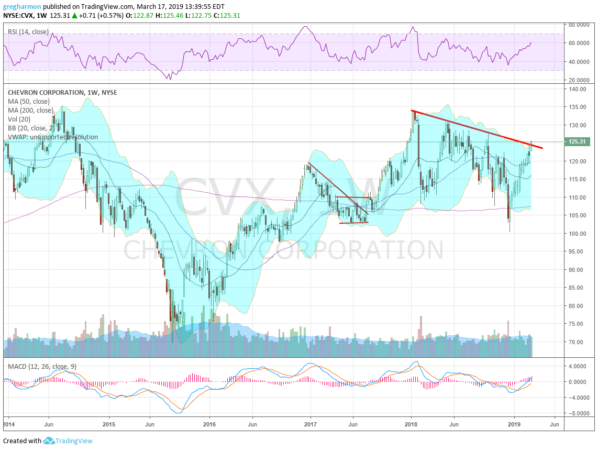

Chevron (NYSE:CVX), $CVX, started moving lower in the middle of 2014 as seen on the weekly chart below. The price bottomed out about a year later. Since then it has trended higher with a couple of major pullbacks along the way. The last one started when it touched the 2014 high, early in 2018. It has been a broad channel pullback that retested the 200 week SMA twice. The last one settled at the June 2017 low and reversed.

The RSI also reversed and is now on the edge of a move into the bullish zone with the MACD crossed up and positive. The price has just passed through falling trend resistance with the Bollinger Bands® opening higher. There is resistance at 126 and 128.60 then 130.75 and 134. Support lower comes at 122 and 119.50 then 114.80. Short interest is low under 1%. The stock also pays a 3.8% dividend and went ex- February 14th. The company is expected to report earnings next on April 25th.

The April options chain shows large open interest at the 125 call with over 8,000 contracts. That is double the next largest at the 120 call which is double any other strike on either side. The April 26 Expiry has very little open interest. In the May chain the biggest open interest is at the 125 and 130 calls with good size at 135 and 140 as well.

Chevron, Ticker: $CVX

Trade Ideas

- Buy the stock now (over 125) with a stop at 122.50.

- Buy the stock now (over 125) and add an April 26 Expiry 125/120 Put Spread ($1.45) while also selling the April 26 Expiry 130 Call (85 cents).

- Buy the May 125/April 130 Call Diagonal for $3.20.

- Buy the May 125/130 Call Spread ($2.40) and sell the May 120 Put ($1.85) for 55 cents.

Elsewhere

Look for Gold to continue to pull back in its uptrend while Crude Oil moves higher. The US Dollar Index looks to move lower in broad consolidation while US Treasuries stall under resistance. The Shanghai Composite and Emerging Markets are back in consolidation mode, moving sideways.

Volatility looks to sit at very low levels, giving support to equities to continue higher. Their charts show the SPY (NYSE:SPY) and IWM taking a pause in the shorter timeframe while the QQQ continues to blast higher. On the longer timeframe, all 3 have recovered from their 1-week pullback and continue to show strong uptrends. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.