Recent Performance of the Stocks Mentioned Below:

Average 1-Week Return: 6.01%

Average 1-Month Return: 5.44%

Average 1-Year Return: 37.4%

1. Adobe Systems Inc. (ADBE). Operates as a diversified software company in the Americas, Europe, the Middle East, Africa, and Asia. Beta at 1.53. Stock trading 0.3% above the 20-day SMA, 1.22% above the 50-day SMA, and 2.6% above the 200-day SMA.

2. AFLAC Inc. (AFL). Provides supplemental health and life insurance. Beta at 1.83. Stock trading 3.47% above the 20-day SMA, 5.92% above the 50-day SMA, and 15.82% above the 200-day SMA.

3. Ameriprise Financial Inc. (AMP). Provides financial planning, products, and services primarily in the United States. Beta at 1.95. Stock trading 3.89% above the 20-day SMA, 5.85% above the 50-day SMA, and 14.15% above the 200-day SMA.

4. Abercrombie & Fitch Co. (ANF). Operates as a specialty retailer of casual apparel for men, women, and kids. Beta at 1.61. Stock trading 26.88% above the 20-day SMA, 27.97% above the 50-day SMA, and 13.99% above the 200-day SMA.

5. Bank of America Corporation (BAC). Provides banking and financial services to individuals, small- and middle-market businesses, corporations, and governments primarily in the United States and internationally. Beta at 2.34. Stock trading 5.05% above the 20-day SMA, 6.47% above the 50-day SMA, and 18.8% above the 200-day SMA.

6. Cameron International Corporation (CAM). Provides flow equipment products, systems, and services to oil, gas, and process industries worldwide. Beta at 1.53. Stock trading 5.37% above the 20-day SMA, 0.39% above the 50-day SMA, and 6.69% above the 200-day SMA.

7. CBS Corporation (CBS). Operates as a mass media company in the United States and internationally. Beta at 2.23. Stock trading 5.98% above the 20-day SMA, 2.67% above the 50-day SMA, and 8.76% above the 200-day SMA.

8. Capital One Financial Corp. (COF). Operates as the bank holding company for the Capital One Bank (USA), National Association and Capital One, National Association, which provide various financial products and services in the United States, Canada, and the United Kingdom. Beta at 1.71. Stock trading 0.23% above the 20-day SMA, 1.02% above the 50-day SMA, and 7.87% above the 200-day SMA.

9. Coventry Health Care Inc. (CVH). Operates as a managed healthcare company in the United States. Beta at 1.8. Stock trading 0.27% above the 20-day SMA, 1.57% above the 50-day SMA, and 22.6% above the 200-day SMA.

10. Eastman Chemical Co. (EMN). Engages in the manufacture and sale of chemicals, plastics, and fibers in the United States and internationally. Beta at 2.01. Stock trading 4.01% above the 20-day SMA, 5.01% above the 50-day SMA, and 14.55% above the 200-day SMA.

11. Eaton Corporation (ETN). Operates as a power management company worldwide. Beta at 1.52. Stock trading 6.15% above the 20-day SMA, 8.91% above the 50-day SMA, and 14.14% above the 200-day SMA.

12. Expedia Inc. (EXPE). Operates as an online travel company in the United States and internationally. Beta at 1.78. Stock trading 5.41% above the 20-day SMA, 7.26% above the 50-day SMA, and 32.33% above the 200-day SMA.

13. Ford Motor Co. (F). Develops, manufactures, distributes, and services vehicles and parts worldwide. Beta at 2.28. Stock trading 2.7% above the 20-day SMA, 6.63% above the 50-day SMA, and 4.6% above the 200-day SMA.

14. Flowserve Corp. (FLS). Develops, manufactures, and sells precision engineered flow control equipment. Beta at 1.69. Stock trading 2.93% above the 20-day SMA, 5.31% above the 50-day SMA, and 17.21% above the 200-day SMA.

15. First Solar, Inc. (FSLR). First Solar, Inc. manufactures and sells solar modules using a thin-film semiconductor technology. Beta at 1.62. Stock trading 2.08% above the 20-day SMA, 6.19% above the 50-day SMA, and 12.56% above the 200-day SMA.

16. Gannett Co., Inc. (GCI). Operates as a media and marketing solutions company in the United States and internationally. Beta at 2.48. Stock trading 4.06% above the 20-day SMA, 0.89% above the 50-day SMA, and 19.23% above the 200-day SMA.

17. Hartford Financial Services Group Inc. (HIG). Provides insurance and financial services in the United States and internationally. Beta at 3. Stock trading 0.6% above the 20-day SMA, 2.92% above the 50-day SMA, and 11.69% above the 200-day SMA.

18. Harley-Davidson, Inc. (HOG). Produces and sells heavyweight motorcycles, as well as offers motorcycle parts, accessories, and related services. Beta at 2.16. Stock trading 3.49% above the 20-day SMA, 8.15% above the 50-day SMA, and 4.97% above the 200-day SMA.

