- Historical data and statistics confirm that market dips are a natural part of investing in equities

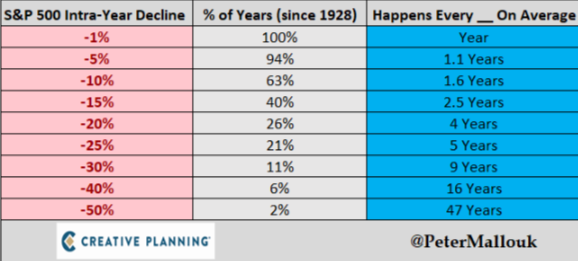

- Large drawdowns in the S&P 500 are less frequent than smaller ones, with falls over 50% occurring on average every 47 years

- Understanding these concepts can help investors better navigate difficult market phases and make informed investment decisions

More and more people are talking about a market crash due to various factors, such as a return of inflation, the Fed raising interest rates more than expected, charts that seem similar to periods like 2001 or 2008, wars, etc.

In 2022, the stock market (measured by the S&P 500) fell about 27.5% from its highs (see below).

This may seem like a big drop, but if you go back a little further, the drawdown (albeit faster and less sustained) in the COVID period was around 35%.

But as always, we need to look at history and statistics to back up our arguments (and, therefore, our strategies and how we trade the markets).

1. Big Drawdowns Are Rare

As we can see from the table above, the drawdowns in the S&P 500 over a year vary in size, and the larger they are, the less frequent they are.

For example, subprime crisis-style falls of over 50% occur on average every 47 years, while falls of around 40% occur every 16 years.

This is the first fact that we need to take home with us. I say this because investors are often unaware of this data and are convinced that any decline must necessarily be -40 or -50%.

Until this happens, they do not invest... but what if (as we now know statistically) the decline stops at -10, 15, or 20%, and then the market starts to rise again?

2. Small Dips Are Frequent

The second fact we need to be clear about, based on what we have seen above, is this: Market dips (even small ones) are frequent because they are part of the nature of the stock market.

Without them, we would not be able to achieve the returns that investing in equities has historically produced. For example, a 10% drop may seem like a big drop, but it actually happens every year and a half on average.

Understanding these two important concepts can help us better deal with difficult market phases such as the one we are currently going through. Repeating these concepts often can seem tedious, but it should be.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such, it is not intended to encourage the purchase of assets in any way. I would like to remind you that any type of asset is highly risky and valued from multiple points of view. Therefore, any investment decision and the associated risk remain with the investor.