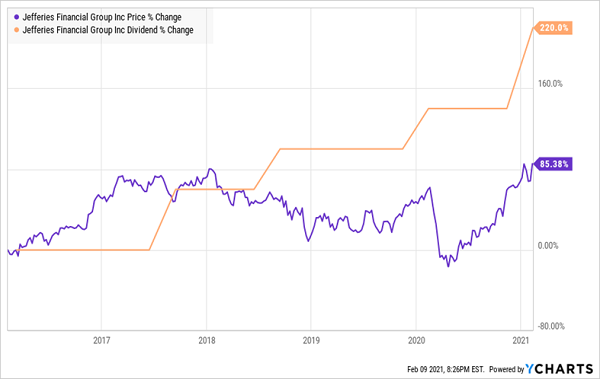

Will the “Dividend Magnet” Pull Jefferies Higher?

Hopefully, that will help JEF improve upon what has been mostly rangebound performance over the past few years.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."