Over the recent decades, we have seen a significant change in global economic forces. China is getting more and more important in the global economy and is responsible for half of the world's economic growth.

A large trading gap was created between the emerging markets and the developed nations. As a result, the old economies created huge mountains of debt and growth slowed while the unemployment rates exploded.

The emerging markets have shown an opposite ratio - low debt to high growth. Unknown companies becamemultinational super companies in only a decade and made people very rich.

Today we'll look at some of the best growth stock with dividend payments from the popular BRIC nations.

My screening criteria are:

- Headquartered in a BRIC country

- Market capitalization over $2 billion

- 5 year expected EPS growth over 5%

- Positive dividend yield

Seventeen companies fulfilled these criteria of which one stock has a high-yield and twelve are recommended to buy.

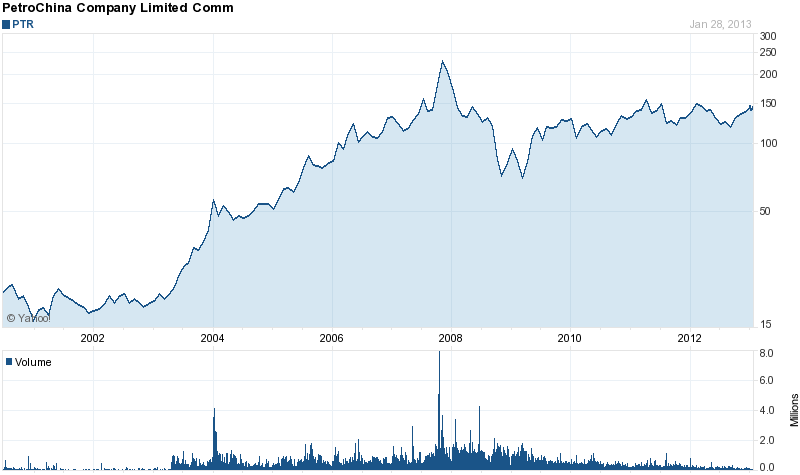

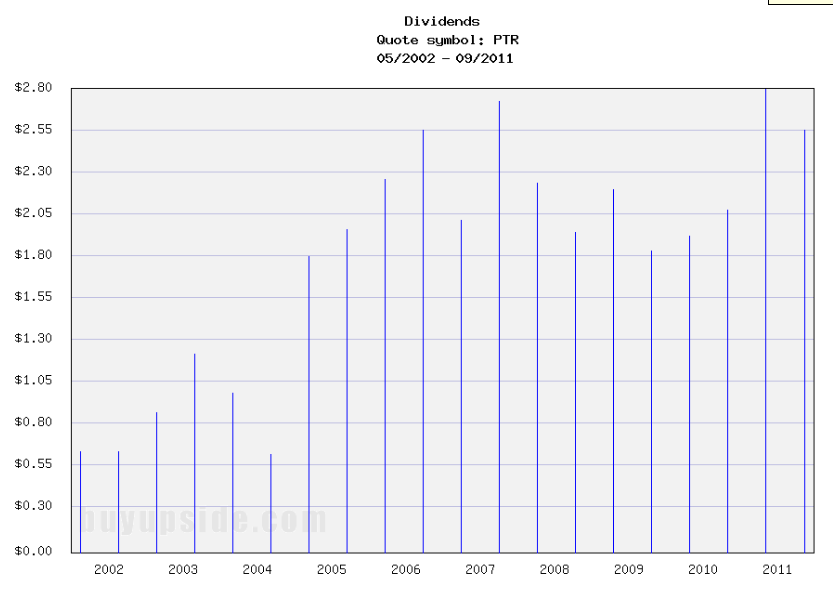

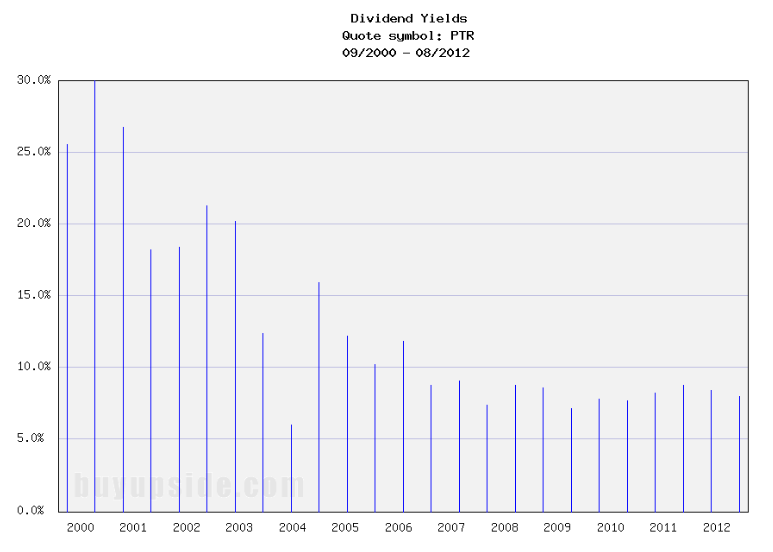

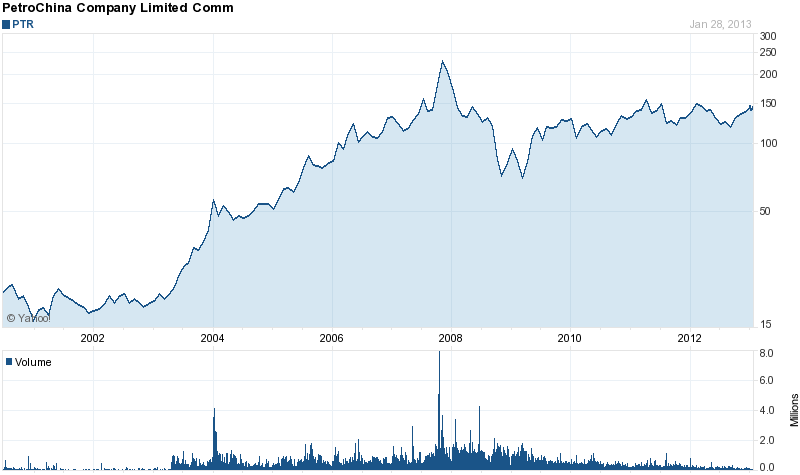

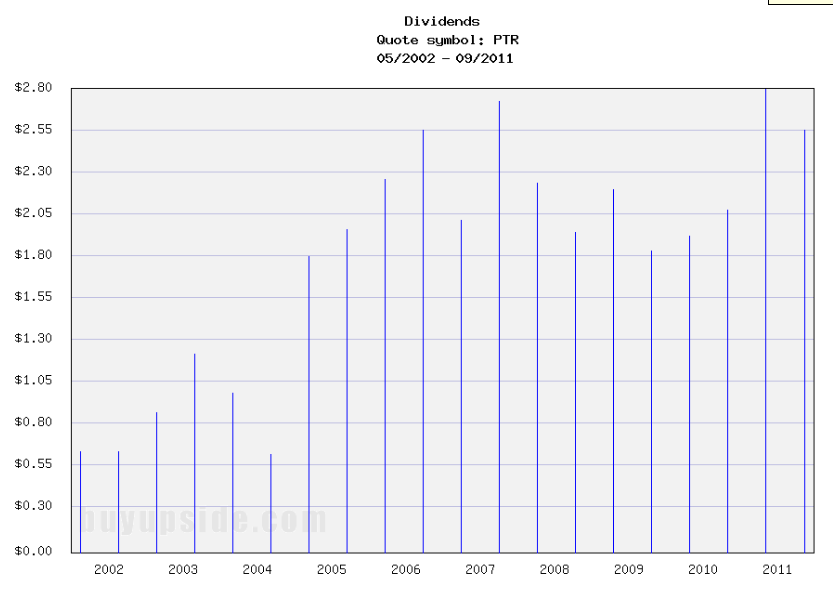

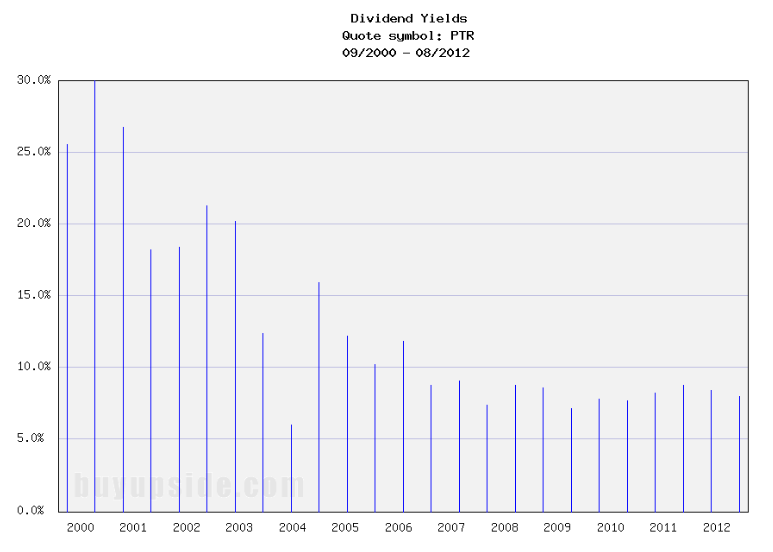

PetroChina (PTR) has a market capitalization of $261.77 billion. The company employs 552,810 people, generates revenue of $322.145 billion and has a net income of $23.464 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $51.583 billion. The EBITDA margin is 16.01 percent (the operating margin is 9.11 percent and the net profit margin 7.28 percent).

