Smart investing involves taking the long view. As Warren Buffett has famously said, “If you’re not willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.” The best way to realize gains in the stock market: get in, and stay in. Patience is a virtue, and compound interest is your friend.

That said, the issues become how to find the right stock for the long-term portfolio. The information you need is all out there – but there’s a lot of it, and it’s easy to get intimidated by the flood of data. That’s where the Investing’s Smart Score comes in. The Smart Score is a data-sorting tool, that collates the collected information in the TipRanks database, information on the performance of more than 9,000 publicly traded stocks, and assesses it according to 8 factors known to be predictive for share appreciation. The result is a score, a single-digit rating indicating the general direction a stock is likely to move in the year ahead.

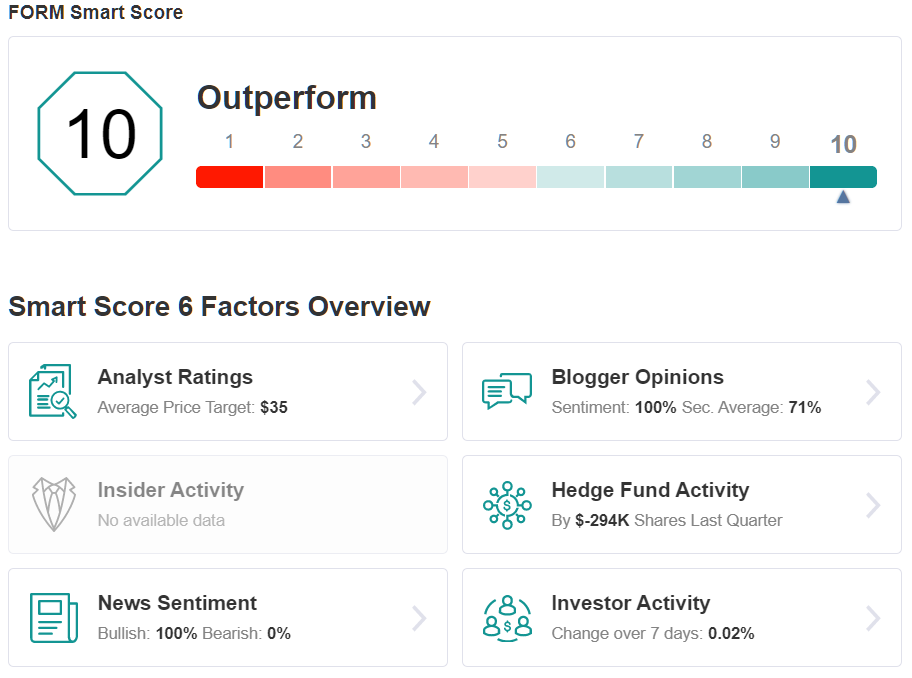