19. International Paper Co. (IP). Operates as a paper and packaging company with operations in North America, Europe, Latin America, Russia, Asia, and north Africa. Beta at 2.22. Stock trading 3.44% above the 20-day SMA, 1.92% above the 50-day SMA, and 10.85% above the 200-day SMA.

20. Ingersoll-Rand Plc (IR). Engages in the design, manufacture, sale, and service of a portfolio of industrial and commercial products in the United States and internationally. Beta at 1.77. Stock trading 3.75% above the 20-day SMA, 5.2% above the 50-day SMA, and 13.6% above the 200-day SMA.

21. Intuitive Surgical, Inc. (ISRG). Designs, manufactures, and markets da Vinci surgical systems for various surgical procedures, including urologic, gynecologic, cardiothoracic, general, and head and neck surgeries. Beta at 1.59. Stock trading 0.03% above the 20-day SMA, 3.29% above the 50-day SMA, and 2.29% above the 200-day SMA.

22. Invesco Ltd. (IVZ). Provides its services to individuals, typically high net worth individuals. Beta at 1.82. Stock trading 3.76% above the 20-day SMA, 1.05% above the 50-day SMA, and 5.65% above the 200-day SMA.

23. JDS Uniphase Corporation (JDSU). Provides communications test and measurement solutions, and optical products for telecommunications service providers, cable operators, and network equipment manufacturers. Beta at 2.46. Stock trading 8.55% above the 20-day SMA, 2.45% above the 50-day SMA, and 0.16% above the 200-day SMA.

24. Nordstrom Inc. (JWN). Nordstrom, Inc., a fashion specialty retailer, offers apparel, shoes, cosmetics, and accessories for women, men, and children in the United States. Beta at 1.62. Stock trading 1.38% above the 20-day SMA, 0.91% above the 50-day SMA, and 5.55% above the 200-day SMA.

25. Lennar Corp. (LEN). Operates as a home builder and provider of financial services in the United States. Beta at 1.69. Stock trading 3.35% above the 20-day SMA, 5.12% above the 50-day SMA, and 29.07% above the 200-day SMA.

26. Legg Mason Inc. (LM). Operates as an asset management company worldwide. Beta at 1.75. Stock trading 3.62% above the 20-day SMA, 3.53% above the 50-day SMA, and 1.62% above the 200-day SMA.

27. Lincoln National Corp. (LNC). Engages in multiple insurance and retirement businesses in the United States. Beta at 2.63. Stock trading 1.28% above the 20-day SMA, 0.46% above the 50-day SMA, and 5.52% above the 200-day SMA.

28. Limited Brands, Inc. (LTD). Operates as a retailer of women’s intimate and other apparel, beauty and personal care products, and accessories in the United States and Canada. Beta at 1.54. Stock trading 3.26% above the 20-day SMA, 0.62% above the 50-day SMA, and 5.8% above the 200-day SMA.

29. Macy’s, Inc. (M). Operates department stores and Internet Web sites in the United States. Beta at 1.63. Stock trading 5.04% above the 20-day SMA, 6.06% above the 50-day SMA, and 10.2% above the 200-day SMA.

30. Masco Corporation (MAS). Distributes, and installs home improvement and building products for home improvement and new home construction markets principally in North America and Europe. Beta at 2.22. Stock trading 8.99% above the 20-day SMA, 10.28% above the 50-day SMA, and 24.9% above the 200-day SMA.

31. Molex Inc. (MOLX). Molex Incorporated manufactures and sells electronic components worldwide. Beta at 1.62. Stock trading 3.02% above the 20-day SMA, 1.17% above the 50-day SMA, and 3.72% above the 200-day SMA.

32. Motorola Solutions, Inc. (MSI). Provides business and mission critical communication products and services for enterprise and government customers worldwide. Beta at 1.56. Stock trading 3.88% above the 20-day SMA, 6.63% above the 50-day SMA, and 11.75% above the 200-day SMA.

33. Newell Rubbermaid Inc. (NWL). Designs, manufactures, sources, packages, and distributes consumer and commercial products. Beta at 1.7. Stock trading 2.86% above the 20-day SMA, 6.6% above the 50-day SMA, and 16.21% above the 200-day SMA.

34. Pioneer Natural Resources Co. (PXD). Engages in the exploration and production of oil and gas in the United States, South Africa, and Tunisia. Beta at 1.83. Stock trading 3.22% above the 20-day SMA, 2.65% above the 50-day SMA, and 6.66% above the 200-day SMA.

35. Ryder System, Inc. (R). Provides transportation and supply chain management solutions. Beta at 1.55. Stock trading 2.12% above the 20-day SMA, 7.53% above the 50-day SMA, and 4.84% above the 200-day SMA.

