Buyers in equity markets have shown their strength. The S&P 500 added 0.4% on Monday. Futures on the index show an upward trend this morning, growing another 1.1%. This recovery did not fully offset the decline of previous days. However, it pushes the same thoughts as last week, when we saw profit-taking after a firm April for the stocks.

Additionally, it is encouraging that the indices are growing quite evenly. Very often it is a sign of confident purchases for the long term rather than speculation on the latest news. Along with the growth of stocks, the dollar has turned to decline. It seems that the demand for dollars was satisfied.

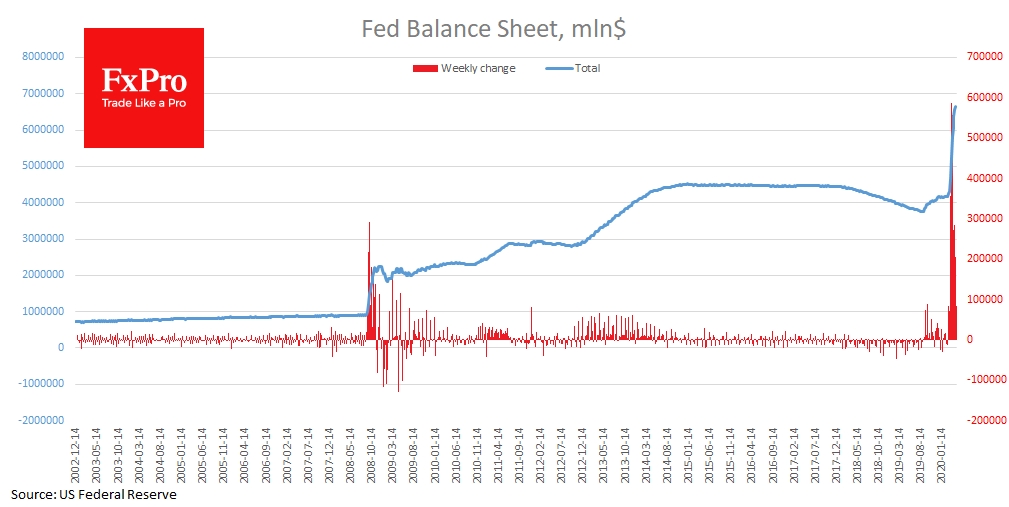

The Fed has managed to quench the dollar thirst, and now reduces the volume of purchases on its balance. In the last two weeks of March, the balance sheet increased by $557B and $586B, while the latest data showed that it grew by “only” $83B. If you assess the actions of the Fed by the dynamics of the dollar, the US Central Bank managed with a thin balance in its operations.

However, the financial system is movable. And now there is a new, no less stressful test coming. The US Treasury Department is going to attract about $3 trillion in the second quarter of the year in its updated borrowing plans. This is five times higher than the previous quarterly record in 2008.

The big question now is what impact this will have on the markets. Historically, such situations have been negative for the markets, as investors will prefer highly reliable US government securities to riskier stocks. On a much smaller scale, this happened in September last year. Back then, the Fed was helping markets by injecting liquidity and can do so now, again dramatically increasing asset purchases on the balance sheet. This is not the only case. The US Treasury bills are regularly placed on a large scale, and the dollar is strengthening. It is an approach based on history.

But there is another approach, the one based on the logic. Besides the US Treasury offer, US bonds government bonds are thrown into the market by many EM countries, that sell their FX reserves to help the economy and keep national currencies from free fall. It may well turn out that the dollar debt may be too large in the markets. In this case, the value of dollar debt may begin to decline, because there will be too much of it.

However, the Fed only comes into play when the situation gets out of control. Will, the US Central Bank, act proactively this time, or will we see signs of a significant shift in balance before the regulator intervenes? Either way, this impending debt placement tsunami is unlikely to be quiet.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

$3 Trillion Tsunami Looms Over U.S. Markets

Published 05/05/2020, 06:18 AM

Updated 03/21/2024, 07:45 AM

$3 Trillion Tsunami Looms Over U.S. Markets

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.