This past week I got to spend some time with Charles Payne on Making Money with Charles Payne.

I mention this because I send Charles (and producers) notes ahead of time.

Charles has an uncanny way of targeting the most salient points from those notes and then discussing them on the air with his guests so his viewers can learn and benefit.

He asked me about 2 major macro themes I wrote about

- “Stag” and “flation”-the new transitory

- Transportation as a lead indicator flashing some warning.

He then picked out one stock out of the several I had sent him-Symbotic (SYM).

So, I thought I would review what Charles zoomed in on and show you why he is so in tune.

Stagflation-Last week Jerome Powell said he sees neither a chance of stagnation nor inflation.

Charles began our segment asking me about why I call this the new “transitory.”

I begin with Shakespeare- “Doth protest too much.”

And then we go into the signs that are already there witnessed by 2 major economic indicators.

Last week we covered the Retail Sector XRT) and how important the consumer is to the health of the US Economy.

That sector has been underperforming.

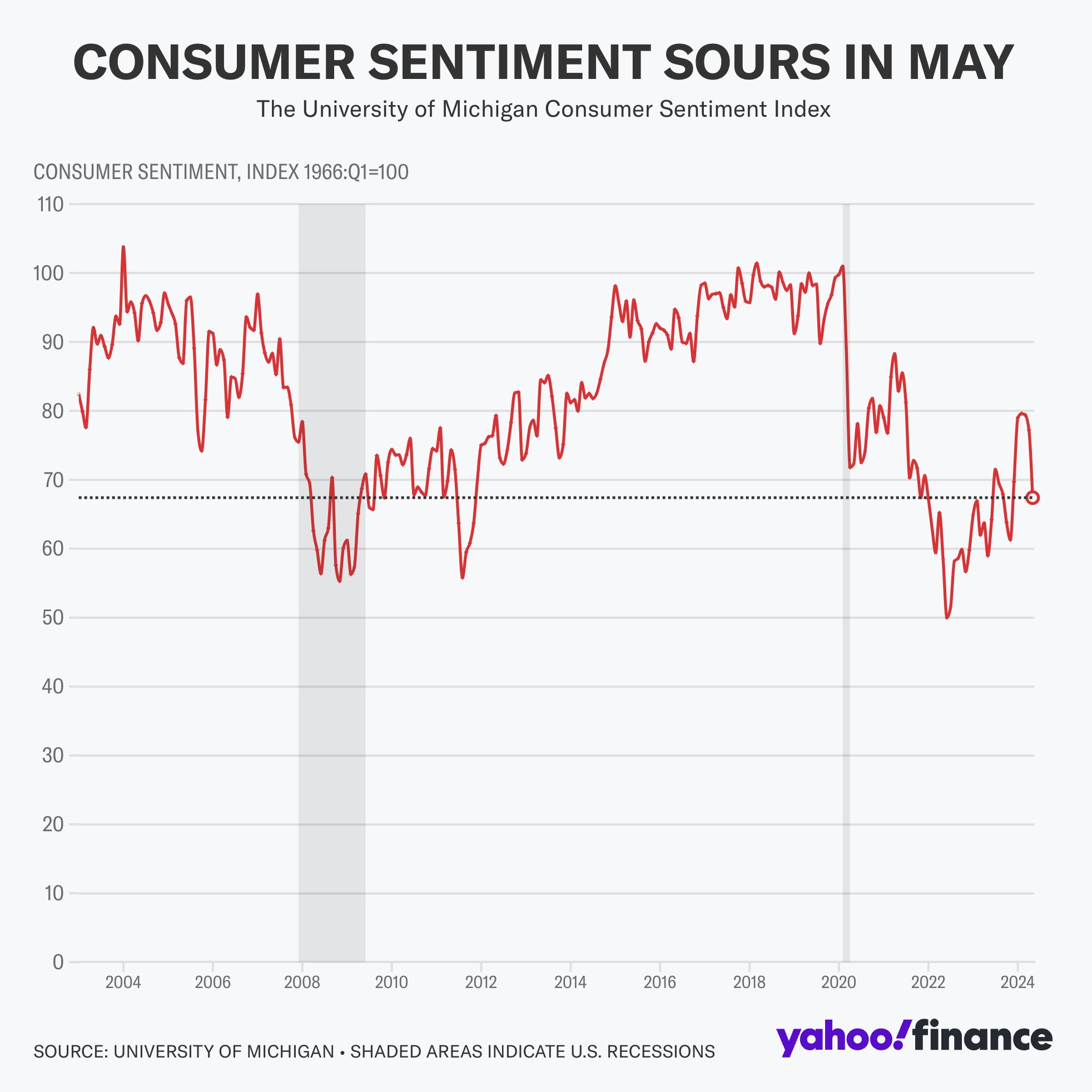

And now that we see a decline in consumer sentiment, we can say that “stagnation” is here.