36. Ralph Lauren Corporation (RL). Engages in the design, marketing, and distribution of lifestyle products. Beta at 1.52. Stock trading 3.4% above the 20-day SMA, 2.47% above the 50-day SMA, and 1.36% above the 200-day SMA.

37. Rockwell Automation Inc. (ROK). Provides industrial automation power, control, and information solutions. Beta at 1.68. Stock trading 4.58% above the 20-day SMA, 8.9% above the 50-day SMA, and 7.91% above the 200-day SMA.

38. Snap-on Inc. (SNA). Snap-on Incorporated manufactures and markets tools, diagnostics, equipment, software, and service solutions for professional users in the United States, the United Kingdom, Canada, Germany, Japan, France, Australia, Spain, the Netherlands, Italy, China, and Sweden. Beta at 1.53. Stock trading 1.47% above the 20-day SMA, 5.17% above the 50-day SMA, and 19.47% above the 200-day SMA.

39. TE Connectivity Ltd. (TEL). Provides engineered electronic components, network solutions, specialty products, and subsea telecommunication systems. Beta at 1.97. Stock trading 6.12% above the 20-day SMA, 3.97% above the 50-day SMA, and 4.82% above the 200-day SMA.

40. Teradyne Inc. (TER). Provides automatic test equipment products and services worldwide. Beta at 1.86. Stock trading 5.33% above the 20-day SMA, 8.09% above the 50-day SMA, and 4.29% above the 200-day SMA.

41. Tenet Healthcare Corp. (THC). Operates acute care hospitals and related health care facilities. Beta at 2.39. Stock trading 10.68% above the 20-day SMA, 14.26% above the 50-day SMA, and 30.93% above the 200-day SMA.

42. Torchmark Corp. (TMK). Provides individual life and supplemental health insurance products, and annuities to middle income households. Beta at 1.57. Stock trading 2.75% above the 20-day SMA, 1.45% above the 50-day SMA, and 4.81% above the 200-day SMA.

43. T. Rowe Price Group, Inc. (TROW). T. Rowe Price Group, Inc. is a publicly owned asset management holding company. Beta at 1.6. Stock trading 1.96% above the 20-day SMA, 2.29% above the 50-day SMA, and 6.7% above the 200-day SMA.

44. Whirlpool Corp. (WHR). Engages in the manufacture and marketing of home appliances worldwide. Beta at 1.93. Stock trading 6.16% above the 20-day SMA, 15.51% above the 50-day SMA, and 41.94% above the 200-day SMA.

45. Weyerhaeuser Co. (WY). Weyerhaeuser Company, a forest product company, grows and harvests trees, builds homes, and manufactures forest products worldwide. Beta at 1.52. Stock trading 0.09% above the 20-day SMA, 0.42% above the 50-day SMA, and 17.87% above the 200-day SMA.

46. Wynn Resorts Ltd. (WYNN). Engages in the development, ownership, and operation of destination casino resorts. Beta at 2.36. Stock trading 0.46% above the 20-day SMA, 1.88% above the 50-day SMA, and 5.17% above the 200-day SMA.

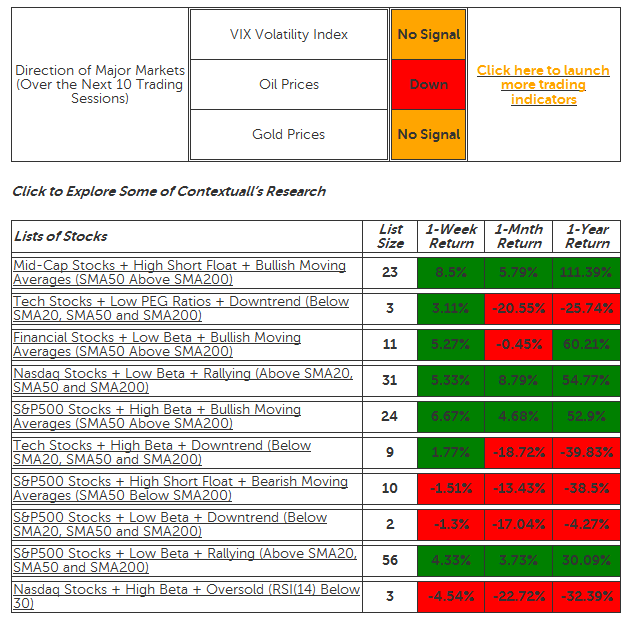

Note: Contextuall’s has built a variety of indicators to predict the near-term direction of the stock market. For current signals and backtests, click here.

Contextuall’s has built a variety of indicators to predict the near-term direction of the S&P500 index. For current signals and backtests, click here.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

46 High Beta S&P500 Stocks In Rally Mode

Published 11/26/2012, 02:09 AM

Updated 07/09/2023, 06:31 AM

46 High Beta S&P500 Stocks In Rally Mode

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.