Stock Market Momentum Continues

Here are seven momentum stocks that increased by at least 30% this year and still have another 30% upside going into 2018.

For the 86th time since the 2016 presidential election, the Dow Jones industrial average closed at a record high on Monday, December 18. This means that 34% of all trading sessions in 2017 closed at new highs and there are still eight trading days left in the year (251 total trading days in 2017).

The S&P 500 also increased on Monday by roughly 0.5%, to finish at its own record high of 2,690. The market continues to gain momentum heading into 2018 as the long-awaited tax bill inches closer to passing. Many expect a deal to be achieved before the end of the year.

As a result, the S&P 500 has climbed 20.1% in 2017 while the Dow Jones has moved 25.4% higher. Many academics are calling this bull market a “momentum effect” which is simply the tendency of winning stocks to keep winning and losing stocks to keep losing due to investor behavioral biases. It is based on the idea that once a stock establishes a trend, it is more likely to continue in that direction instead of moving against the drift even if the stock’s valuation becomes unreasonable.

With no signs of this “momentum market” cooling down anytime soon, I decided to search for momentum stocks that have (1) increased by at least 30% in 2017 and (2) still have another 30% upside potential going into 2018.

I determined which stocks still have upside potential by using the finbox.io Fair Value estimate. This estimate is derived by applying a combination of valuation and risk models like discounted cash flow analysis, dividend discount model, comparable companies multiples, earnings power value and more.

To find these momentum stocks, I applied the following filters in finbox.io’s stock screener:

- YTD Stock Price Change > 30.0%

- finbox.io Upside > 30.0%

- Fair Value Uncertainty is not very high

- Market Capitalization > $500 million

The latest results can be found here: Momentum Stock Screen. Here are the seven momentum stocks I found that could rise another 30% in 2018.

Stocks Ready To Jump Another 30% in 2018

Abeona Therapeutics

Abeona Therapeutics (NASDAQ:ABEO), a clinical-stage biopharmaceutical company, focuses on developing and delivering gene therapy and plasma-based products for severe and life-threatening rare diseases. The company was formerly known as PlasmaTech Biopharmaceuticals and changed its name to Abeona Therapeutics in June 2015.

Maxim Group raised its fair value target to $17.00 per share on July 18 citing positive prospects for its lead gene therapy candidate for the treatment of an inherited disorder characterized by large painful blisters on the skin. The stock sky-rocketed when the FDA confirmed Abeona as the lead cell therapy candidate on August 29.

source: finbox.io

Shares of the biopharma company are up an enormous 250% since the beginning of the year. The stock last traded at $15.20 as of Monday afternoon and five separate valuation analyses imply there is still another +60% upside potential going into 2018.

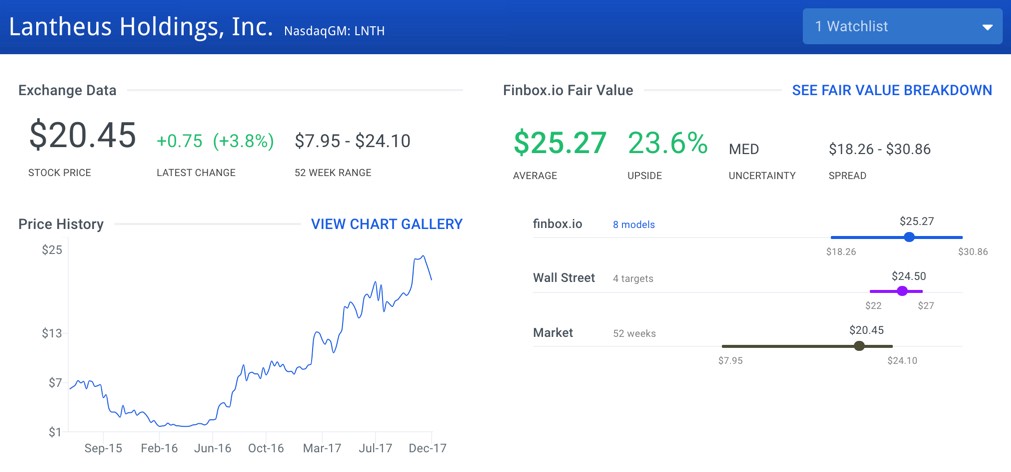

Lantheus

Lantheus Holdings (NASDAQ:LNTH) develops, manufactures and commercializes diagnostic medical imaging agents and products for the diagnosis and treatment of cardiovascular and other diseases worldwide. The company sells its products to hospitals, clinics, group practices and radiopharmacies.

