There’s a “retirement shortcut” far too many people ignore—and it could let you hang ’em up a lot sooner than you think (and with a lot more income, too).

Retirement Investing: Most People Go Wrong At Step 1

When it comes to retirement investing, most folks lean heavily on dividend-paying S&P 500 stocks, particularly those with above-average dividend yields. And if you don’t want to manage a blue-chip stock portfolio on your own, no problem: Wall Street has you covered with the many ETFs it offers.

But this is the wrong route for a number of reasons—the main one being lame dividends!

A classic example: the SPDR® S&P Dividend ETF (NYSE:SDY), which yields 2.1% now. That’s pathetic for a dividend ETF; only a touch higher than the 1.6% the typical S&P 500 name pays.

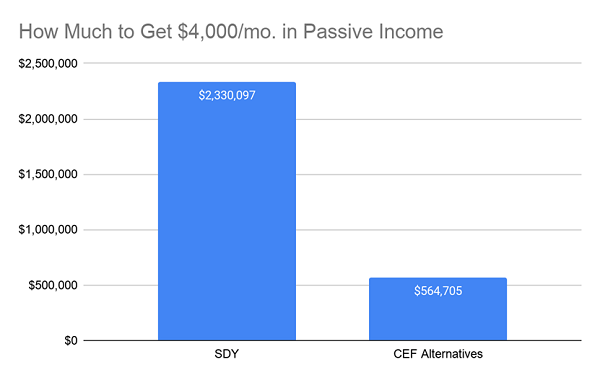

With this fund, you’d need to invest $2,330,000 to get $4,000 per month in passive income. Sure, a middle-class worker could theoretically save that much over, say, a 40-year career, but it would take some very strict saving.

This is where closed-end funds (CEFs) come in: they’re unique funds that hold many of the same stocks as ETFs, but the similarities stop there.

For one thing, when you buy a CEF, you can easily grab yields of 8.5%, which is the average payout of the three funds we’ll discuss in a moment. That’s four times more than SDY pays—and it’s a retirement game-changer!

As you can see, with 8.5%-paying CEFs, you need to save just $565,000 to get our $4,000 monthly income stream. That’s a lot easier to obtain for a middle-class worker, and it can be done a lot faster than 40 years!

Plus, there are CEFs that invest in other assets, such as corporate bonds, municipal bonds and real estate investment trusts (REITs) to provide a well-rounded, well-diversified portfolio that still gets you a massive passive income stream.

A 3-CEF Portfolio Throwing Off A Rich 8.5% Payout

Now let’s look at a model portfolio of just three CEFs that gets you to 8.5% income and diversification, too. And as we’ll see below, you’re not sacrificing performance to get this income—all three of these funds have crushed SDY, our low-paying “dividend” ETF!

1. A 6.3% Dividend With A Dash Of Growth

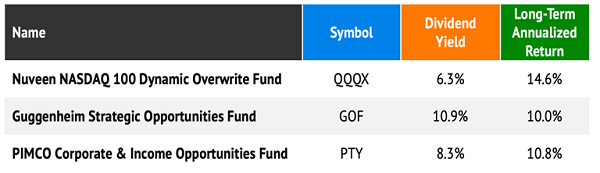

Let’s start with the Nuveen NASDAQ 100 Dynamic Overwrite Closed End Fund (NASDAQ:QQQX). With a focus on the Nasdaq 100 Index, this CEF gives us exposure to tech giants like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and Facebook (NASDAQ:FB), but with a 6.3% dividend, as opposed to the low (or no!) dividends most tech stocks pay out on their own.

That payout is also 12 times bigger than the practically invisible 0.52% paid by QQQX’s ETF cousin, the Invesco QQQ Trust (NASDAQ:QQQ).

QQQX generates that extra income with a smart strategy of selling call options on the stocks it holds (giving the fund the option to sell its shares at a fixed price in the future in exchange for some extra cash upfront, which it then passes on to shareholders). This is a lower-risk strategy that does particularly well in volatile markets, making QQQX a particularly good hold if (when) we see a pullback in the months ahead.

2: A Fixed Income Play Yielding An Incredible 10.9%

Next, the Guggenheim Strategic Opportunities Closed Fund (NYSE:GOF), with a monstrous 10.9% yield, moves us into the bond world, with 97% of its portfolio in fixed income.

The vast majority of its corporate-bond holdings sit just below the investment-grade line, where GOF’s managers can find the highest coupon rates available at the best deals. The fund also diversifies out into the fixed-income space with investments that include asset-backed securities, bank loans, preferred shares and municipal bonds. Guggenheim itself also brings a lot of expertise to these areas: the firm manages $245 billion of assets and boasts a 200-year history.

3. A High, Steady Payout From A CEF Leader

Finally, we’ll add the PIMCO Corporate & Income Opportunity (NYSE:PTY). The fund’s management firm, PIMCO, is one of the titans of the CEF world, and one of the biggest bond buyers, which gives it unrivaled expertise.

PTY, for its part, invests in a variety of real estate-backed assets and government bonds—a combo that offers us a dividend that’s both high, at 8.3%, and steady, having been held at 13 cents per share, paid monthly, for the past nine years.

CEFs Beat ETFs In Dividends And Long-Term Returns

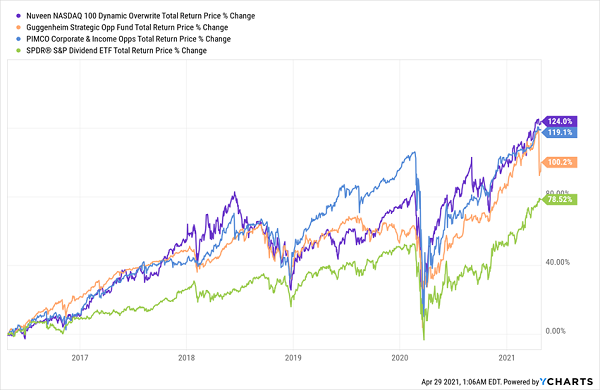

The clincher here is, as I said above, these three CEFs not only generate more income (and give you a more diversified portfolio) than you’d get with just the dividend-paying stocks in SDY, but you’re also getting a higher total return, too.

CEFs Beat The ETF Alternative

Over the last five years, each of these funds has crushed SDY by at least a margin of 40%. And the three of them have posted an average 11% annualized total return over the long-term.

The bottom line? CEFs are, hands down, a far better alternative to ETFs if you want to get financially independent faster (and who doesn’t?). And with nearly 500 CEFs out there, with many different strategies, there’s one for just about every type of investor.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."