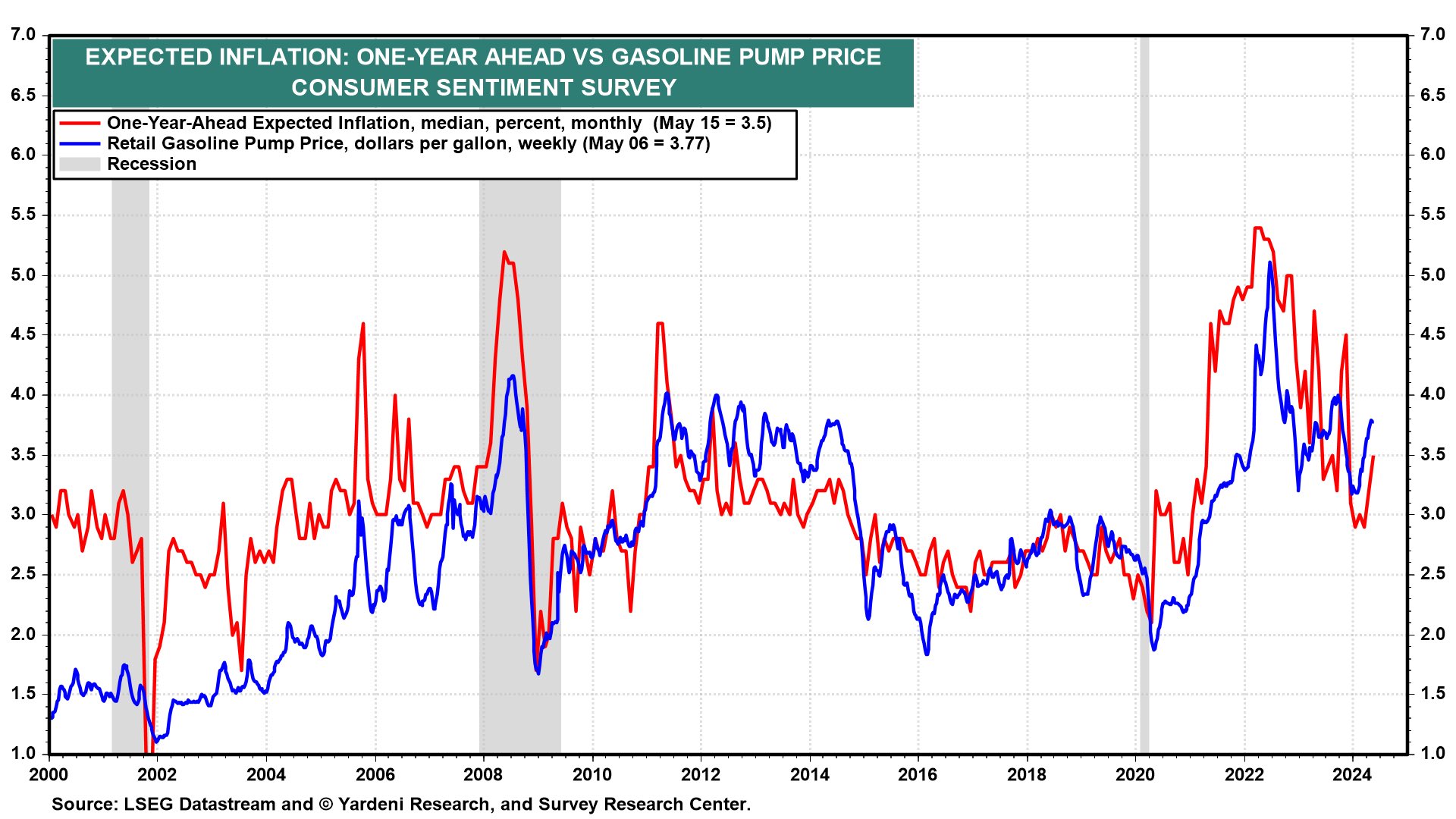

As far as the inflation aspect, consumer expectations are that inflation is rising and will rise, especially as it relates to gas prices.

CPI PPI will be out this coming week.

The labor market also reflects concerns on stagflation as the jobless claims and the cost of doing business have both risen.

Looking at the charts, XRT (Retail) broke back below the 50-DMA on Friday.

XRT now underperforms the SPY.

While XRT trades well above the January 6-month calendar range high, the best news is there is no bearish divergence in momentum (Real Motion).

Rather, the break of the momentum 50-DMA is in synch with the break of the 50-DMA in price.

Transportation IYT - The second point Charles asked about is why I think transportation through the lens of IYT is flashing warning.

We talked about how IYT provides insights into potential economic downturns through the TSI:

The freight TSI tends to be a lead indicator. Thus, monitoring the freight TSI can provide early signals of economic shifts.

Currently, the TSI peaked in 2020 but is far from flashing recession which would we begin to see if the indicator breaks below 130 or Covid lows.

We could, however, make the case for stagnation.

The chart of IYT shows how the price failed to take out the weekly highs though did manage to close up on the week.

Nonetheless, IYT remains above the 200-Daily Moving average yet under the 50-DMA or in a caution phase.

IYT well underperforms SPY.

Real Motion shows a bearish divergence with momentum under the 200-DMA while price sits slightly above it.

Charles and I talked about bonds too.

The takeaway is that the very long pause in cutting or raising rates could be a monetary mistake as inflation is far from over.

Yet, we are beginning to see the potential impact to the “inside” sectors of the economy.

This is precisely why we are looking so carefully at IYT and XRT-for signs.

