Over at Yahoo! Finance, the headline for one of the most popular articles screams, “Housing Already Shows Signs of a New Bubble.”

The exact same sentiment is being shouted from the rooftops at Forbes, too: “Home Builders Could Become Heartbreakers Again.”

We’re less than one year into a legitimate recovery in prices, and already the pundits can’t help but sound the alarm about another possible “bubble”? Give me a break!

Forget Rodney Dangerfield, the residential real estate rebound gets “no respect.”

Don’t worry. We’re nowhere close to another peak. Nor has the profit potential for housing-related investments suddenly vanished.

Here are 10 hard facts to prove it…

1. Too Far, Too Fast? Nope!

Housing market bears point to the meteoric rise of homebuilding stocks as proof that the recovery has been too robust, too soon.

The S&P 1500 Homebuilder group is up 170% since hitting a low in August 2011. In the last year alone, many individual homebuilder stocks, like KB Home (KBH), PulteGroup Inc. (PHM) and Ryland Group (RYL), doubled in price.

As Bespoke Investment Group aptly points out, though, “Remember that ‘too far, too fast’ is relative.” And, in this case, short-term relativity can be deceiving.

It turns out that the S&P 1500 Homebuilder group is still down 55% from its 2005 high, despite the impressive run-up over the last 18 months. Too far, too fast? I don’t think so!

2. Peak Activity? Nope!

Actual homebuilding and sales activity haven’t peaked, either.

Based on the January data, single-family housing starts remain almost 200% below the peak hit during the last boom. And they’re more than 60% below the long-term average since 1962. As far as existing home sales, we’re still about 40% below peak levels.

3. RFI is Back in the Black.

Ever since 2005, the real estate market has been a drag on the U.S. economy. More specifically, residential fixed investment (RFI) weakened GDP growth.

Not anymore! In the fourth quarter, RFI added 0.4% to GDP growth.

In dollar terms, RFI needs to increase another 40% just to hit the long-term average since 1995. So forget being near a top. The latest data indicates that “the housing rebound is fairly entrenched at this point,” as RBS Securities’ economist, Omair Sharif, puts it.

Entrenched… with plenty of room to run, too.

4. Less Distressed.

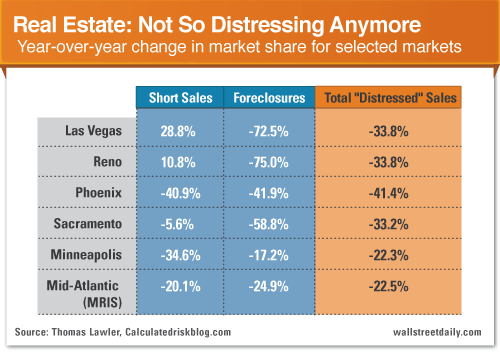

Any talk about the housing market wouldn’t be complete without mentioning the unending onslaught of foreclosures and short sales, which naturally hold back a recovery – particularly in prices. But (surprise, surprise) “distressed sales” are becoming less and less of a factor.

Notices of defaults, scheduled auctions, bank repossessions and other filings fell 28% in the last year, according to RealtyTrac. Perhaps even more telling is the fact that new foreclosure filings are at their lowest levels since June 2006.

As RealtyTrac’s Daren Blomquist says, “We’re now well past the peak of the foreclosure crisis.” I’ll say!

In all fairness, foreclosure filings are still running hot – at about twice the pace experienced in 2005. But we can’t overlook the progress being made. In many hard-hit markets, foreclosure sales now account for a dramatically smaller portion of the market (see table below).

Take Las Vegas, for instance. In January 2012, foreclosures accounted for a staggering 45.5% of sales. Fast forward to today, though, and that figure has been more than cut in half, to 12.5%, according to calculations by economist, Thomas Lawler.

If we look at the short sale data, a similar trend is developing, too.

Add it all up, and as Bill McBride of Calculatedriskblog.com says, “In every area that reports distressed sales, the share of distressed sales is down year-over-year – and down significantly in most areas.”

That means conventional sales are picking up, which is “a major continued improvement for the market,” according to Trulia.com’s Chief Economist, Jed Kolko. I agree.

And once again, the data points to a market on the mend, not in bubble territory.

5. No More Negative Equity for You!

Aside from short sales and foreclosures, the other main factor holding back the real estate market has been the number of homeowners sidelined because of negative equity. But that’s becoming less and less of an issue, too.

Thanks to rising prices, nearly two million homeowners were freed from negative equity over the last year, according to a report from Zillow.

Of course, the number of homeowners underwater remains high, at about 13.8 million. But that just means the real estate recovery has much more room for progress.

That’s it for today. In tomorrow’s column, I’ll share five more signs – backed up by hard data – that the real estate recovery is here to stay. I’ll also share a handful of ways to profit from the continued boom. So stay tuned.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

10 Signs We’re Not In Another Real Estate Bubble

Published 02/26/2013, 03:26 AM

Updated 05/14/2017, 06:45 AM

10 Signs We’re Not In Another Real Estate Bubble

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.