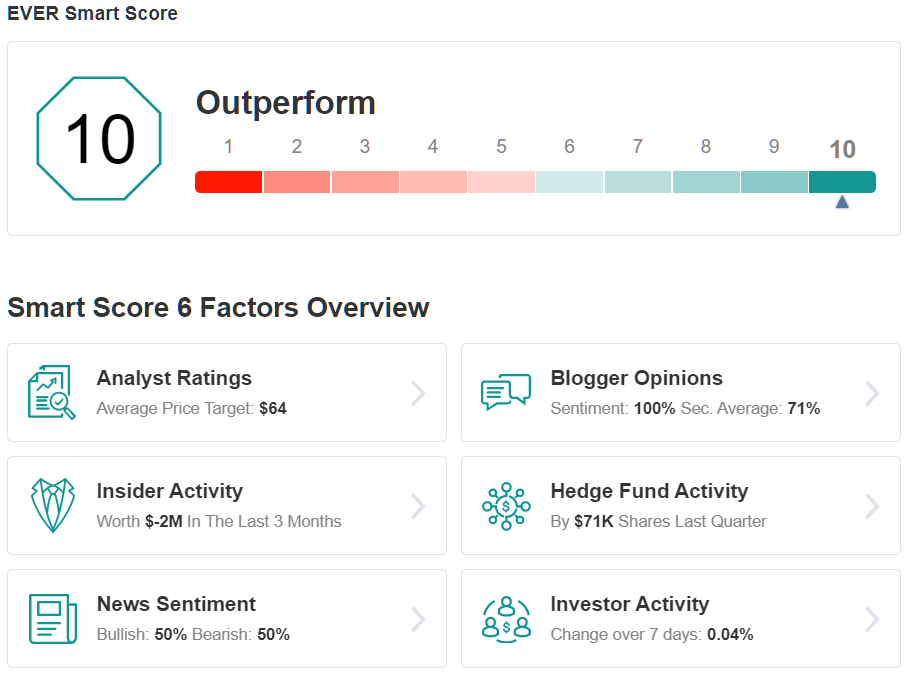

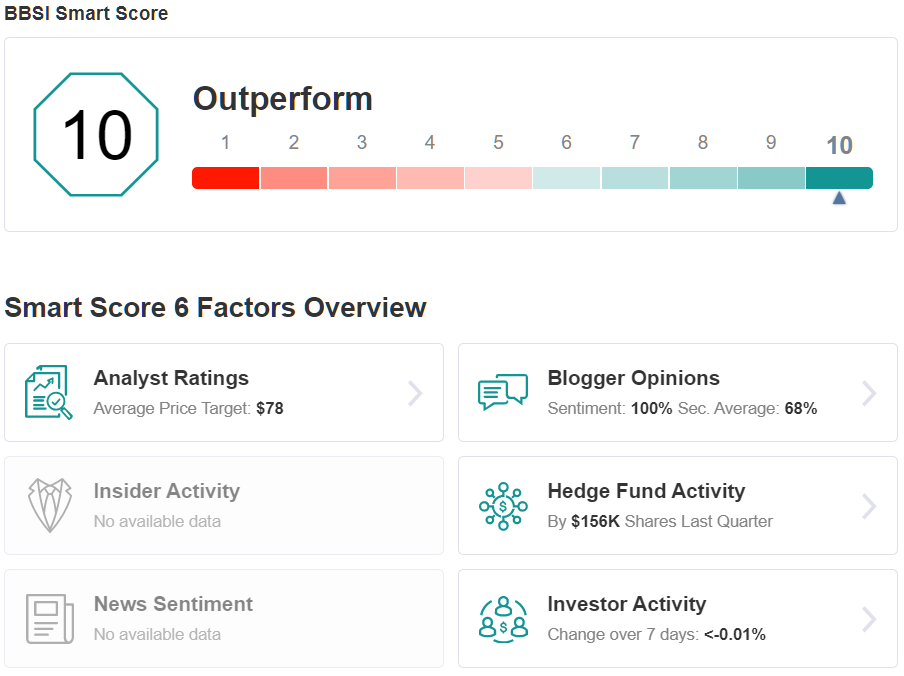

The Smart Scale runs from 1 to 10, with 10 being a perfect score. These ‘perfect 10s,’ with their status derived directly from the objective data, make a good starting point for investors seeking the right long-term stock plays. We’ve done some of the legwork for you, and pulled up three stocks with a ‘Perfect 10’ score. Here are the results.

FormFactor (FORM)

We’ll start in the semiconductor chip industry, where FormFactor (NASDAQ:FORM) is an important provider of high-quality testing equipment essential to the production of DRAM and Flash chips. The company designs, develops, and markets probe sets and other testing devices that are in ever increasing demand as the chip industry expands – and every chip packaged for sale has to pass a testing regimen.

FormFactor has performed well in the current bust-and-recovery market cycle. The stock is up 64% since the March bottom, outperforming both the Dow Jones and S&P 500 indexes.

