There are nearly 10,000 stocks traded daily on the public markets, and that’s just on Wall Street. Collectively, they generate an enormous amount of raw data – price movements, earnings results, analyst reviews, company announcements. All of this will impact investor decisions, which in turn add to the list of data to consider. It’s enough to make your head spin.

What’s needed here is a tool, to collect the data, analyze it, and distill it down, by categories or even into a single score. Fortunately for investors, that’s just what Investing.com has done with the Smart Score, a data tool using machine learning algorithms to read the data flow of the markets – and rate every stock accordingly.

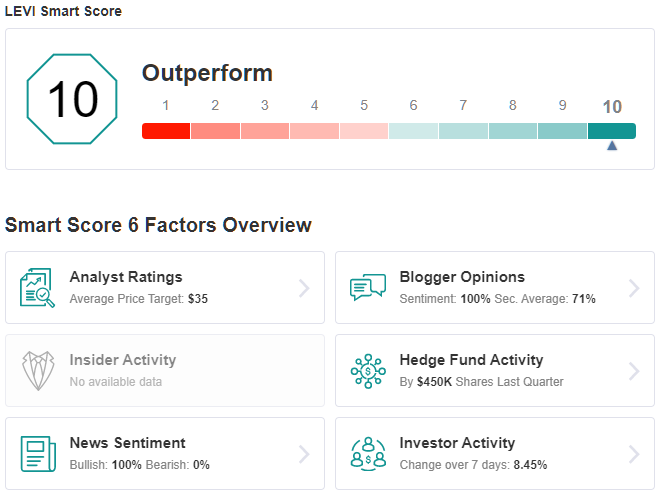

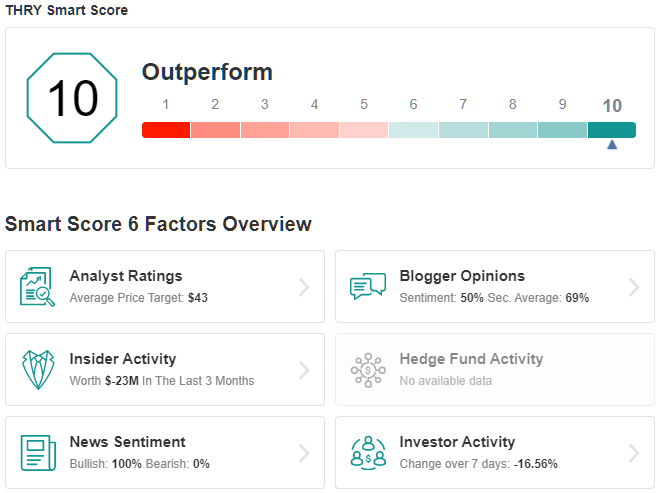

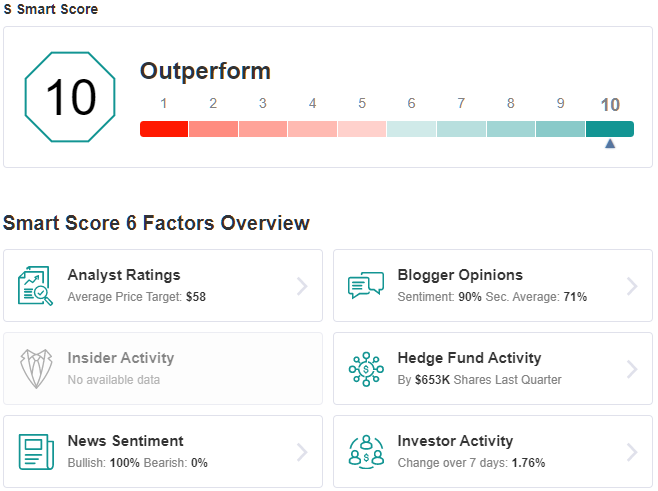

The Smart Score rates stocks according to their performance in 6 separate data categories, each of which has shown itself to correlate with forward share performance. The collected scores are then combined into a single rating, a scale of 1 to 10. The result is a thumbnail sketch, a way to search through the forest in a hurry.

The ‘Perfect 10’ stocks, those equities that have earned the highest ranking from the Smart Score, are rare birds. The top score has done to fewer than 300 stocks in the Investing Insights platform – but they deserve a closer look. Let’s take a look at three of them – they are small- to mid-cap stocks, with Strong Buy consensus ratings and considerable upside potential.

Levi Strauss & Company (LEVI)

The first ‘perfect 10’ stock we’re looking at is an icon of the clothing industry, Levi Strauss (NYSE:LEVI). This name has long been synonymous with blue jeans – in fact, the company’s eponymous founder invented that garment back in 1873, taking out a patent for the unique riveted denim pants. They were originally sold as rugged work clothes for miners in the West; they have since become ubiquitous, in work and fashion, and Levi Strauss’ company now boasts a market cap of ~$11 billion.

Even with the recession we faced last year, Levi Strauss saw over $4.44 billion in annual revenue. Generating that revenue are the sales of four separate brands, including Levi’s and Dockers, which are sold in over 110 countries around the world, through retail chains, online vendors, and more than 3,000 branded stores.

This year, the company has seen $2.58 billion in revenue for the first half. The Q1 top line was down year-over-year, but the Q2 result showed a heavy gain of 156% from the ‘corona quarter.’ EPS came in at 16 cents, far higher than the 92-cent quarterly loss posted during the crisis last year.

