By Silvia Antonioli

LONDON (Reuters) - Diamond jewelery sales will keep growing but at a more modest pace, De Beers predicts, blaming a slowdown that started late last year on changing Christmas shopping trends and protest in Hong Kong.

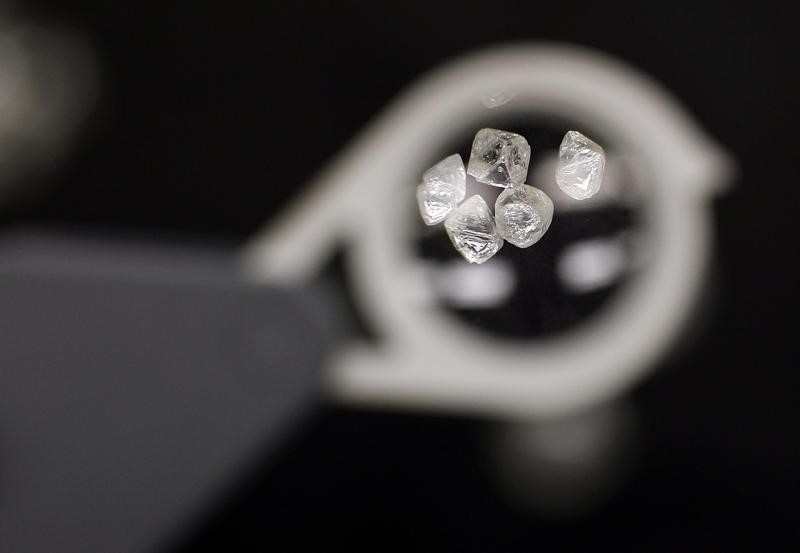

The world's largest diamond company by market value said on Friday that diamond jewelery sales rose almost 3 percent to a record high of $81 billion in 2014, albeit a slower growth pace than in previous years.

Last-minute Christmas buying of luxury gifts has been eroded by planned purchases of new IT products, for instance, in mass retailers' promotions such as the U.S. Black Friday in November or even earlier.

"In the United States there was a trend toward less Christmas gift shopping immediately before Christmas, driven by early retail promotional activity. Meanwhile growth in China was impacted by a softer macroeconomic environment and the protests in Hong Kong," De Beers said in a statement.

Pro-democracy protests in Hong Kong in October and November forced shops to shut, limiting sales of jewelery to locals and Chinese tourists.

De Beers focuses on sales of rough diamonds but also has two retail brands: Forevermark, with 1,500 shops around the world, and De Beers Diamond Jewellers, a very high-end joint venture with LVMH.

HIGH EXPECTATIONS

Middlemen who buy its rough diamonds are struggling with a stronger dollar and liquidity problems.

But De Beers, 85 percent owned by global mining group Anglo American (L:AAL) with Botswana's government holding the rest, voiced confidence in the longer-term outlook, partly anticipating limited new diamond supply.

"This is a cyclical business so it might be a little bit weaker this year than last year but ... the long-term fundamentals are still good," said De Beers' head of strategy and new business, Bruce Cleaver.

Funds available for manufactures have been diminishing since some specialised banks started to cut their exposure to the sector. De Beers has tried to help its clients by allowing them to defer some of their purchases to later in the year.

"This is not something we do terribly often but we do of course respond to what happens in the market," Cleaver said in a phone interview, adding he had seen an improvement in sentiment lately.

Once a niche business for Anglo American, De Beers has grown to become the second-largest contributor to group profit in 2014 and the outlook for diamonds is better than that of most other commodities in Anglo's portfolio. Analysts value De Beers alone at around $12-14 billion.