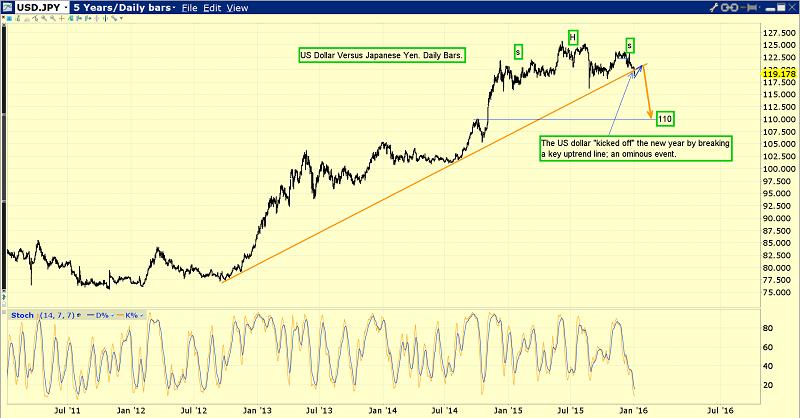

The US dollar has begun 2016, by staging a horrific technical meltdown against the Japanese yen.

That’s a five year chart of the US dollar versus the Japanese yen. The main uptrend line has just been smashed.

Ominously, there’s also a large head and shoulders top pattern in play. Major FOREX players often base their COMEX gold trades on the action of the dollar against the yen, and the current situation indicates a massive rally in gold may be about to begin.

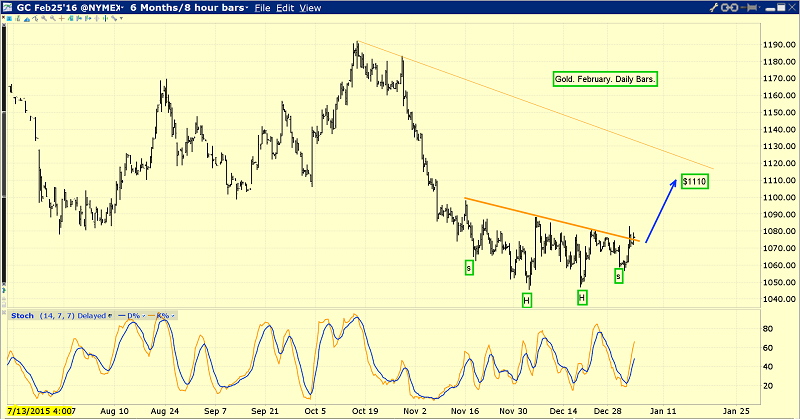

That’s the eight hour bars gold chart, and it looks superb.

A week ago, I suggested gold needed to stage a modest but immediate decline, to form the right shoulder of a double-headed inverse head and shoulders bottom pattern.

That technical event occurred “on cue”, and now the price has staged a tentative upside breakout above the down sloping neckline. Against the background of the dollar’s horrific action against the yen, gold has staged a “gangbuster” start to 2016.

Gold typically sells off into each US jobs report, and the next one is scheduled for release this Friday, at 8:30AM.

Between today and Friday, traders and investors alike should be confident buyers of any softness in the gold price. It’s also possible that the FOREX traders ignore the US jobs report, and keep their focus on the dollar versus the yen price action. In that case, there may not be any traditional sell-off going into this jobs report, but a continuation of the rally after the report is released!

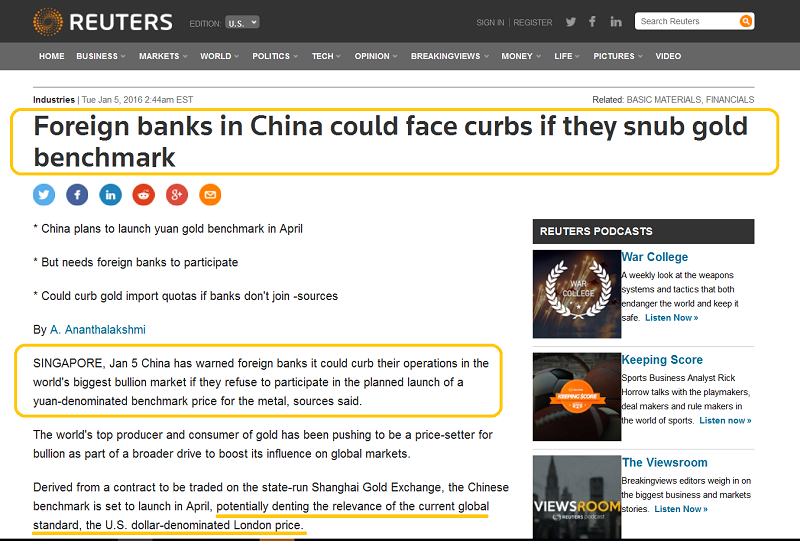

One of the most important fundamental events of 2016 in the gold market is the launch of the Shanghai Gold Exchange (SGE) gold benchmark.

The launch could occur in April, and it’s possible that India cuts its gold import duty around the same time. This is very bullish for gold.