Lantheus inked a deal with GE Healthcare on February 21 for the continued development of an investigational agent that could improve the diagnosis of coronary artery disease. The partnership news led to a number of upgrades from analysts covering the company and the stock has continued to reach new heights.

source: finbox.io

Shares of Lantheus are up 125% year-to-date and finbox.io’s fair value estimate of $25.27 per share calculated from eight cash flow models imply another 23.6% upside. The average price target from four Wall Street analysts of $24.50 also implies similar upside.

Ultra Clean

Ultra Clean Holdings (NASDAQ:UCTT) designs, manufactures and tests production tools, modules and subsystems for the semiconductor capital equipment and equipment industry segments primarily in North America, Asia and Europe. Ultra Clean was founded in 1991 and is headquartered in Hayward, California.

The Semiconductor & Semiconductor Equipment industry has significantly outperformed this year reporting 42% YoY earnings growth in the latest quarter. As a result, Ultra Clean has seen increasing demand for its tools and its stock has appreciated 115% in 2017.

source: finbox.io

However, Ultra Clean’s shares have pulled back recently leading to Stifel upgrading the company to a “Buy” rating on December 4. Stifel noted that Ultra Clean is well positioned to benefit from another strong year in wafer fan equipment and display spending. Finbox.io’s nine separate cash flow analyses support the recent buy rating.

Adamas Pharmaceuticals

Adamas Pharma (NASDAQ:ADMS) discovers, develops and sells chrono-synchronous therapies for chronic neurologic disorders. The company’s product portfolio comprises therapies for the treatment of patients with Parkinson’s disease, Alzheimer’s disease and patients with epilepsy.

The FDA approved Adamas’ new Parkinson’s therapy in August. However, shares were relatively flat until Steve Cohen’s Point72 Asset Management reported a 5.1% stake in the company on October 30. In addition, Evercore upgraded its rating on the stock to Outperform along with an $85.00 per share price target. Shares of the company eventually reached as high as $37.15 per share.

source: finbox.io

Adamas’ stock is currently trading at $31.70 per share as of Monday, more than 100% higher since the beginning of the year. What’s more, finbox.io’s six valuation analyses suggest that shares could increase another 50% in 2018.

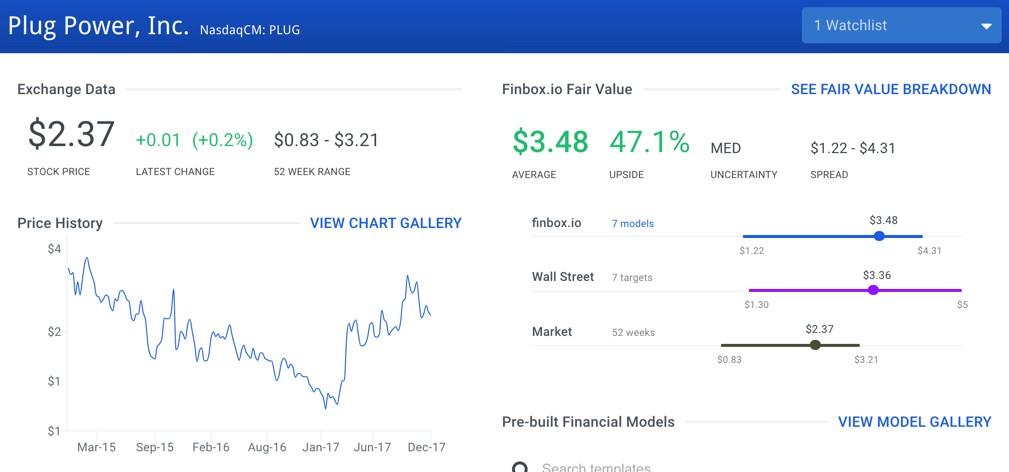

Plug Power

Plug Power (NASDAQ:PLUG) engages in the design, development and manufacture of hydrogen fuel cell systems primarily for the material handling and stationary power markets in the United States. The company offers its products to businesses and government agencies through direct product sales force, original equipment manufacturers, and dealer networks.

