The markets have shown some ups and downs in recent sessions, but their general trend right now is upward. There may be several factors behind this; investors may be less nervous about the upcoming national election, as the polls continue to show a wide lead for former Vice President Biden, or they may be more sanguine about the prospect of a new ‘corona stimulus.’ Whatever the reason, after a rough September, October’s trading has shown a decidedly bullish cast.

In any case, finding the right stock in a time of higher than average volatility presents its own challenges. Stocks are sensitive to a wide range of influences, from macroeconomic trends to political winds. Even experienced investors can get confused.

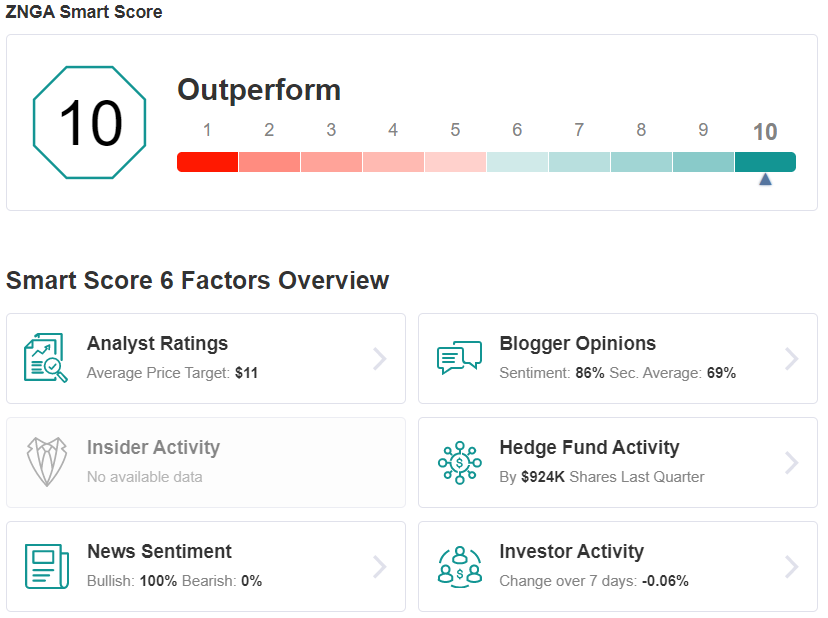

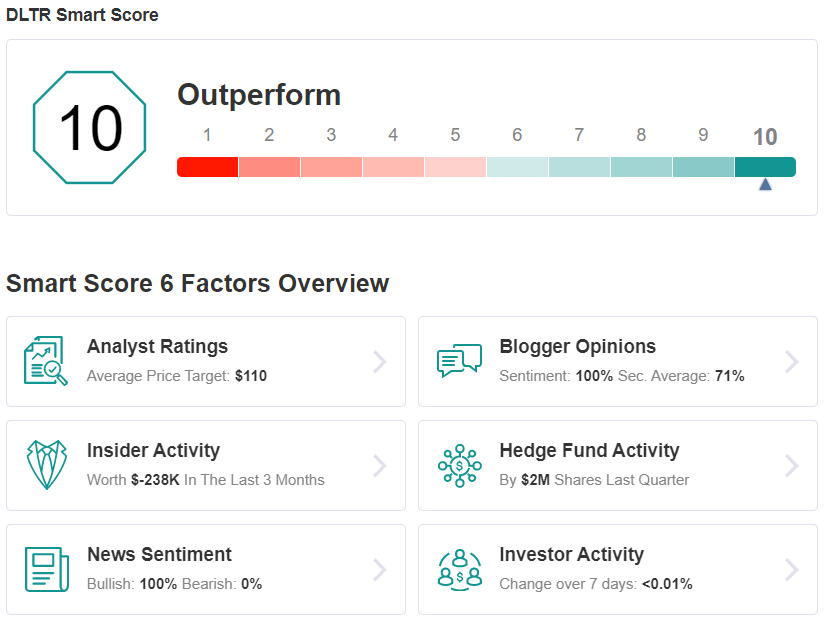

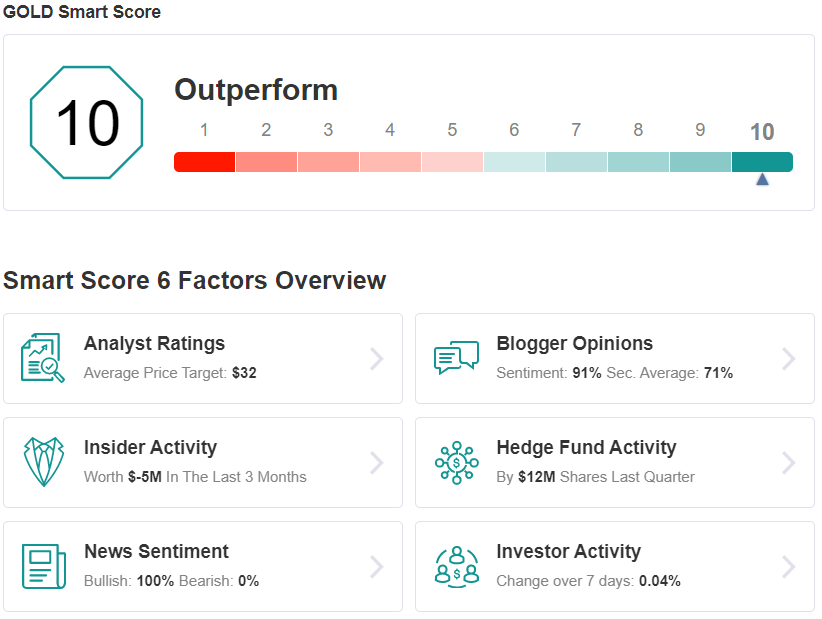

So, what investors need, especially now, is a tool, to filter through the market’s signals. The Smart Score sorts the raw data by 8 factors that are all known to correlate with future stock performance, and uses those factors to generate a single score, on a scale of 1 to 10, that shows at a glance how the stock is likely to move in the near- to mid-term. A ‘perfect 10’ from the Smart Score shows likely overperformance.

