2016 was a year that fit my niche to a tee and it is no coincidence that it has been a good one, performance-wise (though in full disclosure, the last couple of weeks have taken a chunk of profits back as I give the markets some leeway through the ‘Santa’ seasonal). Let’s take a stroll through 2016 before taking a brief look ahead to 2017.

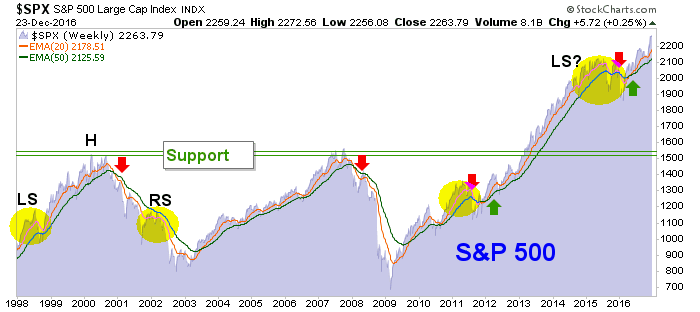

The year started with the topping pattern (that wasn’t, or isn’t yet) in the S&P 500. For all the world it looked like a top, walked like a top and quacked like a top. But it wasn’t a top!

That was proven when SPX rebounded from its lower low to the 2014 and 2015 lows and then rose to cross the 20 and 50 week exponential moving averages back up again. This was similar to the 2011 whipsaw, but on a grander scale. Now of course, the would-be topping pattern may be a left shoulder to a bearish Head & Shoulders pattern in construction. But even if so, the ultimate high could be well higher (ref. the 1998-2000 situation). As of now, the market is bullish. Period.

But considering that Casino Patrons are momo’ing the market and dumb money is strongly over-bullish, and the market is overvalued (one important valuation metric being the greater interest being paid on ‘risk free’ Treasury bonds vs. the S&P 500) as the media TRUMPets a new promotion; namely bond-eroding inflation as far as the eye can see due to coming fiscal policy changes.

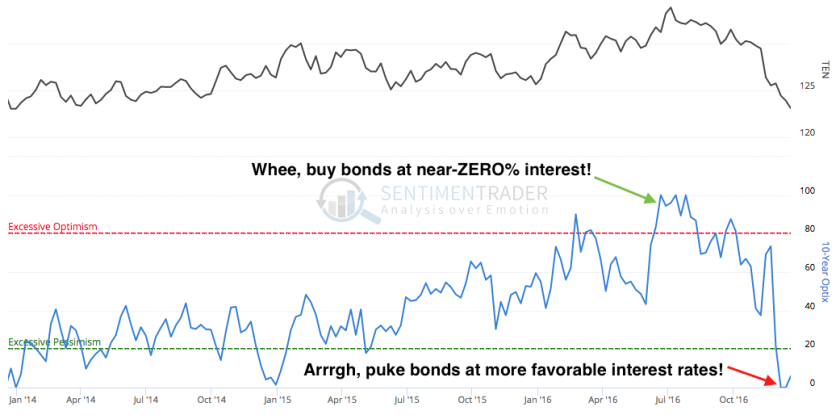

The Treasury bond bull market is DEAD trumpets the mainstream financial media. Well, for another view, let’s compare what the public was doing last summer during the NIRP! hysteria vs. today.

Thanks to the data from Sentimentrader we are able to see that herds of dumb money (per the Public Optimism Index or OPTIX) was thundering into Treasury bonds despite historically low yields last summer because… BREXIT!!! and NIRP!!!.

This was just in time to create a top in bonds prior to dynamic changes over the second half of the year. Now the public hates bonds because… Trump, because… inflation, because… media. Well, Trump’s election did not cause the bond market to fall apart; it was already bearish after last summer’s big, momentum-fueled sentiment event put the dumb money all in.

Now, who was taking the bearish side of the market last summer? The same people taking the bullish side today: the Commercial Hedgers, AKA the smart money. For the sake of space, let’s not cover too much old ground. You can see the Hedgers’ general positioning in the post in which I poked the trend following, rabble rousing media in the eye as it used a simple line drawn by Louise Yamada to make a big declaration in order to get people all worked up (and emotional).

