The consumer staples sector has been performing well of late buoyed by rising consumer confidence and improving economy. Strong recovery in the housing market and an improving labor market played a crucial role in boosting buyers’ confidence. Encouraging manufacturing index readings issued by the Institute of Supply Management (ISM) also hints at a pickup in GDP, indicating that economy is in good shape currently.

The food industry’s performance however is not matching up to investors’ expectations due to industry-wide issues. We note that shift in consumer purchase decisions, evolving shopping behavior and increasing presence of small firms have been plaguing the industry. A shift in consumer preference toward the non-genetically modified, organic, and gluten free products is also hurting business. Also, there is an industry-wide weakness, as deflationary pressure in commodities such as dairy, beef and eggs are hurting the margins of food companies like Sysco Corp. (NYSE:SYY) . The recent news of e-Commerce king Amazon.com, Inc. (NASDAQ:AMZN) acquiring the natural and organic foods supermarket chain Whole Foods Market Inc. (NASDAQ:WFM) has further made competitors skeptical and raised concerns.

Amid such a scenario, let us take look at SUPERVALU, Inc. (NYSE:SVU) and see if it can be a good choice for investors.

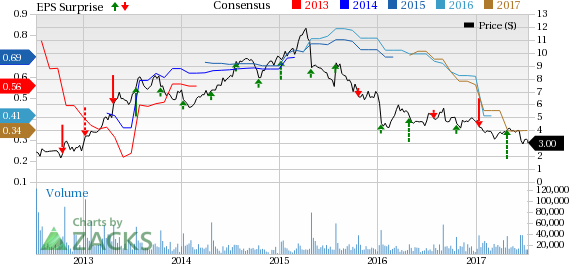

The company’s sales have been declining for the last few quarters due to soft comps. Though SUPERVALU remains focused on cost-cutting measures, its selling and administrative expenses have been rising higher relative to revenues. These headwinds are well reflected in the company’s share price performance. SUPERVALU has been underperforming the Zacks categorized Food-Miscellaneous/Diversified industry and the broader consumer staple sector over the last one year. The stock has declined 39.8% in the said time frame, wider than the industry’s decline of 13.9% and the sector’s fall of 1.5%.

Nevertheless, it is commendable that SUPERVALU is taking measures to turn around.

Why Pick SUPERVALU?

Favorable Rank and VGM Score: SUPERVALU, with a Zacks Rank #1 (Strong Buy), flaunts a VGM Score of ‘B’, which makes it a favorable investing option. You can see the complete list of today’s Zacks #1 Rank stocks here.

We note that the VGM Score is a comprehensive tool that will allow investors to filter through the standard scoring system and choose better winning stocks. In order to screen out potential winning stocks, we consider only those that have a Zacks Rank #1 or 2 (Buy) and a VGM Score of ‘A’ or ‘B’.

Valuation Multiples: If we look into the company’s P/E and P/S multiples, we note that the company generally trades below its industry average.

SUPERVALU has a trailing 12 months PE ratio of 6.8. This level actually compares pretty favorably with the market at large, as the PE for the S&P 500 is 20.2. Further, the stock’s PE also compares favorably with the Zacks classified industry’s trailing 12 months PE ratio, which is pegged at 21.2. This indicates that the stock is relatively undervalued right now, compared to its peers.

Right now, SUPERVALU has a P/S ratio of about 0.1. This is significantly lower than the industry average of 1.8 and S&P 500 average, which comes in at 3.1 right now.

Quarterly Results: After posting negative earnings surprise of 61.5% in fiscal third quarter, Supervalu posted positive earnings surprise of 44.4% in fourth-quarter fiscal 2017. The company also posted positive sales surprise in the fourth quarter, after lagging estimates for the last seven consecutive quarters. We commend its decision to spin off its Save-A-Lot stores as this will help the company to concentrate on its more profitable core businesses. Moreover, it has undertaken several initiatives to improve comps in the retail sector and increase operating efficiency.

Strong Focus on Wholesale Business and Efforts to Boost Retail Banners: SUPERVALU derives a major portion of its revenues from the wholesale business. The company is trying to develop wholesale operations, primarily through adding new customers, retaining and developing business with existing customers and acquisitions.

The company’s recent announcement of the acquisition of Unified Grocers, a West Coast-based wholesale grocery distributor is expected to boost Supervalu’s wholesale business and will also complement its customer base.

In order to boost sales growth, SUPERVALU is set to expand its retail banners. The company is rebranding most of its retail banners so that each has a clearly-defined identity through in-store signage, weekly ads, customer emails, mobile devices and banner web pages. The company is planning to capitalize on the private brands portfolio among the retail banners.

Initiatives to Increase Operating Efficiency: Over the last few years, the company has taken initiatives to reduce its costs and increase effciency. The sale of the Albertsons banners in 2013 helped the company to reduce loss and increase operating efficiency. It also helped to focus more on its smaller regional chains — Cub and Hornbacher's. Further, the spin-off of Save-A-Lot discount stores enabled the company to concentrate on its more profitable core businesses, repay its outstanding debt and improve its capital structure, as well as to fund corporate and growth initiatives.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Sysco Corporation (SYY): Free Stock Analysis Report

SuperValu Inc. (SVU): Free Stock Analysis Report

Whole Foods Market, Inc. (WFM): Free Stock Analysis Report

Original post

Zacks Investment Research