Here is your Bonus Idea with links to the full Top Ten:

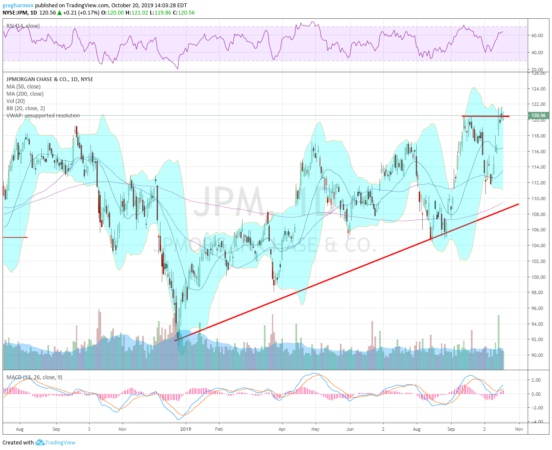

JP Morgan, $JPM, topped in September last year and then started to move lower. It found support finally at the end of December. Since then it has been rising in a broad path. Friday it closed at a new all-time high. The RSI is rising and bullish with the MACD pushing higher and positive. There is no resistance above 121.50. Support lower comes at 119.25 and 117.25 then 115.75. Short interest is low under 1%. The company reported earnings last week and is not expected to do so again until January 14, 2020. The stock pays a dividend with an annual yield of 2.99% and started trading ex-dividend on October 3rd.

The November options chain shows the largest open interest at the 110 and 115 strikes on the put side. It is biggest at 120 and 125 on the call side. December open interest is biggest at the 115 put but much bigger at both the 120 and 125 call strikes. Finally the January chain, the first to cover the next earnings report, has biggest open interest at the 100 and 110 put strikes and the 120 and 125 calls.

JP Morgan, Ticker: $JPM

Trade Idea 1: Buy the stock on a move over 121 with a stop at 119.

Trade Idea 2: Buy the stock on a move over 121 and add a November 120/115 Put Spread ($1.30) while selling the January 130 Calls (94 cents).

Trade Idea 3: Buy the November/January 125 Call Calendar ($1.90) and sell the November 115 Put (78 cents).

Trade Idea 4: Buy the January 110/125/130 Call Spread Risk Reversal (-$0.05).

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.