In recent weeks, three analysts have tagged three ‘perfect 10’ stocks for gains in the months ahead. These are the stocks that investors should note; here are the details.

Zynga, Inc. (ZNGA)

First on the list today is a gaming company. Zynga (NASDAQ:ZNGA) made its name developing social media games; it is best known for FarmVille. While the company has taken a lower profile since then, its Zynga Poker was the world’s largest poker website just four years after its 2007 release. While its market share has since declined to 6.1%, the game still brings in 15% of Zynga’s total revenue. The company has also found success with its Words with Friends social games.

Zynga’s top line revenues have been growing steadily for the past year, rising from $345 million in 3Q10 to $451 million in 2Q20. While earnings have not kept pace – the Q2 result was a net loss – the prospect for the third quarter is a 5-cent per share net profit. The earnings report is expected on November 4.

The company’s share appreciation has drastically outperformed its earnings. ZNGA barely noticed the recessionary pressures imposed by the corona pandemic, and has been showing steady gains through most of 2020. The stock is up an impressive 53% year-to-date.

MKM analyst Eric Handler believes that Zynga has plenty opportunity lying ahead.

“We like Zynga for its leadership position in the mobile games space, the fastest growing segment within the video games industry. In our opinion, the company is well positioned to drive increases in bookings and adjusted EBITDA of 13% and 18%, respectively, between 2020E-2023E… we see call option value on management’s ability to expand into new segments and platforms within mobile gaming and increase its international presence,” Handler opined.

Supporting his Buy rating, Handler gives this stock a $12 price target indicating room for 28% growth.

Overall, Zynga gets a Moderate Buy from the Wall Street analyst consensus. This is based on 14 ratings, including 11 Buys, 2 Holds, and 1 Sell. The shares are trading at $9.37, and the $11.83 average price target suggests the stock has a 26% upside from current levels. (See ZNGA stock analysis)

Dollar Tree (DLTR)

Next up is Dollar Tree Inc (NASDAQ:DLTR), one of several similar chain stores in the discount variety retail segment. Dollar Tree offers a range of low-cost discount products, including food, snacks, and general groceries, housewares, and toys, gifts, and books – to name just a few. Dollar Tree operates across the US and Canada, boasting more than 15,000 store locations.

The company has been pulled in two directions in recent months – the economic shutdowns hurt sales and store traffic, but the low cost and variety of goods helped bring in customer traffic when stores could open. The result was quarterly earnings this year that came in lower year-over-year but still beat the forecasts. The most recent quarterly showed EPS of $1.10 versus an 89-cent expectation. Revenues through 1H20 remained stable at $6.3 billion.

Edward Kelly, covering this stock for Wells Fargo, sums up the case for Dollar Tree in clear, simple prose, stating, “DLTR remains a compelling investment idea, in our view. Underlying fundamentals have been better recently, the core should have positive sales/earnings momentum in 2021 while most peers face challenging comparisons, and its low valuation offers an attractive risk/reward.”

Kelly rates Dollar Tree an Overweight (i.e. Buy), and gives the stock a $125 price target that suggests it can grow 31% in the coming year.

Of the 14 recent reviews on DLTR, 6 are Buys and 8 are Holds, making the analyst consensus rating a Moderate Buy. The stock is priced at $96.63 and has a $110.82 average target; this makes the one-year upside potential 16%. (See DLTR stock analysis)

Barrick Gold Corporation (GOLD)

Barrick Gold Corp (NYSE:GOLD) is a large-cap miner (total market of $49 billion) based in Toronto, Canada and operating in gold and copper mines in 15 countries around the world. Its most recent full-year production, 2019, saw production reach 5.5 million ounces of gold and 432 million pounds of copper.

Judging by the numbers, the corona pandemic seems not to have touched Barrick. From 4Q19 through 2Q20, quarterly revenues came in at $2.9 billion, $2.7 billion, and $3.1 billion – remarkable stability in a difficult time. Earnings over the same period grew steadily, with the Q2 figure of 23 cents per share being the highest in the past two years. Share price has matched this performance; Barrick’s shares are up 54% year-to-date.

This is the background to Deutsche Bank analyst Chris Terry’s upbeat look at this company. He says that Barrick “continues to deliver operationally and to focus on core assets,” and adds, “We believe that the worse of COVID-19 is now largely behind for most of the miners… we note Barrick saw minimal disruptions with only Veladero impacted for some time.”

Terry believes that Barrick is on the way up, and rates the stock a Buy with a $35 price target to imply 24% upside in the coming year.

GOLD is another stock with a Moderate Buy analyst consensus rating, this one based on 8 Buys and 3 Holds. Shares are trading for $28.31 and the average price target of $32.52 suggests a 15% upside from that level. (See Barrick’s stock analysis)

To find more ideas for stocks trading at attractive valuations, visit InvestingInsights.