Financial Analysis: The total debt represents 16.60 percent of the company’s assets and the total debt in relation to the equity amounts to 31.75 percent. Due to the financial situation, a return on equity of 13.70 percent was realized. Twelve trailing months earnings per share reached a value of $10.36. Last fiscal year, the company paid $5.26 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 13.80, the P/S ratio is 0.82 and the P/B ratio is finally 1.62. The dividend yield amounts to 3.50 percent and the beta ratio has a value of 1.10.

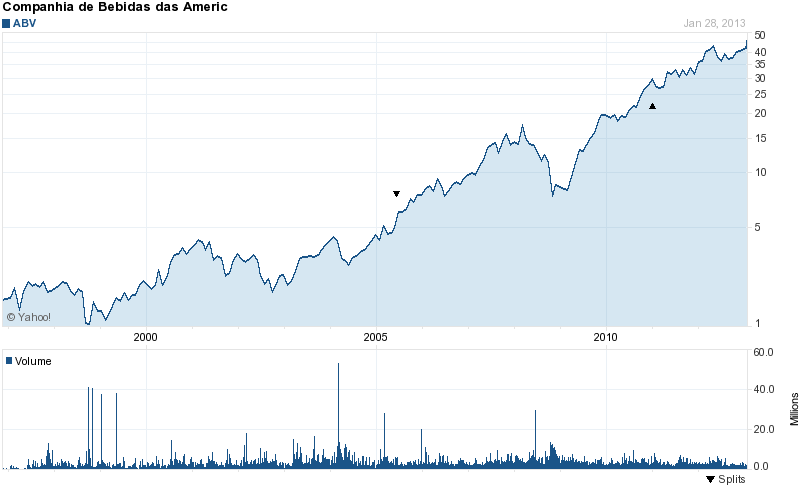

