Open 102.39

High 102.61

Low 101.85

Close 102.36

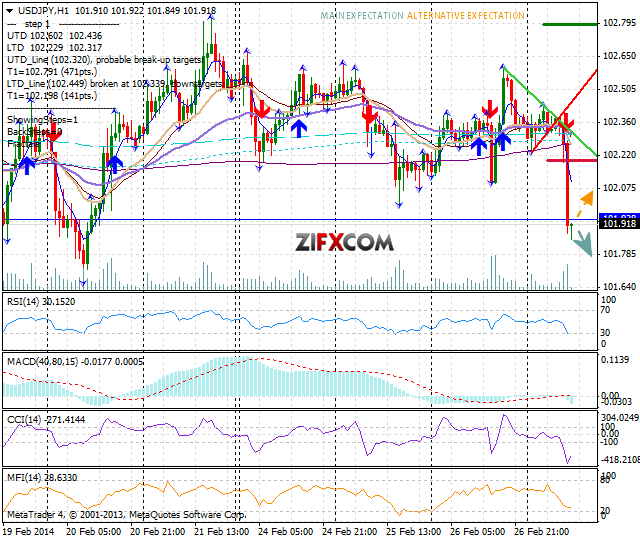

On Wednesday the USD/JPY increased insignificantly with 45 pips. The currency couple appreciated from 102.61 to 102.08 yesterday, not matching the negative money flow sentiment at nearly -11%, closing the day at 102.36. This morning the dollar descended against the yen, reaching down to 101.85.

On the 1 hour chart the downward channel has turned into range trading, while on the 3 hour chart the upward channel is still on hold. Break above yesterday's top and nearest resistance 102.61 would encourage further recovery of the dollar. Immediate support is today's bottom at 101.85, and consistent break below it could strengthen the yen further down towards next target 100.96.

Today are Japan National and Tokyo CPI, Household spending, Unemployment, Retail sales, and Industrial production, at 23:30 and 23:50 GMT respectively.

Quotes are moving way below the close 20 and 50 the EMA on the 1 hour chart, indicating strong bearish pressure. The value of the RSI indicator is negative and calm, MACD is neutral and tranquil, while CCI has crossed down the 100 line on the 1 hour chart, giving over all short signals.

Technical resistance levels: 102.61 103.50 104.32

Technical support levels: 101.85 100.96 100.14

Today so far +7 pips profit/loss on USD/JPY today from the following sent to clients only signal:

5:15 GMT Buy USD/JPY at 102.33 SL 102.07 TP 102.83, exit sent at 5:46 GMT.

Today so far +118, yesterday +85. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="452" height="381">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="452" height="381">