The S&P 500 had a pretty dull day again on the year’s final trading day, with the drop again occurring in the last minutes of trading. The S&P 500 finished lower by 26 bps, while the Qs finished the day down 62 bps.

1. S&P 500

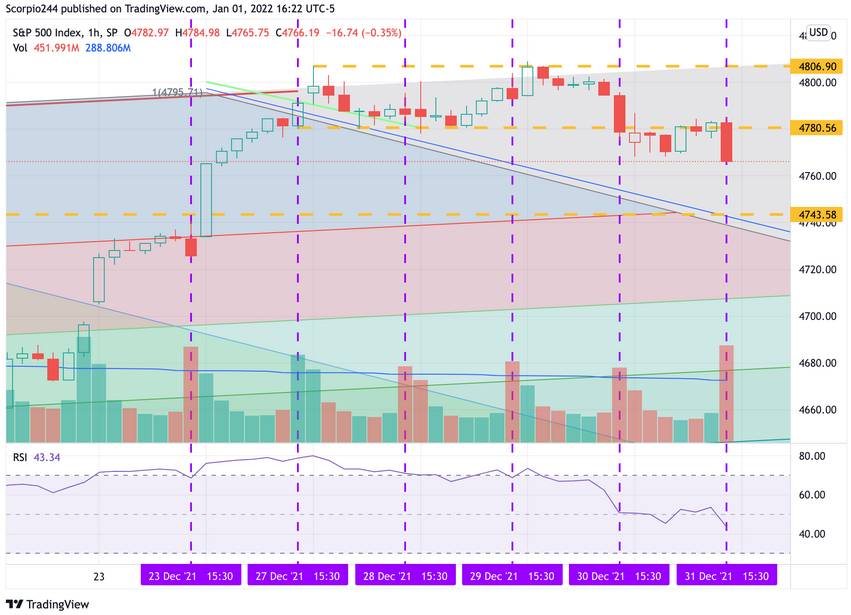

Trading volume was very low for the entire week. The chart below shows that when volume returned in the final 30 minutes of the trading day, it led to lower prices in the S&P 500. Starting on Dec. 23 and ending on Dec. 31, there was only one day that saw a positive final 30 minutes of trading, which was on Dec. 28. It may indicate that when volume returns on Monday it brings the sellers with it.

The actual structure for the S&P 500 index looks very weak and shows that once the index broke support at 4,780, it was unable to recapture that level. That means that support at 4,740 will be critical for the bulls and the level that must hold this week. Once broken, I think the selling can quickly grow with the potential to get back to 4,700 by Jan. 5.

2. Dow Jones

The Dow did not see that big red candle on Friday that I would have liked to have seen, but that’s ok; it was still a down day. Ideally, we need a sharp drop early in the week to keep the 2b topping pattern intact. I still think that pattern is in force and is strong.

3. AT&T

AT&T (NYSE:T) has been battered; maybe it is deserving, maybe it’s not. But the stock appears to have formed a bullish flag pattern, suggesting the equity continues to push higher, perhaps even over $26.

4. Splunk

Splunk (NASDAQ:SPLK) may be bottoming; it appears to be forming an inverse Head And Shoulders pattern, and it does have that giant gap to fill up at $168. That sure would be a great way to start the year for me to make that type of move higher.

5. PayPal

PayPal Holdings (NASDAQ:PYPL) hasn’t been able to bounce, but it has consolidated, and I hate to say it, but I think it is getting ready to take yet another leg lower. The RSI is back to 43, and the pattern looks an awful lot like a pennant, meaning the next stop may be at $175, maybe even the gap fill at $130.

6. Broadcom

The run-up in Broadcom (NASDAQ:AVGO) may be over, with the stock falling out of the rising wedge pattern and the MACD very close to crossing negatively over. Additionally, the RSI has been trending sideways, a bearish divergence against the increasing stock price, with a giant gap to fill at $582 and ultimately at $483.

7. United Health

The pattern in UnitedHealth Group (NYSE:UNH) is very similar to Broadcom with a huge massive rising wedge and a MACD that is negatively crossing over, with the potential for a gap fill at $403.