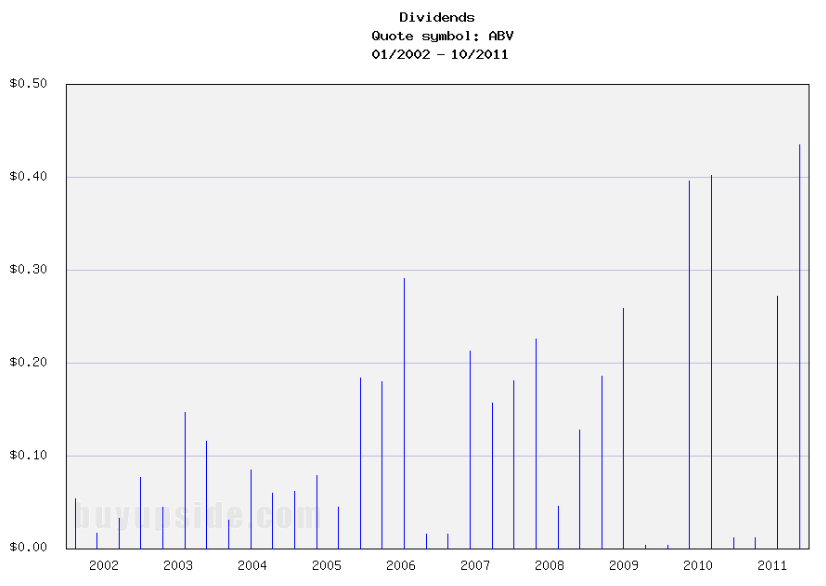

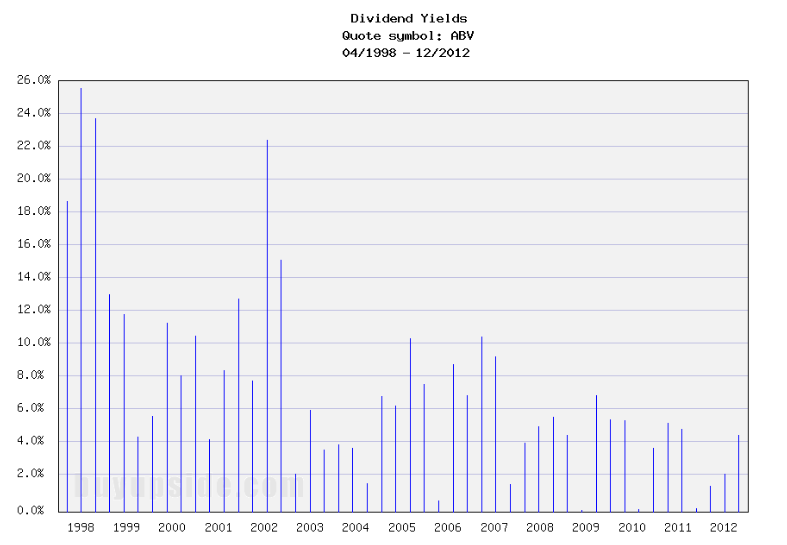

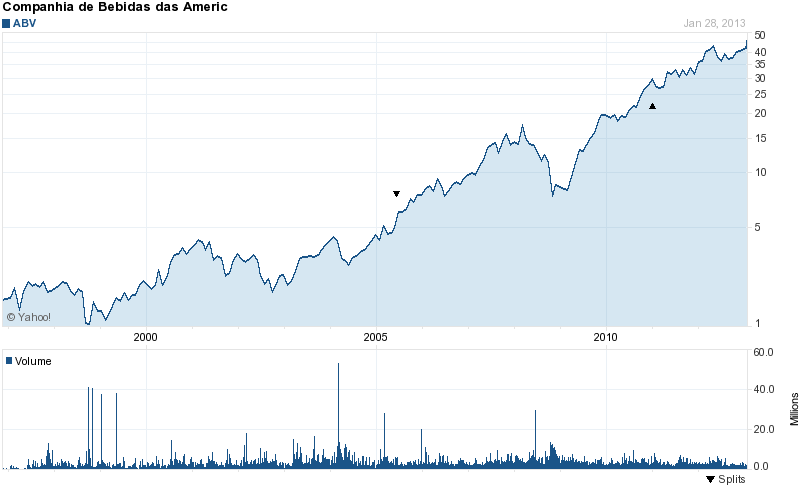

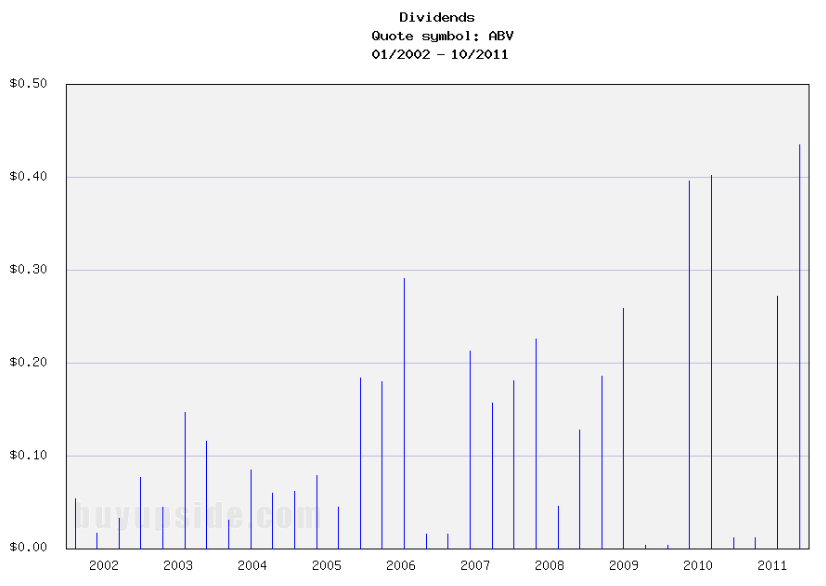

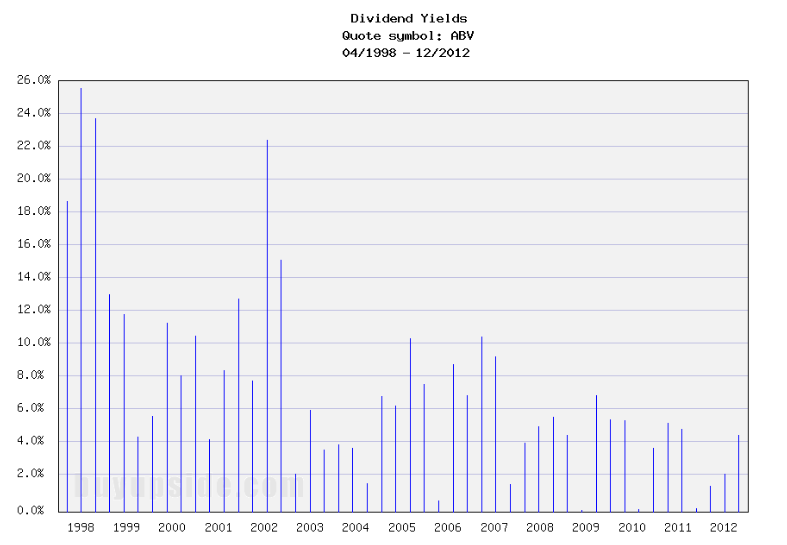

Companhia de Bebidas Das Americas (ABV) has a market capitalization of $143.09 billion. The company employs 46,503 people, generates revenue of $13.369 billion and has a net income of $4.297 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $6.462 billion. The EBITDA margin is 48.34 percent (the operating margin is 43.17 percent and the net profit margin 32.14 percent).

