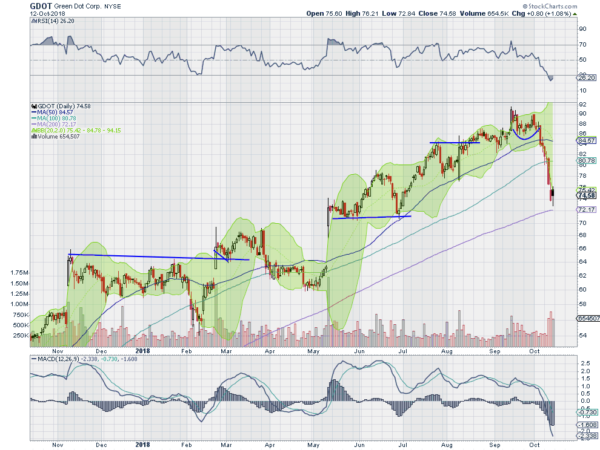

Green Dot Corporation (NYSE:GDOT)

Green Dot, $GDOT, had been moving steadily higher until the end of September. Since the calendar turned to October it has fallen back and comes into the week near the 200 day SMA. The RSI is oversold and started to turn up Friday while the MACD is falling. A bounce Monday gives a reason to participate to the upside…..

Occidental Petroleum Corporation (NYSE:OXY)

Occidental Petroleum, $OXY, rose up from a March low and ran to a high in May. It consolidated there for over 3 months before pulling back into august. More consolidation was followed by a push back higher into the end of September. But that failed at a lower high and it is now back at support and the 200 day SMA. The RSI is turning back up and the MACD falling and now negative. Look for a push back higher to participate to the upside…..

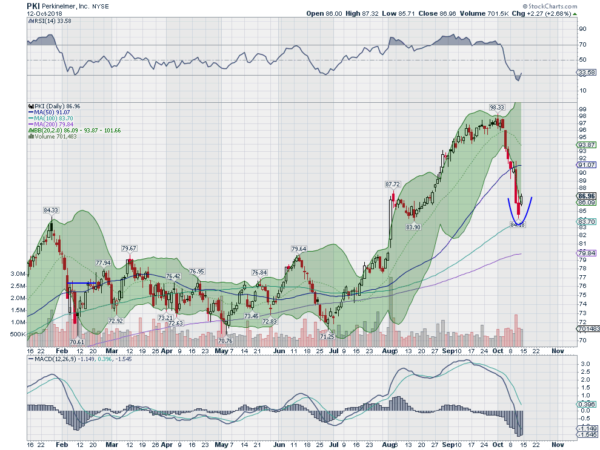

PerkinElmer Inc (NYSE:PKI)

PerkinElmer, $PKI, started higher in July out of consolidation. It continued to a top at the end of September before pulling back. Friday it showed signs of a reversal as it reached the August low and neared the 100 day SMA. The RSI has turned back up after being oversold and the MACD is falling and negative. Look for continuation to participate higher…..

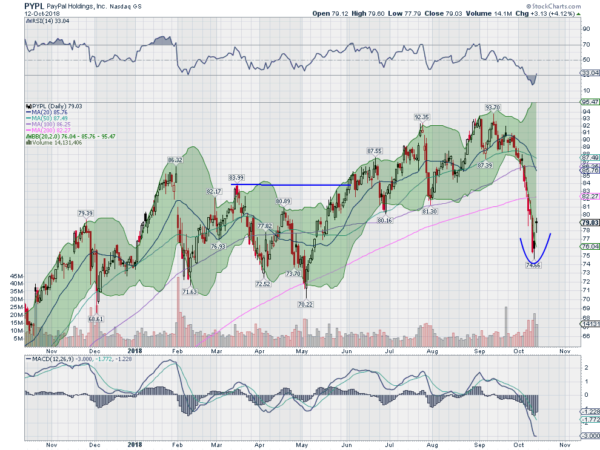

PayPal Holdings Inc (NASDAQ:PYPL)

PayPal, $PYPL, made a top in September and then started to roll lower. It continued through the 200 day SMA last week, finally finding support Thursday and bouncing. The RSI also bounced out of oversold territory with the MACD starting to level. Look for continuation to the upside to participate higher…..

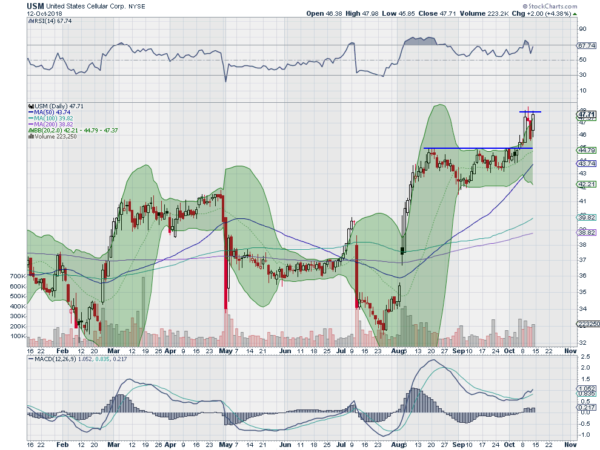

United States Cellular Corporation (NYSE:USM)

United States Cellular, $USM, rose from a low in July, into consolidation through August and September. It then started higher again and is consolidating again. The RSI is rising and bullish with the MACD moving higher. Look for continuation to participate to the upside…..

Up Next: Bonus Idea

Elsewhere look for Gold to rise in the short term while Crude Oil pulls back in its uptrend. The US Dollar Index continues to mark time sideways while US Treasuries are bouncing in their downtrend. The Shanghai Composite looks weak as it makes 4 year lows and Emerging Markets may be ready to reverse their downtrend.

Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts show short term trend changes to the downside and are close to longer term trend changes as well. The IWM is now over 11% off its high and looking the worst, while the QQQ has bounced after dropping more than 10%. The SPY also bounced, after a smaller 8% pullback. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.