Above we have covered the early part of the year with respect to the stock market’s failure to do what it was ‘supposed’ to do, and some incredible contrarian bond market dynamics in 2016.

Now switching back to stocks, we had two great sentiment events this year, which anecdotally at least, seemed to get the max number of players going the wrong way. Those would be the Brexit and US Election hysterias. Common themes attended both of these events, keeping us on the bull side of the barn. We poked the media in the eye about these promotions as well…Brexit! and Trump as Spectacle.

For each situation sentiment was over-bearish right into the actual event. The other common theme – for the broad US stock market at least – was that major technical support was completely intact, as we noted occasionally in public and constantly in our reports. What do they say about an intact uptrend? When pullbacks occur on over bearish sentiment during an uptrend, it is usually a buying opportunity.

Looking at a specific sector, when an industry (in this case Semiconductor Equipment) had positive fundamentals (as we tracked each month) and is technically intact, a bearish sentiment backdrop was a buy, as we noted back in May. Applied Materials Inc (NASDAQ:AMAT) and Lam Research Corp (NASDAQ:LRCX) came to be our primary Semi Equipment picks, here, here and here.

During the time frame of the above linked posts, I was being told that a renowned technology “expert” was exactly opposite my stance, bearish the semis and bullish on gold. You may or may not remember me grousing about that last summer. My belligerence even lost me a long-time subscriber…

Today, I note small and large analytical sources falling all over themselves recommending these Semi Equipment companies. Trend followers all…

I would estimate that 90% of what you read in the financial media, whether at the big shops like Bloomberg and Marketwatch or out there in the blogsphere where we little guys think we can add value to your investment theses, is unadulterated trend-following. It’s what sells. And your eyeballs need to be sold.

The financial media complex is not set up to tell you what is likely to happen. It is set up to tell you what has happened or is happening. From there it will often extrapolate to tell you what will happen, and with current events backing the extrapolation at any given time, 90% of information consumers will take it seriously, forgetting later just who provided the faulty information as it gets lost in the massive buzz of the electronic media industry.

2016 was mainly an exercise in maintaining discipline with respect to technical analysis signposts (most notably, simple support and resistance levels) and discipline from a contrary perspective.

“Nothing would be what it is, because everything would be what it isn’t. And contrary wise, what is, it wouldn’t be. And what it wouldn’t be, it would. You see?”

At this moment in time I cannot tell you whether the S&P 500 will proceed directly to our long-held operating target of 2410 or not. I cannot tell you whether it will get there in our lifetimes or get cut through like warm butter in January.

But that is the whole point; we are at the traditional time of year when the bizarre ritual of crystal ball and tea leave reading is put on display by the financial media as last year’s Wrong Way Corrigans attempt to get it right this year, knowing full well that media consumers do not take the time to go back and check records.

Here is my lone prediction; 98% of these predictions will prove totally bogus and my follow-on prediction is that only 5% of the reading audience will even care or remember come December 26, 2017.

So I’ll leave you with a simple note that in 2016, when the market was over bearish and people thought they knew bearish outcomes were in the offing, the opposite proved true. Today, at the dawn of a new year, sentiment analysis states that increasingly dumb money has made a commitment to what it thinks is a “new secular bull market” in the wake of the supposedly market-friendly Trump election and its fiscal stimulus to come.

NFTRH 427’s Wrap Up segment addressed this…

- The US market went bullish last winter and has remained bullish ever since, with an intervening major support test. We talked about that oncoming test for what seemed like forever, it came about and was successful. The US market is bullish.

- Will it go bearish? The contrary setup is there, with a majority believing fiscal policy will create a new secular bull. Meanwhile, there continue to be sectors that have been out of favor, which may be winners going forward. I’d remain open to continued bulling or a reversal to bearish. It is the market’s decision, not ours.

- But I’d continue to argue that you cannot have a new secular bull market when the old bull market, a short secular or long cyclical bull from 2009, never ended. That was why we gauged the ‘higher low’ major support test. A failure would have ended the bull. Support held and the bull remained intact.

If contrary sentiment analysis paves a way for a future risk ‘off’ view, the likes of Treasury Bonds and Gold, key components of the lowly risk ‘off’ trade, will have their day. I recommend you sit back, relax and let the contrarian signals come in without taking on the pressure and unrealistic expectations of pretending to know. It worked in 2016, after all.