Financial Analysis: The total debt represents 8.92 percent of the company’s assets and the total debt in relation to the equity amounts to 16.07 percent. Due to the financial situation, a return on equity of 34.58 percent was realized. Twelve trailing months earnings per share reached a value of $1.54. Last fiscal year, the company paid $0.91 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 29.66, the P/S ratio is 10.54 and the P/B ratio is finally 11.31. The dividend yield amounts to 3.19 percent and the beta ratio has a value of 0.94.

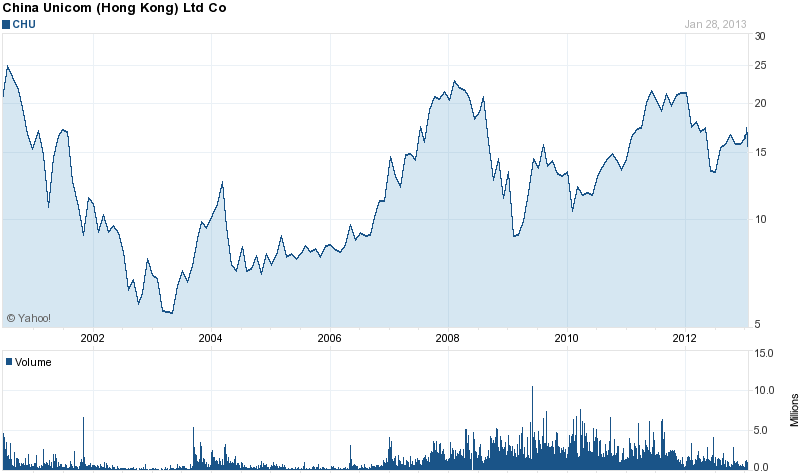