As for the stock pick, Charles asked about this one.

Symbotic (NASDAQ:SYM) creates advanced robots to automate warehousing for increased efficiency, speed, and flexibility.

They reported earnings on May 6th which posted revenue of $424 million, a net loss of $41 million.

For the third quarter of 2024, Symbotic expects revenue of $450 million to $470 million, or higher than prior quarters.

The initial reaction was a significant gap higher in price. However, those gains were eliminated by the end of the week.

I found it interesting that Charles chose this stock.

Many analysts are bullish.

Zacks rating is that the company will perform in line with the overall market. And I believe that is true as how the economy fares (especially retail) will impact their bottom line.

This is why we love charts!

What strikes me about this chart is that the price dropped precipitously below the 50 and 200-DMAs.

The momentum remains ok, just sitting on the 50-DMA. The Leadership dropped to on par with the benchmark, as Zach’s mentioned it would trade in line with the SPY.

For now, we are aside. But I do love what this company is doing.

Should SYM hold above the January 6-month calendar range low or around 40.50, the risk to 2024 lows is minimal.

Otherwise, we will consider $42 as a key pivotal area to watch if this turns out to be a bit of an overcorrection.

ETF Summary

- S&P 500 (SPY) 512 key support

- Russell 2000 (IWM) 200 key support

- Dow (DIA) 387 support and 400 resistance

- Nasdaq (QQQ) 437 key support

- Regional banks (KRE) Through 50.50 compelling

- Semiconductors (SMH) 220 key support

- Transportation (IYT) 63 support 67 resistance -still relatively weak

- Biotechnology (IBB) If cannot clear 135 could see return to 130

- Retail (XRT) 71.50 support 75 resistance

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) Fair warning as this is below its 50-DMA