Goldman Sachs says the Fed will start cutting its bond purchases next month—and that sets up some of our favorite dividend-payers for a quick 61% profit surge. (I’ll reveal the tickers we need to reap this “taper bonanza” in a moment.)

Wait. Why are we taking Goldman’s word here?

Because “Government Sachs” has the deepest DC connections of any bank: former Treasury Secretaries Henry Paulson and Steven Mnuchin are Goldman grads, among many other government bigwigs. When it comes to what’s happening at the Fed, I’d take Goldman’s opinion over that of Jay Powell himself!

A Boon for Dividend Investors

To get at how we’ll flip the taper into big dividends, let’s connect it to a figure we all watch closely: the yield on the 10-year Treasury note.

Treasury yields are based on supply and demand. Supply (bond issuance) is huge, but so is demand, with the Fed stepping in for $80 billion per month. When this big buyer cuts back, we’ll see the yield on the 10-year rise to attract other buyers.

It’s already happening. At the beginning of 2021, the 10-year paid just 1%. It has since soared to 1.55%. That may not sound like much, but it’s a 55% increase.

As Powell throttles back, I expect Treasury yields to pop to between 2% and 3% in the first and second quarters of next year. The midpoint of that range is up 61% from now—fueling big profits in the sectors (and stocks) we’ll delve into next.

1. Regional Banks

Banks profit from the spread between the 10-year rate (benchmark for the loans they make to consumers) and the Fed’s overnight rate (at which banks lend to one another). The latter, of course, is set by the Fed and will likely stay at zero at least until mid-2022, going by the latest read of the Fed futures market.

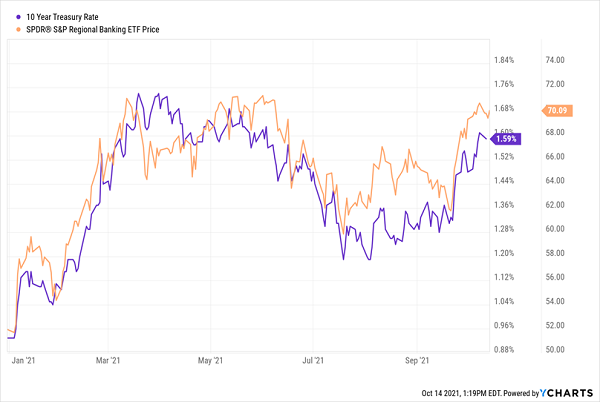

No corner of the banking world is more correlated to Treasury yields than regional banks. You can see that by the performance of the SPDR® S&P Regional Banking ETF (NYSE:KRE) below.

Treasuries Up, Small Banks Up

That brings us to our first “61% profit play,” KeyCorp (NYSE:KEY), with 1,000 branches in Ohio and New York. KEY starts us with a 3.3% yield, then doubles down with payout growth of 517% over the last decade. In other words, if you bought KeyCorp 10 years ago, you’d be yielding a hefty 9.4% now!

With the bank’s payout occupying just 35% of net income, it’s got plenty of room for further growth, and that’s before rate hikes further inflate its loan income. KEY’s bargain P/E ratio of 9.9 adds more upside.

2. Insurance Stocks

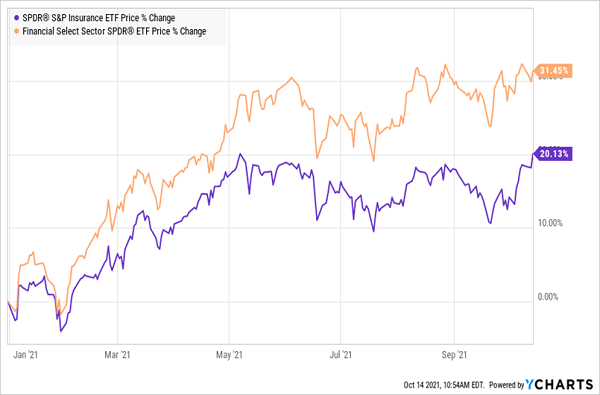

Insurers always play second fiddle to banks in investors’ minds, which is reflected in the SPDR® S&P Insurance ETF (NYSE:KIE), which badly lags the Financial Select Sector SPDR® Fund (NYSE:XLF) this year.

Insurers Trail, Our Opportunity Arrives

That’s too bad for them, because insurers are every bit as solid a rising-rate play as banks. They collect premiums from their customers and invest them in safe fixed-income securities until they have to pay them out (if they ever do!). So it follows that they’ll see higher profits as Treasury yields rise.

That’s part one of our opportunity. Part two comes when we target insurers trading for less than book value (or what their assets would be worth if they were sold off today). Buying stocks trading “below book” means we get their businesses for free!

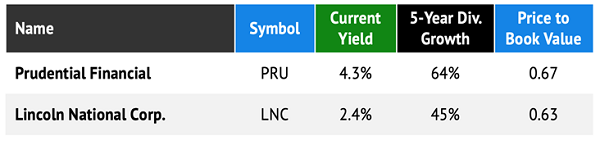

Right now, two leap out as stunning bargains: Prudential Financial (NYSE:PRU) and Lincoln National (NYSE:LNC):

Prudential: “Get a Piece of the Rock” for Nothing

You may remember Prudential Financial for its 1970s slogan “Get a piece of the rock.” Today, that best describes PRU’s dividend: it’s the rare stock with a high current yield, at 4.2%, and fast dividend growth, too.

Despite PRU’s strong position as rates rise (and COVID-19 recedes, reducing life-insurance claims), we still have an opportunity because the stock “breaks” every valuation measure, trading at just 6-times earnings and 67% of book value.

Management knows a great deal when it sees one—it’s repurchased 10% of PRU’s stock in the last five years. Now is a good time to follow their lead.

Lincoln National: 2.3% Dividend Today, 9.1% Tomorrow

Life insurer Lincoln National Corporation (NYSE:LNC) sports a lower yield than PRU, at 2.4%, but that’s just the start. Over the last decade, LNC’s payout has skyrocketed 425%, boosting the yield on a buy made then to 9.1% today.

Continued fast payout growth is likely as rising rates, fast economic growth and a greater focus on health post-COVID-19 drive policy origination—and profits. Silly valuations of 62% of book value and 9-times earnings add more upside.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."