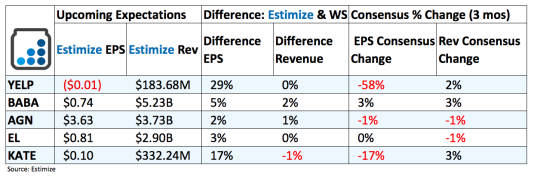

Yelp Inc (NYSE:YELP): Shares are trending higher in the past 12 months after a series of better than expected earnings reports. Yelp delivered a strong second quarter on the back of greater cumulative reviews, local advertising accounts and unique downloads. The company is still struggling to turn a profit as more competition floods the market. There are now a handful of major players including Uber, GrubHub, Amazon and even tech giants, GGoogle and Facebook. All these companies have ramped up their efforts to capture a bigger part the market, which means Yelp isn’t likely to turn a profit in the near future.

Alibaba (NYSE:BABA): Chinese companies have had a difficult time this year but Alibaba has been the exception. Shares of the often called Chinese Amazon are up 25% in 2016 on a string of robust top line growth. The ecommerce giant’s strong market position in China has helped deliver uninterrupted growth in mobile and improving gross merchandise value. Additionally, mobile monetization has started to gain traction with revenue per mobile user growing to $21 in the previous quarter. Baba’s cloud component has far outpaced growth in every other segment of the business. Sales from Aliyun reported a 156% increase in the first quarter and should continue to improve as it increases in scale.

Allergan (NYSE:AGN_pa): Expectations for the upcoming quarter are trending lower leading into the print on increasing competition and the divestiture of its Anda distribution business. Allergan recently sold its generics and distribution business to Teva Pharmaceutical (NYSE:TEVA) which is expected to hurt second half revenues by nearly $100 million. Analysts at Estimize expect this to look like a 7% decline on the top line compared to the same period last year. An earlier acquisition of the Botox treatment should offset some of these losses while the performance of a handful of new products is still a mystery.

Estee Lauder (NYSE:EL): Estee Lauder has been trending lower the past few quarters. Slow retail growth in China and macroeconomic uncertainty continue to have an unfavorable impact on the top line. The recent acquisition of Elizabeth Arden, new product innovation and efficient cost controls will partially offset this pressure.

Kate Spade (NYSE:KATE): Kate Spade’s second quarter was highlighted by an unnerving slowdown in comparable sales and continue to pressure margins. Sales comps grew 4% in the second quarter, compared to 15% in the previous four quarters. The slowdown was driven by weaker traffic trends, frequent promotional activity and heavy discounting. The third quarter is expected to be influenced by some of these trends but should show some signs of improvement heading into the holiday season. Recent promotional initiatives including a new Miss Piggy Disney collection and a smartwatch collaboration with Fossil are encouraging leading into the high spending months.