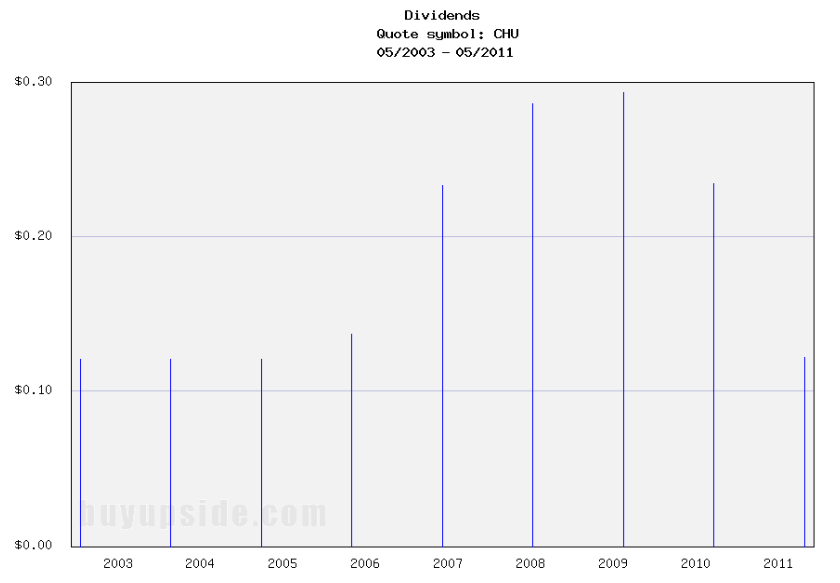

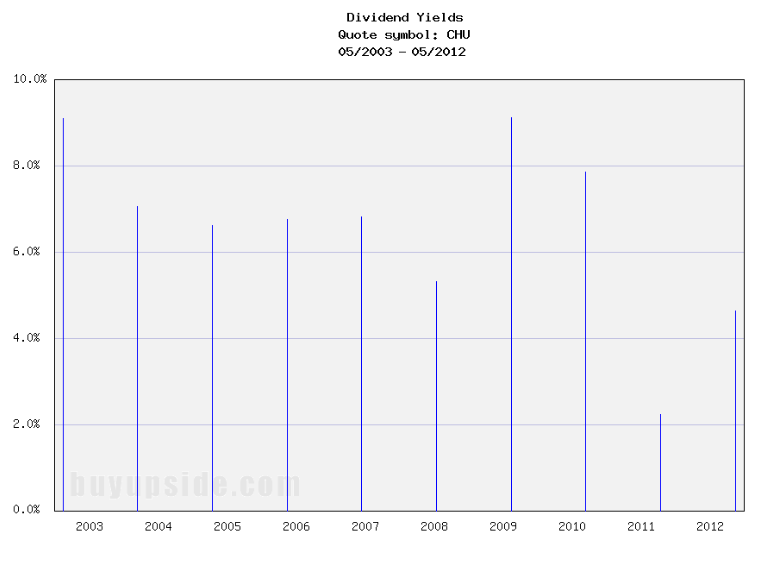

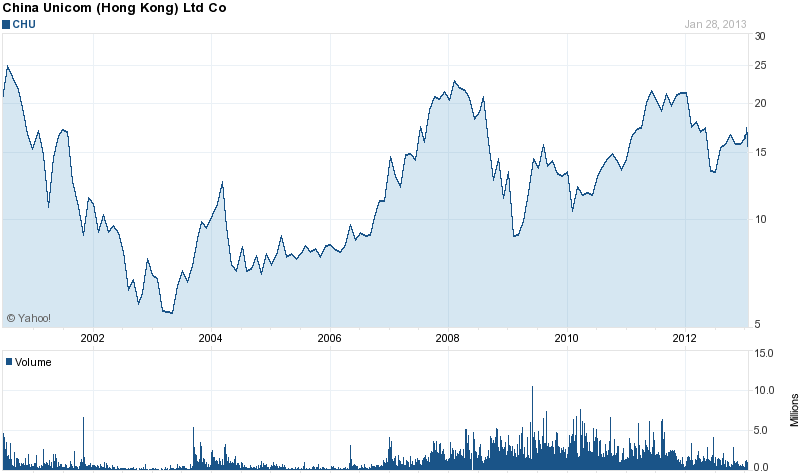

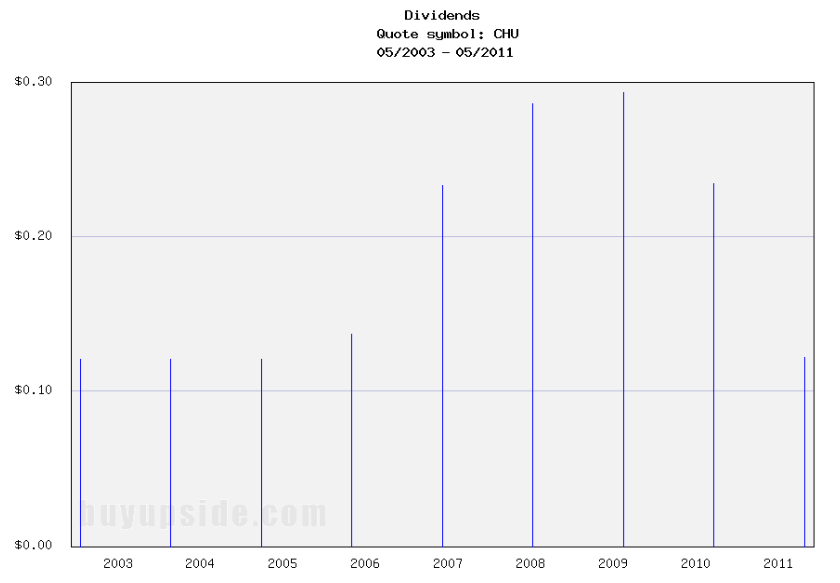

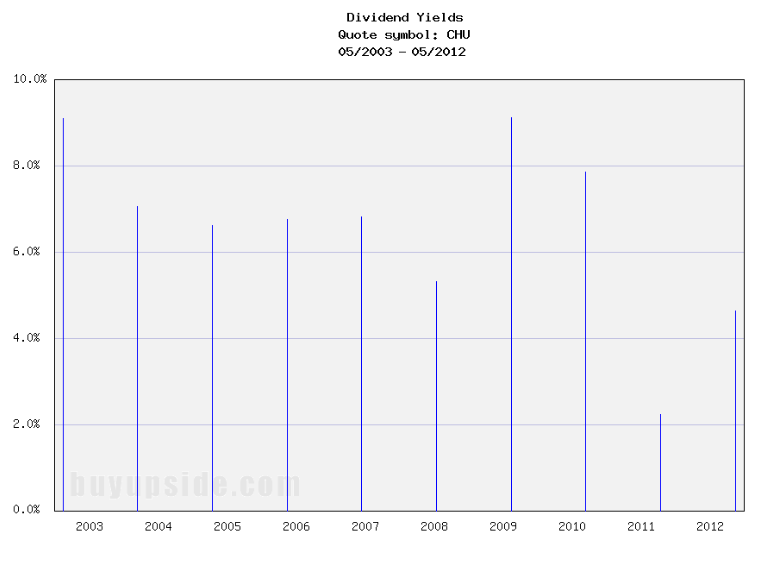

China Unicom (CHU) has a market capitalization of $36.81 billion. The company employs 215,450 people, generates revenue of $33.626 billion and has a net income of $679.55 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $10.194 billion. The EBITDA margin is 30.32 percent (the operating margin is 2.58 percent and the net profit margin 2.02 percent).

