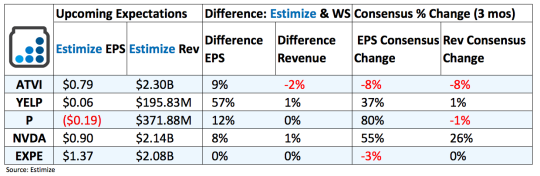

Activision Blizzard (NASDAQ:ATVI): Activision’s storied run came to an end after third quarter revenue fell short of the Estimize consensus by nearly $30 million. Since then the stock tumbled by about 5% with investors now calling for a weak fourth quarter. On the bright side, increasing digital revenue from titles like Call of Duty and World of Warcraft should continue to support the top line. More importantly the acquisition of King Digital in early 2016 provides the publisher with an entry point into the fast growing mobile gaming space. Additional Overwatch sales and the continued success of its e-sports league will also help results for the quarter to be reported. Nonetheless, stiff competition from Electronic Arts (NASDAQ:EA), Take-Two (NASDAQ:TTWO), and Glu Mobile (NASDAQ:GLUU) remain near term headwinds. The uncertain consumer outlook for 2017 poses additional problems for Activision which relies heavily on discretionary spending.

Yelp (NYSE:YELP): Yelp’s strong third quarter reflects significant improvements in cumulative reviews and local advertising revenue. A large portion of the gains originated from the mobile app which management believes can continue to support financial performance. Unfortunately, weak international sales forced Yelp to reallocate resources out of those regions back to profitable U.S. and Canadian operations. Meanwhile, stiff competition from Uber, GrubHub Inc (NYSE:GRUB) and even major tech companies like Google (NASDAQ:GOOGL), Facebook (NASDAQ:FB) and Amazon (NASDAQ:AMZN), pose a large threat.

Pandora (NYSE:P): Despite ongoing initiatives to right the ship, Pandora missed analysts estimates for two consecutive quarters. During the fourth quarter the company launched Pandora Plus and Premium services to stave off threats from Amazon and Apple (NASDAQ:AAPL) but also regain market share from Spotify. The services compliment a preexisting line of premium services starting at $4.99 per month. Pandora also intends on driving growth in the ticketing industry with the acquisition of Next Big Sound, Rdio and Ticketfly and by cutting label costs. More recently the company announced that it will slash 7% of its workforce in an effort to curb costs.

Nvidia (NASDAQ:NVDA): The hottest stock of 2016, Nvidia will need to post the biggest blowout to surprise investors this afternoon. Earnings for the third quarter topped analysts’ estimates by over 50% while sales trumped those very same expectations by 18%. Management credited strong growth on the continued success of its core GPU business and significant progress made in VR, self driving cars and data center computers. NVidia has left very little reason to believe that any of these businesses will take a step back in future quarters.

The chipmaker's success has been tied to wider adoption of its GPUs not only by gamers but in high growth markets such as data centers, automotive and virtual reality. It also hasn’t hurt that PC gaming is one of the highest grossing forms of entertainment with many gamers relying on high end chips produced by NVIDIA.

Some near term concerns include increasing competition, namely Advanced Micro Devices (NASDAQ:AMD), and unrealistically high expectations. If Nvidia doesn’t meet or beat analysts estimates this quarter it would naturally hurt its stock.

Expedia (NASDAQ:EXPE): Travel trends improved throughout the quarter largely thanks to ongoing promotional and discounting activity. Additionally, Expedia’s efforts to consolidate the travel market through acquisitions helped support strong traffic trends. The purchase of Homeaway earlier this year provides Expedia with an entry into the fast growing sharing economy. Meanwhile, financial performance is less prone to currency headwinds as the company operates largely in North American markets. New initiatives during the quarter include a partnership with TripAdvisor's (NASDAQ:TRIP) Instant Booking platform and the successful IPO of Trivago (NASDAQ:TRVG) in late December. Given the improvements in the travel industry, Expedia looks poised to put on a repeat performance in the fourth quarter