The gold mining stocks we have identified have low All-in Sustaining Costs (ASIC) relative to their peers

SmallCapPower | May 18, 2018: Gold prices continue to decline, having decreased 4.4% M/M, from US$1,350 last month to US$1,290 today, including a US$30 drop over the past three days. As gold prices generally increase in times of economic and political instability, investors may be reassured by European countries refusing to sanction Iranian oil despite U.S. challenges, and progress towards a North Korean peace deal, although both deals are on shaky ground. The gold mining stocks on our list today are expected to produce this year at an all-in sustaining cost of US$800/oz, as compared to their peers, which are guided to produce at US$950/oz.

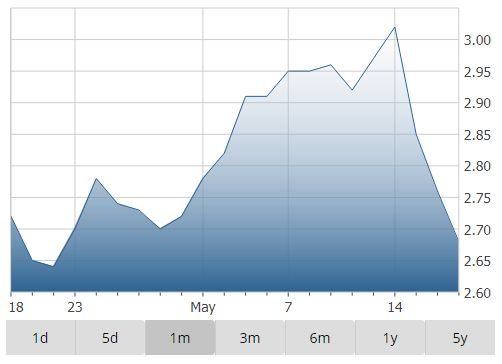

Premier Gold Mines Limited (TO:PG) – $2.68

Gold

Premier Gold Mines operates two producing mines, a developing mine, and three exploration projects throughout North America. Premier’s 100%-owned Mercedes mine, located in Sonora, Mexico, is guided to produce 80,000-85,000 oz. Au in 2017. The South Arturo Mine, 60% owned by Barrick Gold Corporation (TO:ABX), is an open pit mine in Nevada, guided to produce 5,000 – 10,000 Au in 2018. PG aims to develop an EA/EIS and PEA at other locations throughout 2018.

- Market Cap: $543.0 Million

- Gold Production FY2017: 139,658 oz.

- Gold Production Guidance FY2018: 85,000 – 95,000 oz.

- All-In Production Cost FY2017 (USD): $627/oz. Au

- All-In Production Cost FY2018 (USD): $800-850 /oz. Au

- YTD Total Return: -23.3%

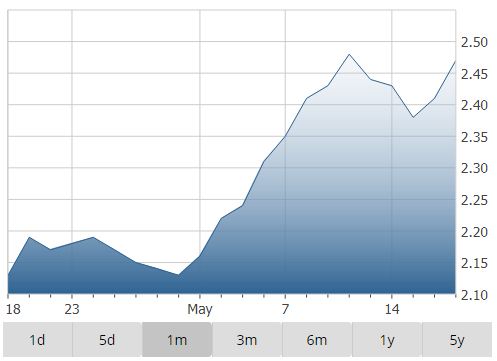

Alacer Gold Corp (TO:ASR)– $2.47

Gold

Alacer Gold is a U.S.-based gold company operating in Turkey. The Company’s primary asset is its Çöpler mine, producing 170,000 oz. in 2017, with an expansion of production expected to be completed in Q3 2018. Alacer expects to begin production at its Çakmaktepe project in Q4 2018.

- Market Cap: $725.6 Million

- Gold Production FY2017: 168,163 oz.

- Gold Production Guidance FY2018: 120,000 – 190,000 oz.

- All-In Production Cost FY2017 (USD): $685/oz. Au

- All-In Production Cost FY2018 (USD): $750-800 /oz. Au

- YTD Total Return: 8.1%

Roxgold Inc (TO:ROXG) – $1.29

Gold

Roxgold is a gold producer operating in Burkina Faso. The Company’s flagship asset, the Yaramoko project, began commercial production in October 2016. Yaramoko is an underground gold mine located in southwest Burkina Faso, the only underground gold mine in the country. The mine hosts mineral reserves of 1.8 million tonnes at 11.47g/t of gold, or 662 koz of gold. The mine produces an average of 125 koz per year.

- Market Cap: $481.3 Million

- Gold Production FY2017: 126,990 oz.

- Gold Production Guidance FY2018: 110,000 – 220,000 oz.

- All-In Production Cost FY2017 (USD): $740/oz. Au

- All-In Production Cost FY2018 (USD): $780-830 /oz. Au

- YTD Total Return: -9.3%

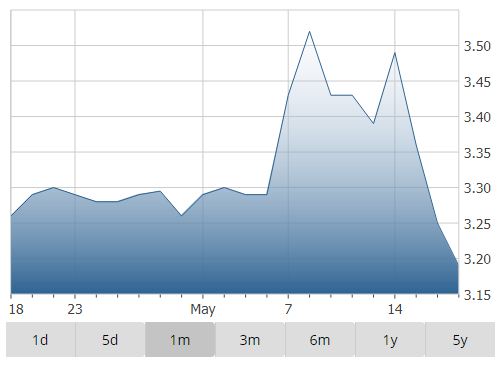

Dundee Precious Metals Inc (TO:DPM) – $3.19

Gold & Copper

Dundee Precious Metals is a Canada-based gold explorer and producer with one operating mine and development project, as well as four other exploration projects around the world. The Company’s flagship asset, the copper-gold Cehlopech mine in Bulgaria, is guided to produce 140,000-170,000 oz. Au and 31-37M lbs Cu in 2018. Dundee also operates a copper smelter in Namibia, which services a local mine and other international clients.

- Market Cap: $569.4 Million

- Gold Production FY2017: 197,684 oz.

- Gold Production Guidance FY2018: 140,000 – 170,000 oz.

- All-In Production Cost FY2017 (USD): $802/oz. Au

- All-In Production Cost FY2018 (USD): $640-855 /oz. Au

- YTD Total Return: 8.3%

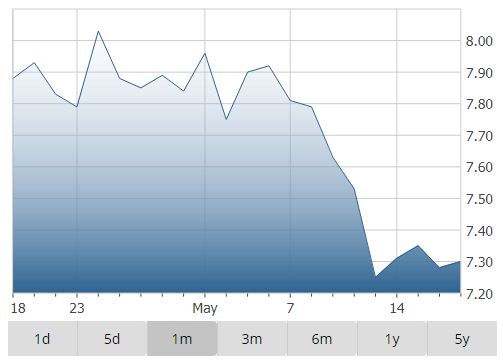

Centerra Gold Inc (TO:CG) – $7.30

Gold

Centerra Gold is a globally operating gold producer, with a focus on royalties with strong free cash flows. The Company holds four producing royalty assets and 14 other royalty assets, located primarily in Canada, but also in Mexico, Australia, and Turkey. On May 17, 2018, the Company announced sale of three royalty assets and a silver stream for US$200M.

- Market Cap: $2,130.0 Million

- Gold Production FY2017: 785,316 oz.

- Gold Production Guidance FY2018: 645,000 – 715,000 oz.

- All-In Production Cost FY2017 (USD): $688/oz. Au

- All-In Production Cost FY2018 (USD): $810-900 /oz. Au

- YTD Total Return: 13.0%

Disclosure: Neither the author nor his family own shares in any of the companies mentioned above.