Levi Strauss is benefitting from the return of economic activity. As consumer get out and start restocking personal items, clothes are near the top of the list. The result: strong sales, with US and Chinese results in Q2 exceeding the year-ago quarter. The company has revised its full-year 2021 outlook for revenue and EPS, moving both upward. Management now predicts 28% to 29% full-year revenue growth, and 2021 EPS in the range of $1.29 to $1.33.

On the analyst side, Omar Saad, of Evercore ISI has weighed in with an Outperform (i.e. Buy) rating and a $40 price target indicating a robust 50% upside for the next 12 months.

Backing his stance, Saad, writes, “Levi’s delivered another solid quarter with a nice sales beat and record gross margin for the 3rd consecutive print…. given strong pent-up demand, end of the social recession, return of fashion, emerging and potentially sizable new denim silhouette trend, the continued casualization of fashion, and the global embrace of the jeans & sneaker phenomenon, would it be that surprising if sales accelerated (not decelerated) over the remainder of the year?… we think with its newfound pricing power and profitability, Levi’s could generate substantial earnings upside in the coming quarters and beyond if sales sustain or accelerate from June.”

Along with the perfect Smart Score, Levi Strauss also has a unanimous analyst consensus rating. The Strong Buy rating is supported by 8 positive reviews set in recent weeks. Shares are priced at $26.89 and their $35.38 average price target implies ~32% one-year upside potential. (See LEVI stock analysis)

Thryv Holdings (THRY)

Next up, Thryv Holdings (NASDAQ:THRY), is a company whose name you probably don’t know – but whose earliest product you are almost certain to have used. The company got its start as a combination of companies that owned and published the Yellow Pages phone directories. From that beginning, Thryv has moved on to software-as-a-service. The company offers a service platform to small businesses, amalgamating a range of services including – but not limited to – marketing automation, document storage and sharing, sales and payments, customer service management. These can be accessed through a single login, allowing users to avoid having to navigate multiple applications.

Thryv is a well-established company, and last fall it chose to enter the public markets in an unorthodox fashion. The company held a direct listing of its stock, rather than an IPO. That is, Thryv did not create new shares, but simply put its existing shares – previously all privately held – onto the public exchanges. There are no underwriters in a direct offering. Thryv’s stock started trading on the NASDAQ on October 1, and closed that day at $11.08. Since then, the stock has almost tripled in value.

This past June, Thryv announced that it was joining the Russell 2000 index. The index is a high-profile benchmark of small cap stocks, being used for the smaller companies the same way that the S&P 500 is used to track market giants. Thryv has a market cap of $1.1 billion, and so fits right into the Russell 2000’s cohort.

5-star analyst Rob Oliver, of Baird, was impressed enough by Thryv’s product and niche potential to initiate his coverage of the stock with an Outperform (i.e. Buy) rating, along with a $43 price target suggesting a one-year upside of ~30%.

“We believe we are in a ‘golden age’ for SMB software, where small businesses increasingly realize the power of software to drive revenue and efficiencies. The COVID-19 pandemic underscored and accelerated digital engagement for SMBs. With a best-in-class SMB SaaS offering, legacy business offering fertile ground for low-cost conversion, and management team with a proven track record of having executed in SMB, we view THRY as beneficiary of the trend of SMB digital transformation,” Oliver opined.

Oliver is no outlier on Thryv. He’s one of 5 analysts who have published recent reviews of this stock – and they are unanimously bullish, making the consensus a Strong Buy. THRY has an average price target of $43, matching Oliver’s. (See THRY stock analysis)

SentinelOne (S)

California-based SentinelOne (NYSE:S) is a cybersecurity company, a growing field in high demand by the digital economy. SentinelOne uses a patented behavioral AI platform to monitor a range of digital security needs: cloud workspaces, IoT devices, personal computers, all on one security platform.

This company recently held one of the year’s major IPO events, entering the NASDAQ on June 30 at a share price of $46. This was significantly higher than the $35 initial pricing, and even though the stock closed at $42.50 on its first day of trading, the company raised over $1.2 billion in the IPO. Since then, the shares have gained over 12%, and are now trading higher than the opening price. SentinelOne now boasts a market cap of $12.2 billion.

By entering the public markets, SentinelOne both raises capital and raises its profile – both necessary for expanding the business. Gray Powell, 5-star analyst with BTIG, notes both factors.

“While S is admittedly an expensive stock relative to peers in the security space, we think the company will be able to maintain hyper growth for at least the next five years and probably longer. In our opinion, S’s core corporate endpoint security target market is unique in that it is simultaneously experiencing elevated demand trends and migrating away from legacy solutions. We think this creates a very big opportunity for share gains for S, because the company frequently receives high marks in our independent fieldwork, is consistently recognized as a top 2 – 3 player in the space (sometimes 1st ) in terms of product capabilities, and is building brand awareness,” Powell explained.

Powell starts his coverage on S with a Buy rating. His $61 price target suggests ~25% upside for the year ahead.

Once again, we’re looking at a stock with a Strong Buy consensus rating from the Wall Street analyst corps. They are not unanimous however; the 13 recent reviews include 11 Buys and 2 Holds. Shares are trading for $48.95 and the average target of $57.62 implies ~18% upside from that level. (See SentinelOne stock analysis)

To find more ideas for stocks trading at attractive valuations, visit Investing Insights.