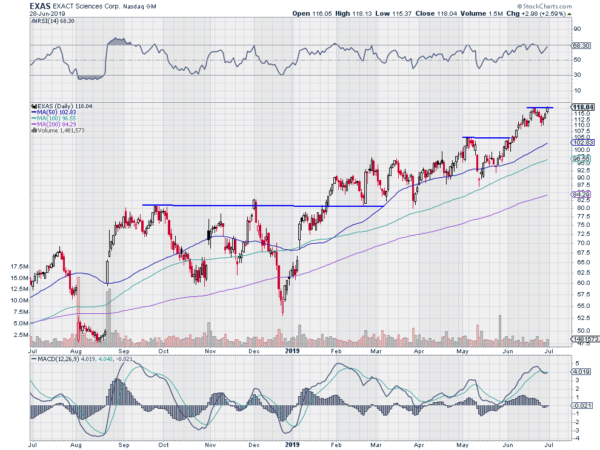

Exact Sciences, Ticker: $EXAS

EXACT Sciences Corporation (NASDAQ:EXAS) confirmed a change of character to an uptrend when it broke above resistance in January. It retested the breakout 3 times before continuing higher. It gave a second opportunity in early June as it recovered from a pullback and is doing the same now. The RSI is rising and bullish while the MACD is turning back higher. Look for continuation to participate.

Fifth Third Bancorp (NASDAQ:FITB), Ticker: $FITB

Fifth Third Bancorp (NASDAQ:FITB) made a higher high at the beginning of May and then started lower. It found support at the beginning of June and has been consolidating. Last week ended with it rising toward resistance. The RSI is moving up to the bullish zone with the MACD crossed up and positive. Look for a pushover resistance to participate.

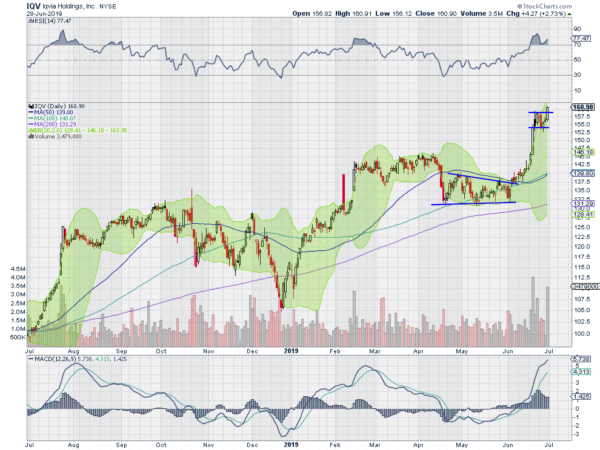

IQVIA, Ticker: $IQV

Iqvia Holdings Inc (NYSE:IQV) rose up out of consolidation at the beginning of June. It met resistance 2 weeks ago and consolidated. But Friday saw it break the consolidation to the upside. The RSI is bullish and tad bit overbought with the MACD rising and bullish. Look for continuation to participate.

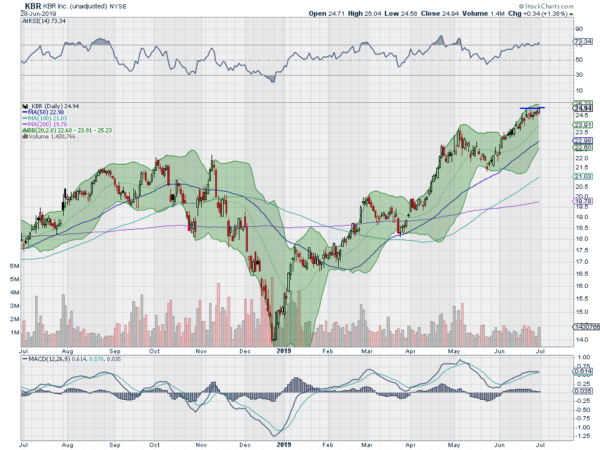

KBR, Ticker: $KBR

KBR Inc (NYSE:KBR) has trended higher since the December bottom. It crossed the 200 day SMA in February and came back to retest it before continuing higher. Another short term peak in May led to a pullback and then the rise to the current mini consolidation. The RSI is bullish and the MACD positive and avoiding a cross down. Look for a pushover short term resistance to participate.

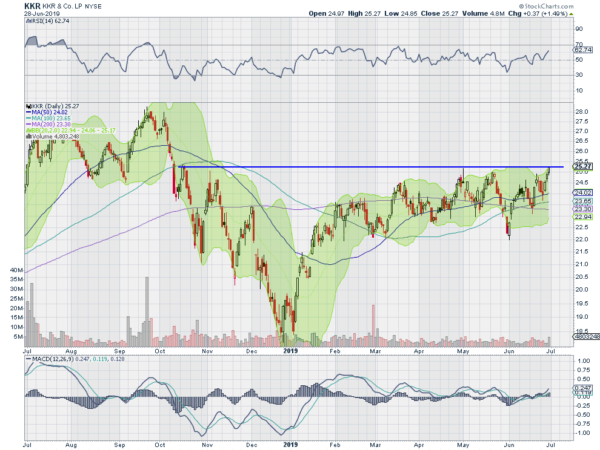

KKR, Ticker: $KKR

KKR & Co LP (NYSE:KKR) started higher from a December low and then leveled as it hit the 200 day SMA. It has oscillated around it ever since in consolidation and under resistance. Friday it ended at resistance. The RSI is rising and in the bullish zone with the MACD positive and growing. Look for a break of resistance to participate.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.