If you’re not holding at least some of your portfolio in international dividend stocks, you’re missing out.

Stocks (and funds) in some overseas markets pay higher dividends than US companies. The 60 biggest stocks on Canada’s Toronto Stock Exchange yield 2.5% right now, for example, compared to a 1.3% average yield for the S&P 500.

What’s more, plenty of US investors are (in many cases unintentionally) biased toward their home country, with more than three-quarters of their portfolios, on average, invested in the US, according to recent numbers from Franklin Templeton.

To a degree, that’s understandable—after all, America has the world’s biggest and most dynamic stock markets, boasting dominant big cap firms such as Pfizer (NYSE:PFE), Ford (NYSE:F) and Walt Disney (NYSE:DIS),the likes of which simply don’t exist anywhere else.

Still, it pays to make investing abroad a priority, both for income reasons and for the reduced volatility that a geographically diverse portfolio brings. But of course, not all overseas markets have appeal right now.

Which brings me to the specific country I want to talk to you about today: China.

Chinese stocks aren’t known for their dividend yields—the benchmark iShares MSCI China ETF (NASDAQ:MCHI) yields just 1.1% right now, less than the S&P 500. But you still might be tempted, because Chinese stocks have moved in the opposite direction as their American cousins this year, suggesting there could be deals to be had.

Chinese Stocks Mirror the S&P 500 (in a Negative Way)

You might even be tempted to go around America’s high-flying tech names, like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN), by picking up big Chinese giants like Tencent (OTC:TCEHY), Baidu (NASDAQ:BIDU) and Alibaba (NYSE:BABA),which have all seen double-digit declines this year.

Chinese Tech Stocks Drop (but They’re Still Not Bargains!)

Don’t take the bait!

Truth is, these tech giants (and Chinese stocks more generally) are falling for good reason—starting with that ever-present boogeyman of investing in the country: ever-shifting (and sometimes absent!) regulations.

Case in point: the Chinese Communist Party has recently warned some companies that they are, in fact, no longer allowed to earn profits! Most recently, any company in the education sector, including online private test-prep schools, are forbidden to earn any profit at all.

And there’s another legal trap that could become a problem for investors in Chinese stocks.

This one stems from the fact that investors outside of China, ranging from multi-billion-dollar hedge funds to your average retail investor, don’t actually own shares in Chinese companies. Instead, they own parts of something called variable interest entities (VIEs)—companies that have contractual agreements to receive profits from Chinese firms. It’s not entirely clear how legal this approach is, and that could put your Chinese holdings in jeopardy if the country’s government decides to act against it.

It’s no small amount of money we’re talking about here, either—Chinese megacorps like Alibaba are major VIE users, according to Nikkei Asia. All told, there are about $1.6 trillion in Chinese investments tied to the VIE structure.

Chinese Funds to Avoid

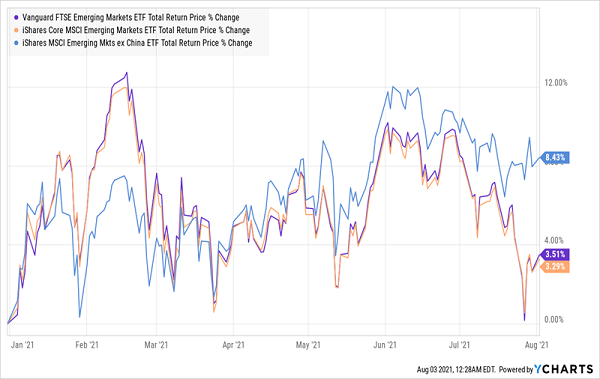

In light of all this, I recommend staying well clear of China ETFs right now, despite the dip in these assets. And it’s not just pure-play Chinese ETFs that are risky: there are other ETFs out there that are also weighted heavily to China, such as the Vanguard FTSE Emerging Markets ETF(NYSE:VWO) and the iShares Core MSCI Emerging Markets ETF (NYSE:IEMG).

VWO and IEMG are spread out around the world, but 40% of their portfolios are in Chinese tech companies, which is why both funds are underperforming the iShares MSCI Emerging Markets ex-China ETF (NASDAQ:EMXC), in blue below, which, as the name says, excludes China.

China Drags Down VWO and IEMG

That suggests EMXC is a much better option if you want emerging-market exposure, but it’s far from the best option out there.

How to Invest Beyond the US for 7.4% Dividends (With Less China Risk)

If you want emerging markets in your portfolio, I’d recommend avoiding ETFs entirely, because a simple passive approach to these complex markets just doesn’t work.

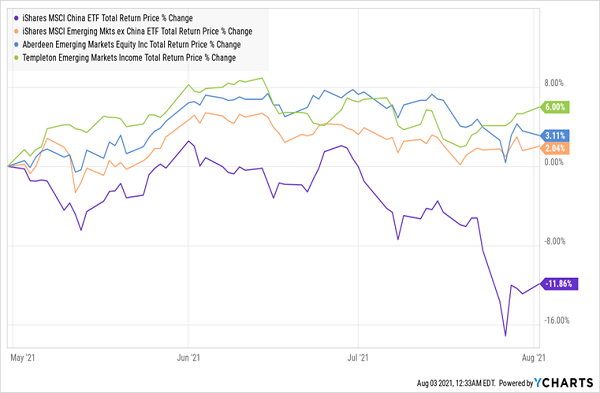

Instead, look at a high-yielding emerging-market closed-end fund (CEF) like the Aberdeen Emerging Markets Equity Income Fund (NYSE:AEF),with its 7.4% yield, or the Templeton Emerging Markets Income Closed Fund (NYSE:TEI), with its whopping 9.3% dividend.

These funds are managed by professionals who can anticipate changes in the market. This is why both of them have been outperforming both the China and ex-China ETFs over the last few months.

Human Managers Clobber the Emerging-Market ETFs

The fact that these two CEFs hand over huge income streams (multiples higher than the 1.4% average yield you get from the three ETFs we’ve discussed) is just icing on the cake.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."