With stocks breaking to all-time highs, we should emphasize security of the dividends we’re purchasing first and foremost. In previous months, it was a good time to be greedy. Now, with other investors in a fervor, let’s be careful.

The main thing we don’t want to do in a pricey market like this? Join the millions of “buy and hopers” out there. I call them that because they “buy” the typical S&P 500 stock and then “hope” for gains.

They’re sure not buying for the dividends: the popular names pay a poverty-level 1.6% income stream, on average.

With a lame yield like that, hoping for a jump in the share price is the only play you’ve got! So let’s leave these “investors” to their casino and buy assets that pay us in not one but three ways:

- A huge dividend: I’m talking 7%+ payouts here—more than four times the typical S&P 500 payout.

- A narrowing discount: The funds we’ll discuss shortly trade for less than their “true” value. As these discounts shrink, they’ll chip in some nice price upside for us.

- A rising share price as the economy inevitably recovers.

The key to pulling off all of the above is a group of often-ignored investments called preferred shares, which have several advantages over the “common” shares most investors buy on the market every day.

Preferreds are different; they’re wonderful hybrids that offer aspects of both stocks and bonds. They can trade on an exchange, like any common stock, but they trade around a par value and dole out a set regular payment, like a bond.

Their biggest appeal is their payouts. Many preferreds yield 6%+. Problem is, the preferred-stock market can be tough for individual investors to access, which makes funds the best way for us to buy in. And you can boost your income stream from preferreds even further, to 7%+ with the two closed-end funds (CEFs) we’ll look at now.

Preferred-Stock CEF No. 1: A 7.1% Payer That Jumped 66% (It’s Just the Start)

CEFs make preferred shares more potent in a couple ways, the main one being that CEF managers can borrow money for basically nothing and reinvest it in additional high-yield investments, amplifying their upside as they do.

The Nuveen Preferred & Income Opportunities Fund (NYSE:JPC), for example, boasts 243 holdings—mainly preferred stocks, though it does have the option of stashing assets in other income instruments, like municipal bonds and corporate debt.

As is the case with most preferred funds, financials dominate JPC’s holdings, as these firms are the most prolific issuers of preferred. Four of its top five industries are financials-related and makeup 70% of its total assets.

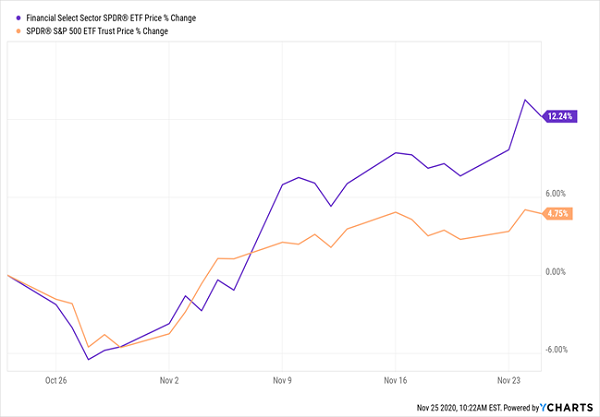

That’s given JPC an advantage, as the financial sector, represented below by the benchmark Financial Select Sector SPDR ETF (NYSE:XLF), has showed what I like to call “relative strength” in the last month, soaring 12% and crushing the market:

Financials Show “Relative Strength” …

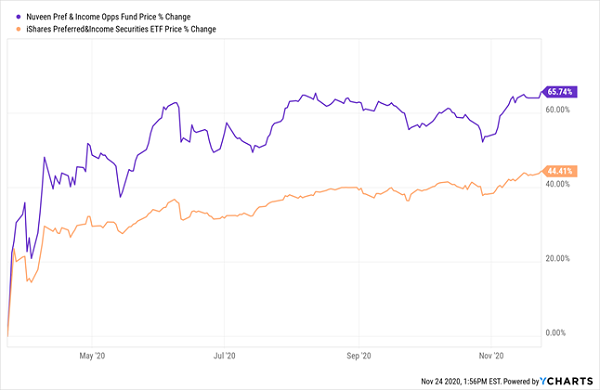

That’s been a big plus for finance-weighted JPC, which has crushed the preferred-share benchmark, the iShares Preferred & Income Securities ETF (NASDAQ:PFF), on a price basis since the trough of the March selloff:

… And So Does JPC

Buying a stock or fund when it’s just starting to take off is one of my favorite strategies—and a proven way to set yourself up for fast upside. And JPC’s “relative strength” is more than a short-term pop: the CEF has also clobbered PFF in the last 10 years, with a 143% return, compared to PFF’s 75%.