The strong share performance has been supported by solid revenues and earnings. EPS in the first two quarters of this year did fall off from Q4 – but beat the forecasts by wide margins, and remained safely in profitable territory. The outlook for the third quarter predicts EPS in line with pre-corona levels. It’s notable that FORM has beaten earnings forecasts in each of the last three quarters.

Covering this stock for Craig-Hallum, analyst Craig Ellis writes, “We view FORM uniquely accomplished with M&A sourcing, integration and EPS accretion, thus we like potential for eventual inorganic target upside. Bears will now have a harder time pushing INTC 7nm risks but may note moderate GM expansion from current levels—something the right deal could fix. Overall, we believe positives outweigh negatives and we retain above-Street CY20-22 EPS.”

Ellis rates FORM a Buy, and his $45 price target implies an impressive upside of 65% for the stock.

Overall, FormFactor’s Strong Buy analyst consensus rating is based on 6 Buys and 1 Hold set in the past two months. The stock is currently trading for $27.47, and the $35 average price target suggests it has room for 27% growth over the coming 12 months. (See FORM stock analysis)

EverQuote, Inc. (EVER)

Next on our list, EverQuote (NASDAQ:EVER), is an online marketplace for the insurance industry. The company has built on the wide accessibility of information in our digital world to develop a platform that lets customers and insurance providers find each other, through searches for policy offerings and price points. Customers can shop for insurance policies in the auto, home, and life sectors, and the service is free on that end. EverQuote’s profits are derived from referral fees paid by policy providers at the time of purchase.

EverQuote’s most recent quarterly report, for calendar Q2, showed a 10-cent per share net loss, double the expected loss of 5 cents. This was the bad news, but it was not the only news. On more positive notes, the revenue verticals showed solid gains. Automotive insurance revenues increased 29.7% year-over-year, while home, life, and health insurance revenues combined gained 133.2% yoy. Total revenues were up 41% from last year’s Q2, to $78.3 million.

Turning to Wall Street’s analysts, Raymond James’ Aaron Kessler writes of EverQuote, “We maintain our Outperform rating… given: 1) EverQuote’s position as a leading insurance marketplace with a large TAM increasingly shifting online; 2) strong revenue growth driven in part by tech investments; and 3) expectation for significant EBITDA margin expansion driven by operating expense leverage.”

The 5-star analyst rates EVER shares as Outperform (i.e Buy) along with a $63 price target. This figure suggests room for a robust 69% upside on the one-year time horizon.

EverQuote is rated a Moderate Buy from the analyst consensus, with 5 Buys and a single Sell set recently. Shares are selling for $37.20; the average target of $64.80 is slightly higher than Kessler’s, and implies a 74% upside. (See EVER stock analysis)

Barrett Business Services (BBSI)

The last stock on our list, Barrett Business Services (NASDAQ:BBSI), started out in the staffing sector but has since grown to become a major consultant and service provider for small businesses. The company offers a variety of cost-saving outsource services to small businesses, to encourage success: HR and payroll, risk mitigation, and business planning.

Barrett showed a high level of resiliency against the corona epidemic, and earnings remained stable – within the company’s historical pattern – during 1H20. The Q1 contraction and Q2 rebound were both in-line with the year-ago numbers.

5-star analyst Terry Tillman, of Roth Capital, likes what he’s seeing. He writes, “We are encouraged by the stability in PEO gross billings and expect improved retention as a result of the value proposition during the pandemic. We expect sustained strength in the stock as investors shift focus to outer years and the organic growth potential of the business. BBSI is well capitalized with $130mm of unencumbered cash on the balance sheet and flexibility to execute on growth initiatives, including targeting a larger addressable market enabled by the myBBSI platform and geographic expansion.”

Accordingly, Martin rates BBSI shares a Buy, and his $84 price target implies a one-year upside of 47%.

All in all, BBSI shares have a Strong Buy analyst consensus rating – and it is unanimous. All three recent reviews are positive. The stock has an average price target of $78.67, suggesting room for 37% upside growth this year. (See BBSI stock analysis)

To find more ideas for stocks trading at attractive valuations, visit Investing Insights.