Plug Power stock jumped nearly 75% on April 5th following news that it signed an agreement with Amazon.com (NASDAQ:AMZN) for multi-site GenKey deployments. The deal involved the company supplying batteries to power forklifts used by Amazon in the online retailer’s warehouses in exchange for the right to buy up to 23% of Plug Power.

source: finbox.io

Shares of the company are trading nearly 80% higher on a year-to-date basis. But the stock price could end up trading another 47.1% higher in 2018 based on Plug Power’s future cash flows.

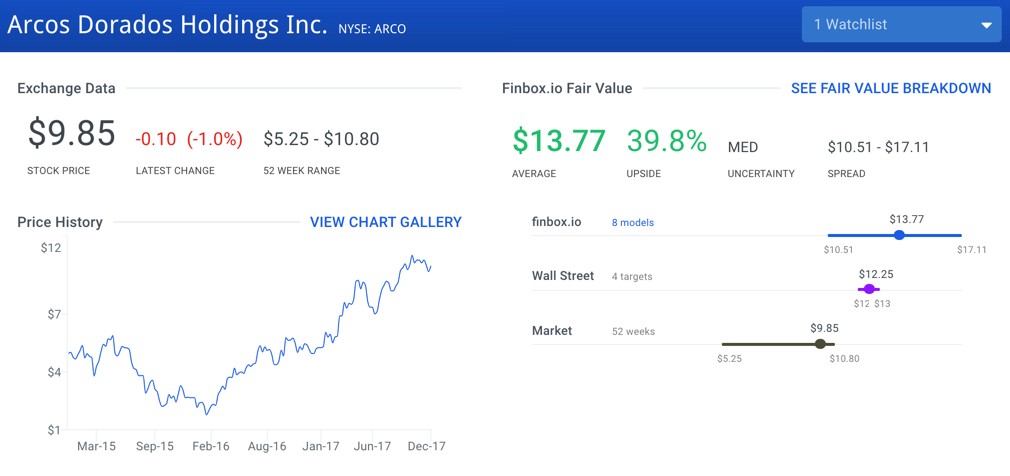

Arcos Dorados

Arcos Dorados Holdings (NYSE:ARCO) operates as a franchisee of McDonald’s (NYSE:MCD) restaurants. It has the exclusive right to own, operate, and grant franchises of McDonald’s restaurants in 20 countries and territories in Latin America and the Caribbean. As of December 31, 2016, the company operated and franchised 2,156 McDonald’s branded restaurants.

Shares of Arcos Dorados have steadily increased throughout the year as favorable consumer recovery trends have played out across Brazil and Argentina in 2017. The franchisee has also benefited from lower beef prices.

source: finbox.io

Arcos Dorados’ stock last traded at $9.85 as of Monday, near its 52-week high and nearly 40% higher year-to-date. On a fundamental basis, the company’s stock is still trading at a 39.8% discount to finbox.io’s intrinsic value.

Looking to next year, the company has signed international soccer superstar Neymar to an exclusive contract in front of the 2018 World Cup. Neymar will serve as an ambassador in Arcos Dorados’ media and marketing campaigns related to next year’s World Cup.

Sarepta

Sarepta Therapeutics Inc (NASDAQ:SRPT), a biopharmaceutical company, focuses on the discovery and development of RNA-based therapeutics for the treatment of rare neuromuscular diseases. The company distributes its products through a network of specialty distributors and specialty pharmacies in the United States. Sarepta Therapeutics, Inc. was founded in 1980 and is headquartered in Cambridge, Massachusetts.

On September 6, the company’s stock jumped by more than 15% in response to its announcement of positive results from a study assessing golodirsen in 53 boys with Duchenne muscular dystrophy. The company then reported Q3 sales of $46 million compared to $0 the previous year and lifted its full-year revenue guidance.

source: finbox.io

Shares of the biotech company are up 33.3% year-to-date and have momentum going into 2018. Five of finbox.io’s valuation models calculate an average fair value estimate of $67.13 per share implying almost 25% upside potential.

In conclusion, the table below ranks all seven stocks by their year-to-date returns.

This momentum investing strategy is not for the faint-hearted as it typically calls for investors to “buy high”. Many value investors dislike the strategy because it can often result in purchasing shares at a premium valuation.

However, this is why I added finbox.io’s fair estimates to the stock screen to make sure each stock is still trading at a reasonable level. Therefore, investors looking to ride the current bull market into 2018 may want to consider the companies listed above.