Financial Analysis: The total debt represents 22.99 percent of the company’s assets and the total debt in relation to the equity amounts to 50.93 percent. Due to the financial situation, a return on equity of 2.05 percent was realized. Twelve trailing months earnings per share reached a value of $0.36. Last fiscal year, the company paid $0.16 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 42.88, the P/S ratio is 1.11 and the P/B ratio is finally 1.11. The dividend yield amounts to 1.01 percent and the beta ratio has a value of 0.72.

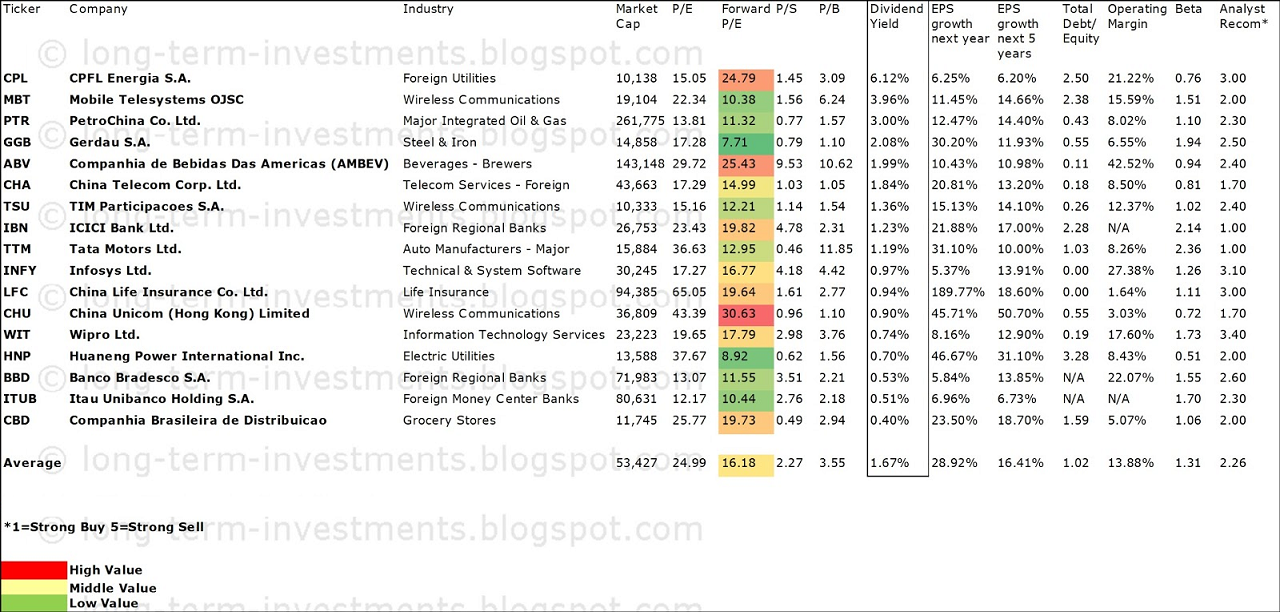

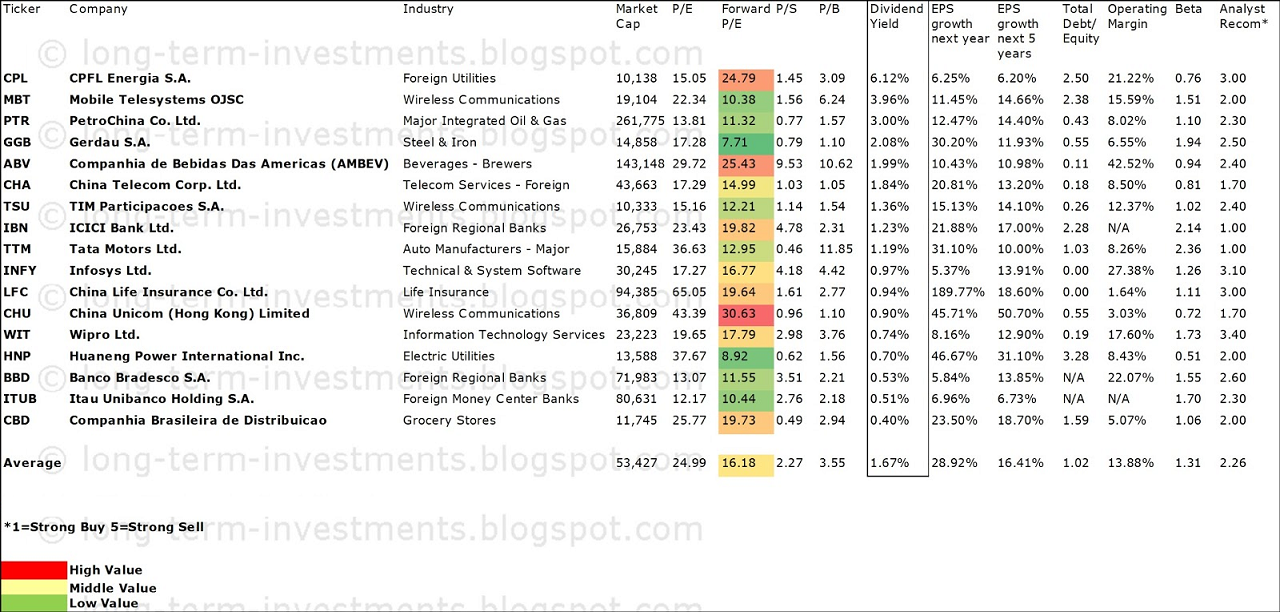

The average P/E ratio amounts to 24.99 and forward P/E ratio is 16.18. The dividend yield has a value of 1.67 percent. Price to book ratio is 3.55 and price to sales ratio 2.27. The operating margin amounts to 18.89 percent and the beta ratio is 0.74. Stocks from the list have an average debt to equity ratio of 1.02.

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

CPL, MBT, PTR, GGB, ABV, CHA, TSU, IBN, TTM, INFY, LFC, CHU, WIT, HNP, BBD, ITUB, CBD

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.

A large trading gap was created between the emerging markets and the developed nations. As a result, the old economies created huge mountains of debt and growth slowed while the unemployment rates exploded.

The emerging markets have shown an opposite ratio - low debt to high growth. Unknown companies becamemultinational super companies in only a decade and made people very rich.

Today we'll look at some of the best growth stock with dividend payments from the popular BRIC nations.

My screening criteria are:

- Headquartered in a BRIC country

- Market capitalization over $2 billion

- 5 year expected EPS growth over 5%

- Positive dividend yield

Seventeen companies fulfilled these criteria of which one stock has a high-yield and twelve are recommended to buy.

PetroChina (PTR) has a market capitalization of $261.77 billion. The company employs 552,810 people, generates revenue of $322.145 billion and has a net income of $23.464 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $51.583 billion. The EBITDA margin is 16.01 percent (the operating margin is 9.11 percent and the net profit margin 7.28 percent).

Financial Analysis: The total debt represents 16.60 percent of the company’s assets and the total debt in relation to the equity amounts to 31.75 percent. Due to the financial situation, a return on equity of 13.70 percent was realized. Twelve trailing months earnings per share reached a value of $10.36. Last fiscal year, the company paid $5.26 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 13.80, the P/S ratio is 0.82 and the P/B ratio is finally 1.62. The dividend yield amounts to 3.50 percent and the beta ratio has a value of 1.10.