While gold, the mightiest of metals, is off to a flying start for 2016, things are certainly looking “less than rosy”, for the US stock market. The Dow is fighting to hold the key 17,000 “line in the sand” zone. I think it will lose that battle, and lose it badly.

A meltdown appears to be imminent, and many institutional investors base their decisions for the year, on how the US stock market performs during the first week of trading.

I predicted that Janet Yellen would raise rates in December, and that gold would rally and the Dow would tremble. That’s exactly what is happening. More rate hikes are coming. Here’s why:

The US government has not reduced its debt, and seems uninterested in doing so, even with ridiculously low interest rates. The Fed gave the US government more than enough rope to hang itself. It kept rates low and engaged in a bizarre QE program, for an extended period of time.

Now, the Fed has raised rates, and it will keep raising them until the US government shows a willingness to get its financial house in order. The small business private sector has nothing to fear from higher rates. In fact, higher rates are probably going to create a bank lending boom in this part of the private sector, while the public sector goes into its greatest debt crisis in history.

Larger companies that trade on the NYSE will be affected by higher rates. That’s because the stock buyback boom fueled by low interest loans is finished now. Corporate price/earnings ratios were kept at moderate levels by these buybacks, and so the ratios may begin to rise quite quickly. That could cause a panic amongst stock market money managers.

Janet Yellen has repeatedly suggested that she sees signs that inflation will rise over the medium term, but GDP growth will remain sluggish.

That’s a recipe for stagflation, and if banks begin moving money out of the Fed and into the private sector, the rising velocity of the US money supply could turn that stagflation into a major concern.

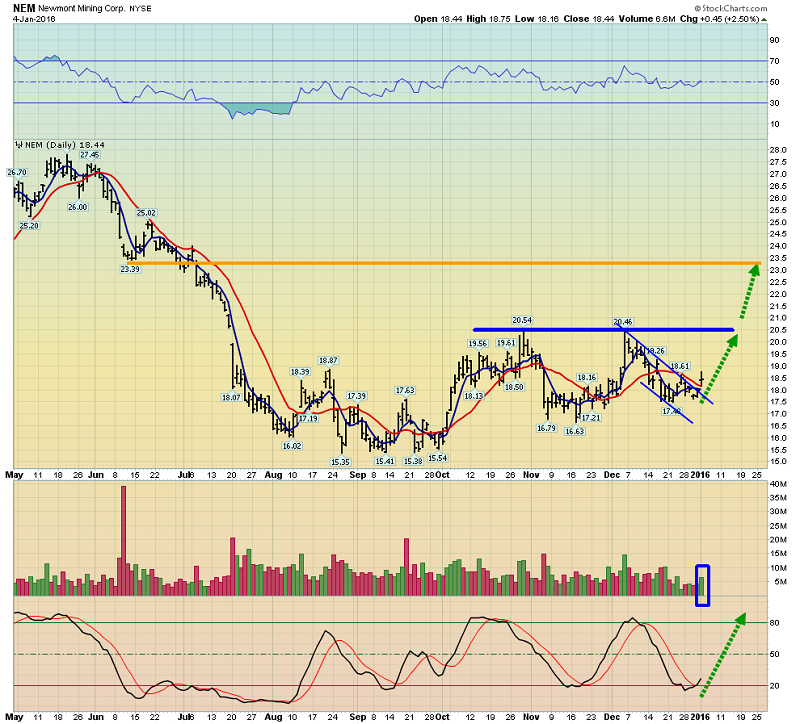

When stagflation appears, the risk-on asset of choice is gold and silver stocks! Newmont Mining (N:NEM) began the trading year with a great upside breakout. Volume increased, and that’s healthy technical action!

Newmont is a “must own” investment vehicle, for any seniors-oriented gold stock investor. Rather than vainly trying to call “final bottoms” and “new bull markets” for this great stock, investors can use my unique pyramid generator to systemically allocate capital into it. That ensures solid participation when the stock rallies, and keeps a reasonable amount of “dry powder”. It’s a win-win approach to investing!

For investors who like the idea of buying a senior gold stock production company at junior prices, Harmony Gold Mining (N:HMY) is ideal. The company has gold reserves in excess of 40 million ounces, and calls its Papua New Guinea joint venture with Newcrest a “game changer”.

At about one dollar a share, even after staging a 100% rally, this stock is ideally priced for investors who like making money. South Africa is home to some of the world’s largest reserves, and even moderately higher gold prices can turn quality miners into “cash cows”, for the next several decades! South Africa’s currency has declined, chopping costs for miners, and the country is a BRICS member, which bodes well for long-term gold supply deals with China, Russia, and India.

I’m a buyer of Harmony on every ten cent decline. I don’t want to miss a single entry point, and I invite all Western gold stock enthusiasts to take a closer look at this dynamic company.

In 2016, the Iran-Saudi tensions, the SGE benchmark launch, US stagflation, an India import duty chop, and a potential US government debt crisis are all very positive factors for gold and silver bullion, and related mining stocks!

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?