The manufacturing sector continues to bear the brunt of the protracted U.S.- China trade war. Per the Institute for Supply Management’s latest report, the U.S Purchasing Managers’ Index (PMI) declined to 47.2% in December 2019, contracting for the fifth consecutive month. This marked the lowest PMI reading since 46.3% in June 2009 — the last month of the Great Recession.

The PMI reading had been showing signs of deceleration since April last year, but remained above 50. Notably, a reading above 50 denotes expansion in the manufacturing sector and below 50 indicates contractions. However in August, the index fell to 49.1% – marking an end to 35 consecutive months of expansion. Overall in 2019, the PMI has averaged 51.2%, ranging from a low of 47.2% (December) to a high of 56.6% (January).

In December 2019, only three of the 18 manufacturing industries reported growth. New Orders Index registered 46.8% in December, its lowest reading since 46% in April 2009. Production Index came in at 43.2% in December, decelerating from the 49.1% in November. This was the index’s worst performance since April 2009, when it stood at 36.7%. Employment Index registered 45.1% in December, down from 46.6% in November. This marked the index’s lowest reading since 44.6% in January 2016. The new orders index, production index and employment have all contracted for five consecutive months in December.

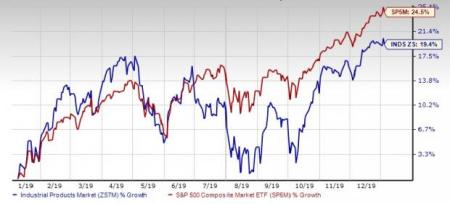

The Industrial Products sector has underperformed the S&P 500 market over the past year. In the past year, the sector has gained 19.4% while the S&P 500 has gone up 24.5%. Apart from the waning demand, the sector has been grappling with concerns regarding the impact of tariffs. Given that steel is a primary raw material, every company involved in manufacturing bore the brunt of rising steel prices owing to tariffs.

Will the Sector Rebound?

In the backdrop of the waning demand, manufacturing companies continue to combat cost inflation to sustain their margins through pricing actions and cost control, increasing productivity and eliminating waste.

After the first phase of agreement between the United States and China, tensions between the world’s two largest economies are likely to ease and this, in turn, will aid the sector’s recovery. Further, the ongoing improvement in homebuilding and government projects bode well. With U.S. economy expected to maintain momentum this year, employment and wage gains are likely to continue fueling demand for housing. Fed’s dovish stance and favorable demographics are also expected to provide a major boost to demand for homes in the upcoming quarters.

Stocks That are Poised to Grow

Using the Zacks Stock Screener, we have zeroed in on five lucrative investment options from the Zacks Industrial Products sector that boast solid growth opportunities despite the slowdown in the overall sector. These stocks have a Zacks Rank #1 (Strong Buy) or Rank #2 (Buy) and a VGM Score of A or B. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three scores. Our research shows that stocks with an impressive VGM Score of A or B when combined with a Zacks Rank 1 or 2, offer the best upside potential. Further, these companies have healthy earnings growth expectations for 2020.

You can see the complete list of today's Zacks #1 Rank stocks here.

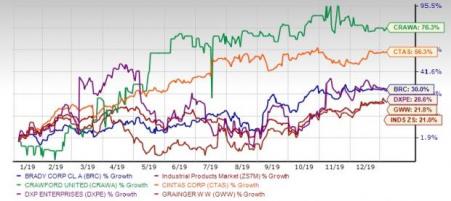

All of these stocks have outperformed the broader sector over the past year as evident from the chart below.

Brady Corporation (NYSE:BRC) : The Zacks Consensus Estimate for earnings for this Milwaukee, WI-based company for this fiscal suggests year-over-year growth of 5.47%. The company has a Zacks Rank #2 and a VGM Score of B. The company has beat estimates in the trailing four quarters by 9.67%, on average.

Hickok Inc. (OTC:CRAWA) : This Cleveland, OH-based company has beat estimates in the trailing four quarters by11.45%, on average. The Zacks Consensus Estimate for earnings suggests year-over-year growth of 12.2% for fiscal 2020. The stock has a Zacks Rank #1 and a VGM Score of A.

Cintas Corporation (NASDAQ:CTAS) : This Cincinnati, OH-based company currently has a Zacks Rank #2 and a VGM Score of B. The company has an estimated long-term earnings growth rate of 10.4%. The Zacks Consensus Estimate for earnings for fiscal 2020 indicates year-over-year improvement of 15.7%. The company has beat estimates in the trailing four quarters by 8.50%, on average.

DXP Enterprises, Inc. (NASDAQ:DXPE) : This Houston, TX-based company has beat estimates in the trailing four quarters by 17.7%, on average. The Zacks Consensus Estimate for earnings for fiscal 2020 suggests year-over-year growth of 10.5%. The company has a Zacks Rank #2 and a VGM Score of A.

W.W. Grainger, Inc. (NYSE:GWW) : This Lake Forest, IL-based company has a Zacks Rank #2 and a VGM Score of B. The company has beat estimates in the trailing four quarters by 1.94%, on average. The Zacks Consensus Estimate for earnings for fiscal 2020 indicates year-over-year improvement of 8.20%. The company has a long term estimated earnings growth rate of 11.3%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Cintas Corporation (CTAS): Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE): Free Stock Analysis Report

Brady Corporation (BRC): Free Stock Analysis Report

W.W. Grainger, Inc. (GWW): Free Stock Analysis Report

Hickok Inc. (CRAWA): Free Stock Analysis Report

Original post

Zacks Investment Research