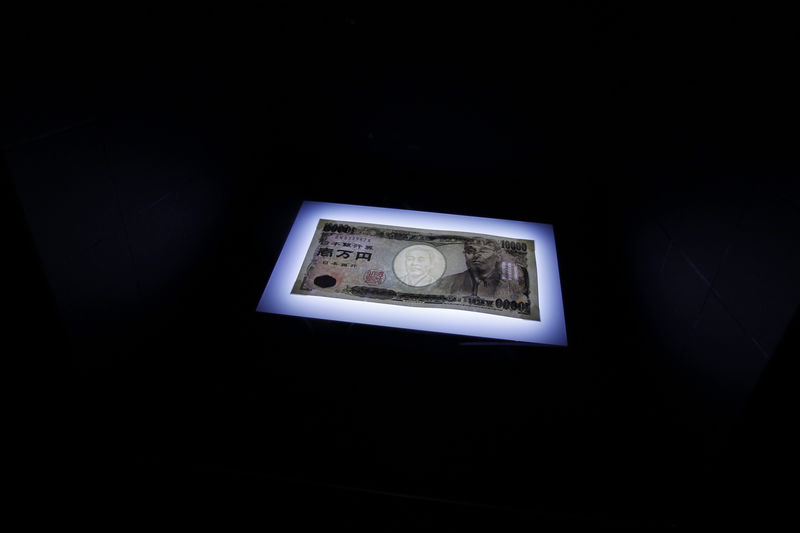

Investing.com - The yen surged more the 2% against the dollar and the euro on Thursday after the Bank of Japan held back from further stimulus, defying market expectations for additional monetary easing.

USD/JPY was last down 2.83% at 108.30 after falling as low as 108.06 earlier.

EUR/JPY was at 123.06, off 2.5% for the day, after falling to overnight lows of 122.68.

The BoJ kept the deposit rate at minus 0.1% and its asset purchases at ¥80 trillion per year. It also pushed back the expected data for reaching its 2% inflation target.

The decision came on the heels of data showing that consumer prices fell in March at the fastest pace in three years and household spending falling at the fastest rate in a year.

Ahead of the meeting expectations had been building for more monetary stimulus measures.

The BoJ shocked markets with its decision to adopt negative interest rates in January, but the continued strength of the yen has kept up pressure on the central bank to do more to spur price growth.

Overnight, the Federal Reserve kept interest rates unchanged and indicated that data on jobs and inflation will determine whether it raises interest rates in June.

The dollar was lower against the euro, with EUR/USD rising 0.3% to 1.1357.

The dollar was also sharply lower against the New Zealand dollar, with NZD/USD jumping 1.23% to 0.6969.

The Reserve Bank of New Zealand kept interest rates on hold overnight, but signaled that further monetary policy easing may still be necessary in the coming months.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was down 0.68% at 93.74.