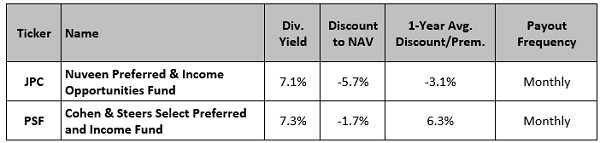

This is where that discount I mentioned earlier comes in: JPC trades at a 5.7% discount to net asset value (NAV, or the value of its portfolio) as I write this, and it’s traded at a 3.1% discount, on average, in the past year. This means we can expect a roughly 3% price lift as its discount reverts to normal.

That may not sound like much, but it’s more than ETF buyers get, because ETFs almost always trade at par with their NAV. And our next preferred-stock CEF is primed for even bigger discount-driven gains.

“Preferred” CEF No. 2: A 7.3% Dividend at a Big Discount

The Cohen & Steers Select Preferred and Income Fund (NYSE:PSF) is another preferred-stock CEF that’s crushed the benchmark, returning 142% in the last decade, to PFF’s 75%.

Portfolio managers William Scapell and Elaine Zaharis-Nikas oversee 244 preferred stocks across a range of sectors, although, as with JPC, financials lead, with banks and insurance companies comprising around 70% of the portfolio.

One place you do get some diversification is geographically. Just over half of the portfolio (52%) is invested in the US, with significant holdings in the UK (12%), France (7%) and Canada (7%), among several other developed markets.

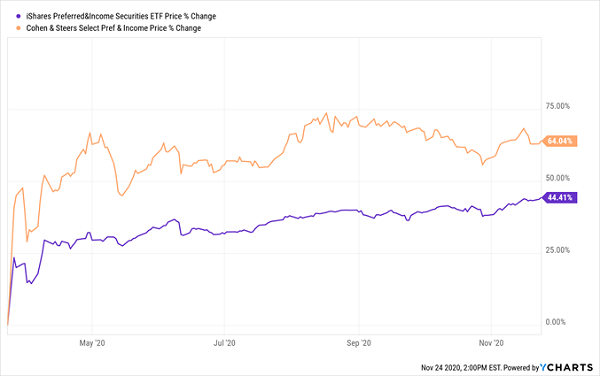

Remember the relative strength we saw with JCP? PSF is packing it in spades, too:

PSF Surges Out of the Selloff

The capper is that PSF boasts even more discount-driven upside than JPC: it trades at a 1.7% discount to NAV now, but it’s sported an average premium of 6.3% in the past year. If the discount moves back to that level, you’d grab roughly 8% upside from the closing discount alone, in addition to PSF’s 7.3% dividend.

Let’s wrap with the vital stats on each of these preferred-stock CEFs, so you can see what each one offers—in dividends and discount-driven upside—at a glance:

How We’ll Win in 2021: Crush the Market in Dividends Alone

The beauty of the 7% dividends you get from these two CEFs is that you’re matching the S&P 500’s total return (which has been around 7% annually over the long run) in dividends alone.

And you’re getting your dividends every month—no more waiting a full quarter for your next payout. Your monthly dividends from JPC and PSF match up perfectly with your bills.

Most folks would be happy to stop here. But we should demand more, especially when the average CEF yields 7% today—and that’s just the average. There are plenty of CEFs paying even more.

A 10% Income Stream—Year in, Year Out—Paid Monthly

Let’s inflate our income stream even further, to a gaudy 10%, with my “10% Monthly Dividend Portfolio.” It’s a collection of proven income plays (including CEFs) that, as the name says, pay you a steady 10%, every year, in dividends.

That’s more than the S&P 500 has returned over the long run—and you’re getting it in dividend cash alone!

Invest $500K in this powerful portfolio and you’ll kick-start a $50,000-a-year cash stream, easily enough income to retire on in many parts of the country.

That amounts to a steady drip of $4,167 (give or take a bit) dropping into your account every month!

PLUS, every one of these picks is cheap, nicely setting you up for double-digit price appreciation in 2021, to go along with your 10% dividends!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."