Companhia de Bebidas Das Americas (ABV) has a market capitalization of $143.09 billion. The company employs 46,503 people, generates revenue of $13.369 billion and has a net income of $4.297 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $6.462 billion. The EBITDA margin is 48.34 percent (the operating margin is 43.17 percent and the net profit margin 32.14 percent).

Financial Analysis: The total debt represents 8.92 percent of the company’s assets and the total debt in relation to the equity amounts to 16.07 percent. Due to the financial situation, a return on equity of 34.58 percent was realized. Twelve trailing months earnings per share reached a value of $1.54. Last fiscal year, the company paid $0.91 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 29.66, the P/S ratio is 10.54 and the P/B ratio is finally 11.31. The dividend yield amounts to 3.19 percent and the beta ratio has a value of 0.94.

China Unicom (CHU) has a market capitalization of $36.81 billion. The company employs 215,450 people, generates revenue of $33.626 billion and has a net income of $679.55 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $10.194 billion. The EBITDA margin is 30.32 percent (the operating margin is 2.58 percent and the net profit margin 2.02 percent).

Financial Analysis: The total debt represents 22.99 percent of the company’s assets and the total debt in relation to the equity amounts to 50.93 percent. Due to the financial situation, a return on equity of 2.05 percent was realized. Twelve trailing months earnings per share reached a value of $0.36. Last fiscal year, the company paid $0.16 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 42.88, the P/S ratio is 1.11 and the P/B ratio is finally 1.11. The dividend yield amounts to 1.01 percent and the beta ratio has a value of 0.72.

The average P/E ratio amounts to 24.99 and forward P/E ratio is 16.18. The dividend yield has a value of 1.67 percent. Price to book ratio is 3.55 and price to sales ratio 2.27. The operating margin amounts to 18.89 percent and the beta ratio is 0.74. Stocks from the list have an average debt to equity ratio of 1.02.

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

CPL, MBT, PTR, GGB, ABV, CHA, TSU, IBN, TTM, INFY, LFC, CHU, WIT, HNP, BBD, ITUB, CBD

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.